New research by commercial property auction house Acuitus shows the growing importance of private investor buying power in the sector. Richard Auterac, chairman and auctioneer at Acuitus, reviews the key findings

Investment into commercial property by private investors is now at its highest level since 2007, and the auction room is a natural route to market for many buyers as it provides the lot sizes, asset profiles and yield profiles that buyers require.

New Acuitus research aims to give a better understanding of the part that private investors are playing in the commercial property investment market and the way their participation may be affected by current and future economic and regulatory factors.

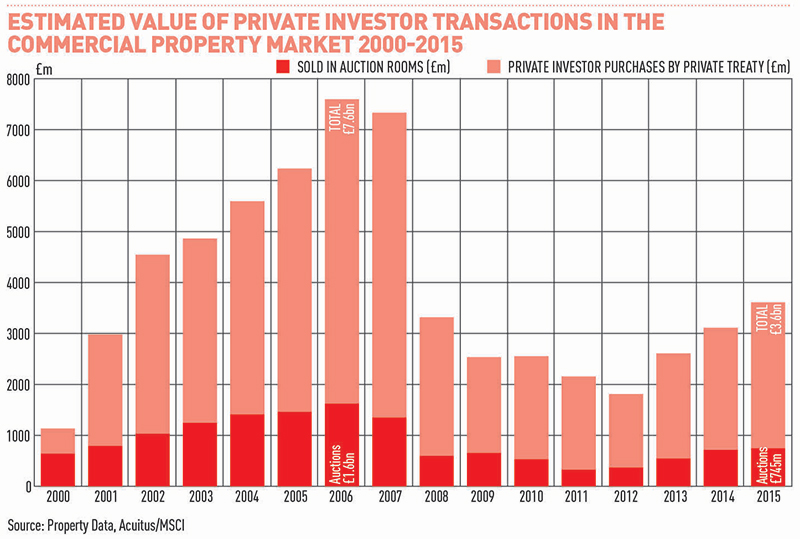

In 2015, private investors invested around £3.6bn in UK commercial property and we estimate close to £2bn will be invested this year, despite the hiatus caused by the run-up to the EU referendum and its result. The majority of these investment purchases are focused on assets valued at below £5m. In fact, 75% of private investor transactions are below this level, with the median value of assets being £1.95m.

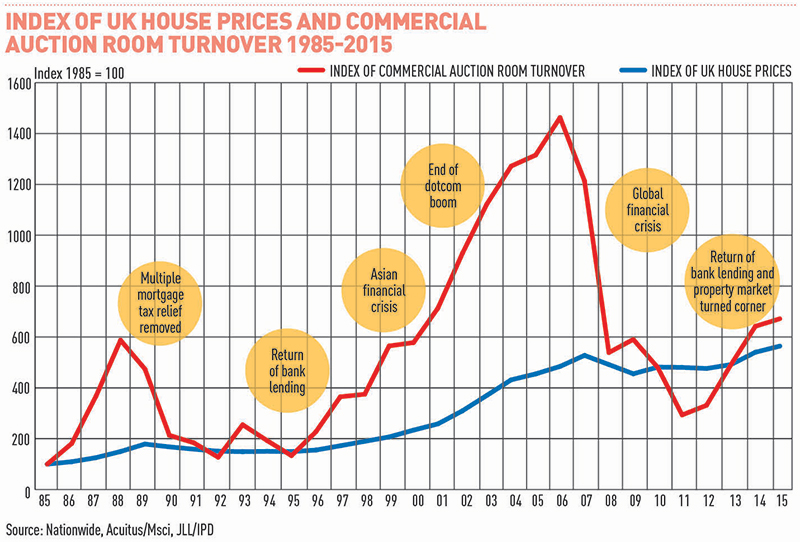

Although private investor buying in the sector is clearly rising, it is still significantly below its 2006 high (see chart 1) and this points to the latent potential for enhanced levels of buying. This will be reinforced by the revolution in the pensions sector that has taken place since the last high watermark in private investor buying.

Last year, the auction room was the conduit for 21% of all private investor commercial property buying by value. If portfolio acquisitions are excluded from the total, the auction proportion rises significantly.

