Bovis’s share price slumped by 10.2% on Monday as the embattled housebuilder released less-than-stellar annual results for the year to December.

Bovis’s share price slumped by 10.2% on Monday as the embattled housebuilder released less-than-stellar annual results for the year to December.

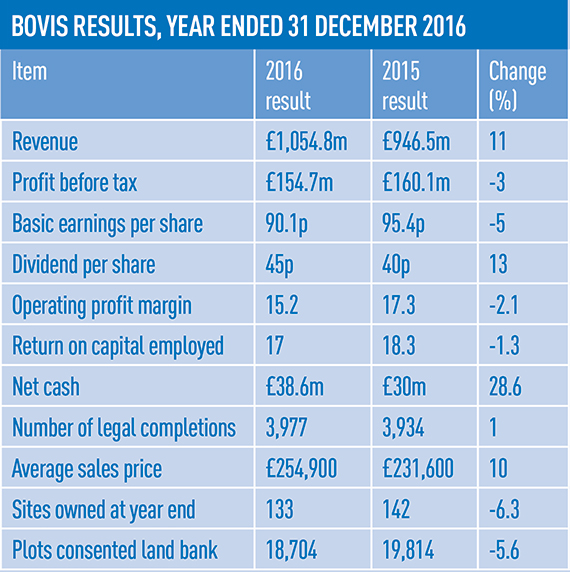

The group delivered a profit before tax of £154.7m, below its forecast range of £160m to £170m, while completions increased by just 1% to 3,977.

But rather than suffering at the hands of macro-economic uncertainty caused by the recession, the housebuilder has been more a victim of its own practices.

In his chairman’s statement, Ian Tyler said the shortfall in performance had two underlying causes. He said: “Firstly, our production processes have not been sufficiently robust to cope with the twin pressures of our growth strategy and the resource shortages across the industry.

“Secondly, we have not designed and resourced our customer service proposition and processes appropriately to deliver a ‘customer-first’ culture.”

In short, it has been expanding too quickly and has not focused enough on some of its finished products. As a result, the housebuilder has said completion volumes in 2017 will be 10-15% lower than 2016, and it has posted a “one-off £7m customer care provision”.

How did it get here?

Like most housebuilders, Bovis was hit by the referendum uncertainty in June, before seeing the market turn around in the second half of the year. On 10 November, it issued a trading statement saying everything was relatively fine.

Then chief executive David Ritchie said: “Another year of both growth in volume and increase in average sales price is expected to deliver record revenues for the group in 2016.”

But by the closing days of the year, it was issuing warnings about the number of homes it would complete for the year.

On 28 December Bovis said: “We have experienced slower than expected build production across the group’s sites during December, resulting in approximately 180 largely built and sold private homes that were expected to complete in 2016 being deferred into early 2017.”

Then on 9 January Ritchie, who has been at the helm for eight of his 25 years at Bovis, announced he was stepping down with immediate effect. Earl Sibley, the group’s finance director, took over as his interim replacement.

While the 180 deferred completions may seem a relatively small number, the results hid a larger problem. The housebuilder was receiving complaints around its sales, customer care and quality procedures.

It was reported before Christmas that Bovis was offering buyers between £2,000 and £3,000 to complete on purchases early and some residents were unhappy with the finished product they received. The Bovis Homes Victims Group has 1,429 members on Facebook.

In the Home Builders Federation’s customer satisfaction survey for 2016, Bovis is one of just four – of the 35 housebuilders listed – that received fewer than four stars. The others were Persimmon Homes, Avant Homes and Lagan Homes.

All of this led to the current predicament and the housebuilder’s acknowledgment that things are not as they should be.

Sibley said: “Our customer service standards have been declining for some time and combined with the delays to production towards the year end, we have entered 2017 with a high level of customer service issues. Our customer service proposition has failed to ensure that all of our customers receive the expected high standard of care.”

He adds: “I would say two things. We have been following an ambitious growth strategy, and we have put stress on our plans from that growth, so we have been trying to do much too much in peak periods of the year.

“The second bit, I suggest, is that we have expanded the business very rapidly, and some of the business infrastructure investment has followed a bit later.”

The reaction

A month ago, there were calls from Bovis’s largest shareholder, Schroders, for a merger with Berkeley. These were dismissed as impractical, and behind the headlines and despite the turmoil, the view seems to be that the housebuilder’s problems are fixable.

Jefferies continues to list Bovis as a hold, because it is putting its money where its mouth is, and stating publicly that costs will rise and volumes fall until it has dealt with its problems.

It said: “Medicine rarely tastes good, but it often makes you better. We would encourage investors to look through today’s downgrades as a necessary big step taken to address some big issues.”

According to the bank’s analyst, Anthony Codling, the housebuilder’s troubles fail to undermine its long-term land supply, which essentially gives a view of its long-term dividend.

“It has a strong history in buying land very well. It used to have the highest margins and return of capital in the sector. The issue has been building the houses; this has been exacerbated by pursuing a high-growth strategy, which pushed those issues up the agenda. While painful for investors in the short term, better to address them and move on,” he said.

Perhaps of more concern should be the future of growth stock housebuilders and their ability to get the people and resources they need to keep expanding.

• To send feedback, e-mail alex.peace@estatesgazette.com or tweet @EGAlexPeace or @estatesgazette