At the start of the year when I penned my first column, I spoke of a changing market in which strong demand and falling supply would dominate. In my final column of the year, I think it is an opportune time to review the year and predict the main trends for 2015.

In hindsight, the upswing in the market has taken us all by surprise. Supply has fallen sharply – the last time supply was at these levels was 2007 – and take-up is likely to be ahead of last year’s level by a significant margin.

With space under offer still well above average, momentum remains strong in the leasing market. Rents have now risen across all the central London markets – the first time this has happened since 2010.

Another revelation has been how footloose tenants have become. In 19 years as an agent I haven’t seen anything like it. Who would have imagined that Amazon would take space in the City – not once but twice – or, that a Mayfair lawyer would relocate its main office to the South Bank.

So what does 2015 have in store? Three key questions will determine the answer.

First, what sectors will drive demand? Professional and business services will be important and after a few barren years we are seeing expansionary demand emerge in the banking and finance sector, which will benefit the City and Canary Wharf.

And let’s not forget about creative industries. I have just come back from Berlin, a great city, vibrant and dynamic with a strong creative sector, but nothing on the scale of London. I have no doubt that London will remain the key location in Europe for creative companies and this will be a major source of demand for office space for some time.

Second, what will happen to supply? It will continue to tighten, and competition for space will heighten. So expect rents to jump next year – and the lack of new development completions will compound the situation. Also expect more preletting. Amazon, M&G Investments, Transport for London, the Financial Conduct Authority and Société Générale have all prelet during 2014; as completion levels dip sharply next year and supply tightens, larger occupiers will have to resort to preletting to satisfy new requirements.

Finally, will occupiers become even more footloose? The one thing for certain is that the search for value and tightening of supply will force more tenants to satisfy space requirements by searching across central London. Locations such as Paddington and Canary Wharf will be among the main beneficiaries.

Importantly for the market, the outlook is positive over the medium term. The London economy is forecast to be the fastest growing of any major European city over the next five years, and the office sector will grow more strongly than the rest of the economy overall. A stronger development response will emerge but the time lag between construction starts and completions means it will be a while before we see schemes emerge.

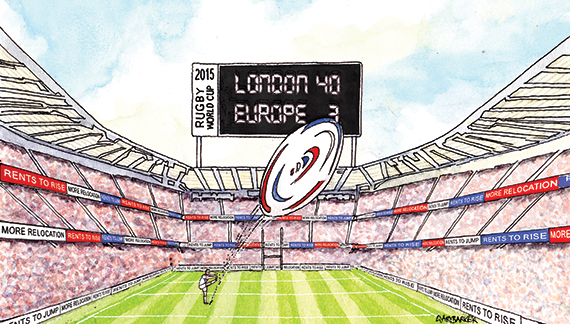

Against this backdrop, I predict that the City and West End will exceed the rent peaks of the last cycle. And as a rugby fan I’m also feeling confident that England will win next year’s Rugby World Cup.

Emma Crawford is central London executive director, CBRE