New investors have been attracted to commercial real estate assets because of the chancellor’s new tax burden on residential buy-to-let investment. BTL investment has fallen since the increase in stamp duty on residential investment purchases in April, with the value of lending to landlords in July standing 44% down on the same point in 2015. The RICS Residential Market Survey in August 2016 reported that enquiries from investors dropped more sharply than among other buyer groups in the residential market, while agents – on balance – expected investor disinvestment from the sector over the coming year.

These changes have not only reduced the viability or feasibility of buy-to-let investment for many investors, but the drip‑feeding of the changes over recent years has had an impact on confidence in the sector and raised concerns over future measures that could damage viability further. With house prices considered relatively full in some markets in London and the South East, it is expected that this trend will continue with the tax changes proving a spur to profit-taking.

As a result, there are a growing number of investors who were previously focused on the buy-to-let market looking to the commercial property sector. Certainly, evidence from both the auction room and Acuitus Private Finance indicates a resulting shift towards commercial property on the part of some residential investors. However, many of these investors do not have existing relationships in the commercial market so the open source nature of the auction room offers both transparency and a breadth of available stock.

There is also a perception that commercial assets can offer a high income return without the hassle of residential property management.

With regard to the security of income, the increased stability of the non-prime asset market has played a large part in convincing investors that they can lock into investments that offer solid returns without the volatility or low yields that are respectively seen in the equities and bond markets.

During the five years to the end of the second quarter of 2016, commercial property delivered a total return of 10.1% pa with a return of 9.1% over the 12 months to the end of the first quarter (source: MSCI). This compares with returns from equities of 2.2% (source: FTSE All Share) during the past 12 months – albeit with significant volatility since the referendum.

Although direct investment into the smaller, non-prime assets may be less liquid than investing in institutional property funds, it is less likely to display short-term volatility. This was illustrated in the summer by the redemption issues encountered by the major open-ended funds that are invested primarily in large lot-size prime property. Having said this, the amount of investment required to enter the direct property market is significantly higher than for the retail property funds.

For the past five years or more, institutional and global capital has focused on prime assets in the £50m-plus range while, in contrast, the smaller lot size sector – predominantly outside London – has been slower to come back into favour.

It is only comparatively recently that the vast majority of the smaller assets that constitute the core of the UK commercial property investment market have begun to display the characteristics that have justified concerted buying outside the capital.

In this context, the continued rebasing of retail rents to sustainable levels has been a major influence on private investor buying patterns. And for the more adventurous investor with some residential experience, the permitted development rights regime has seen an increasing number of redundant office buildings being bought up for conversion to homes.

So somewhat ironically, as the prime market has cooled in recent months, buying in the core of the market has gathered momentum, with many private investors in the vanguard.

On the supply side, the active management of the underlying property assets of recently acquired loan portfolios, the divesting by institutions of their smaller assets and sale and leasebacks by owner-occupiers are providing a range of investment opportunities.

The robust sales rates achieved by commercial property auctions immediately following the EU referendum result further underlined the appeal of smaller lot size commercial property to deliver long-term income during a period of some uncertainty.

Looking ahead, the scale of private investor investment into commercial property will grow as the population’s wealth continues to expand and an ageing population looks to secure income for its retirement years. Certainly, new pensions flexibility is making more people consider investing directly in commercial property to provide a solid cornerstone to their retirement fund, again a growing trend in the auction room.

Analysis suggests that many pensioners are likely to have a greater variety of income and assets available for use in retirement and that commercial property investment will play its part in this new private investor landscape.

A transparent and easily accessible marketplace such as that offered by the high-value auction rooms has an important role to fulfil.

Reading for new commercial sector investors

The Appetite for Direct Investment in Commercial Property by High-Net-Worth Investors is a new piece of research by auction house Acuitus. It follows in the footsteps of the Opening the Door to Property – Assessing the Needs of Small Investors in Property report, which was commissioned by the British Property Federation, Investment Property Forum and Royal Institution of Chartered Surveyors in 2004.

The needs of private investors and their advisers have also been addressed by the IPF’s Understanding UK Commercial Property Investments: A Guide for Financial Advisers. Both are recommended reading for investors who are new to the commercial sector.