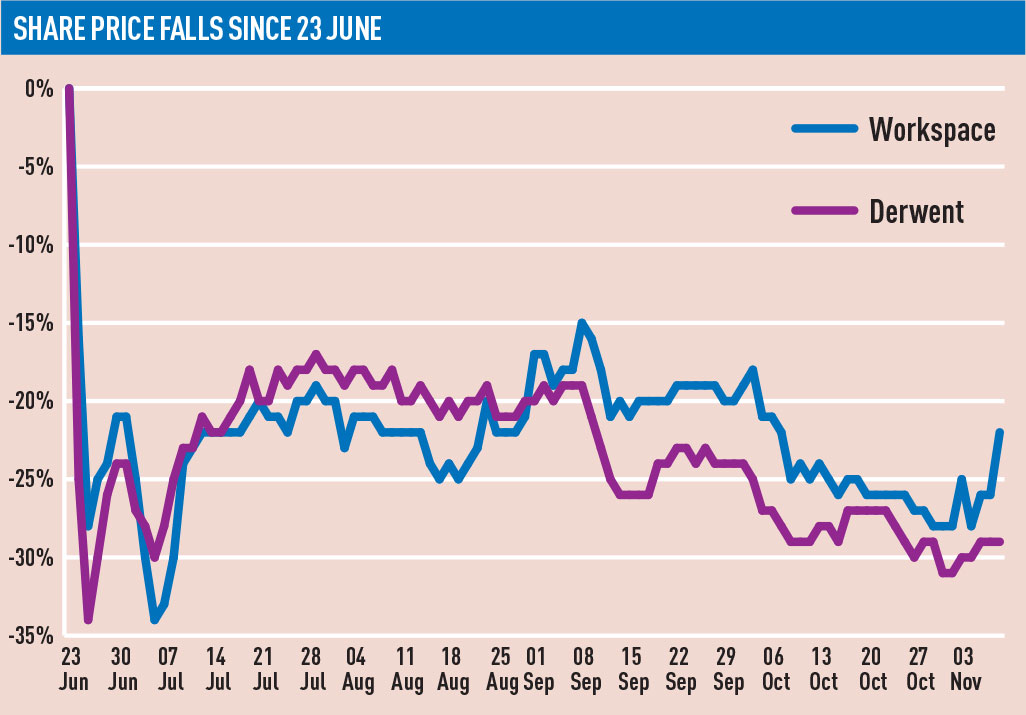

Derwent London and Workspace, two of the hardest-hit REITs in the FTSE 350 following the EU referendum, defied an apprehensive stock market with strong business updates this week.

Derwent, whose share price before posting its update was still 29% down on its pre-referendum price, reported a record number of new lettings since January, while Workspace, whose share price was down by 26%, posted a 16% uptick in adjusted profits and a 0.9% fall in NAV despite exposure to London’s office market.

Workspace outperformed expectations as JP Morgan predicted its NAV would fall by up to 4.9% because of its position in London, where capital values have shrunk by more than 4%.

In a sign of confidence, the REIT raised its interim dividend by 40% to 6.8p per share – despite still trading at a discount to NAV of 25% on the day of its results.

Meanwhile, Derwent reported 495,300 sq ft in new lettings, generating £28.3m of rental income since January – compared with £27.1m in the whole of 2015. About 40% of this has been signed since 30 June.

John Burns, chief executive of Derwent, said: “People are concerned about where rents are going. Announcements like the one we made indicate that the market is still alive and kicking. But when things appear to be slowing down, investors will go for high-yielding stocks. We have never been a high-yielding stock. We have always been an added- value model. When markets settle down, our shares should move ahead.”

Jamie Hopkins, chief executive of Workspace, said his firm had been “put into a bracket” with other London landlords because of panic and confusion over the future of the City.

With no exposure to the City or the West End, however, he said he expected little impact from financial companies looking to exit London.

He said: “There is a big divide between operational confidence and capital markets. We were one of the early movers in terms of announcing our results, and we have taken a few people by surprise on the upside.”

Hemant Kotak, managing director of research at Green Street Advisors, said the upcoming results season, which includes British Land’s and Land Securities’ half-year results next week, could bring some reassurance but would not fix a stock market still in the doldrums.

Kotak said: “The results being reported look back, but the market is trying to look ahead. That is where some of the concerns lie, so the fact that these companies trade at a discount makes sense.

“The market is looking for good sustained operating results and some confidence and clarity with these Brexit negotiations. That will take a while and is out of the companies’ hands.”

Workspace and Derwent have low gearing with LTVs of 14% and 19.3%, which Kotak said would put them in a strong position to take advantage of any other “dislocations” in the market.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette