US bank JP Morgan has topped the table in Dealogic’s semi-annual review of syndicated real estate lenders.

The league tables are the second in a series launched by Dealogic, in conjunction with the Commercial Real Estate Finance Council Europe, to provide transparent deal data in real estate lending. The company aims over time to mirror the level of information provided by other syndicated lending markets.

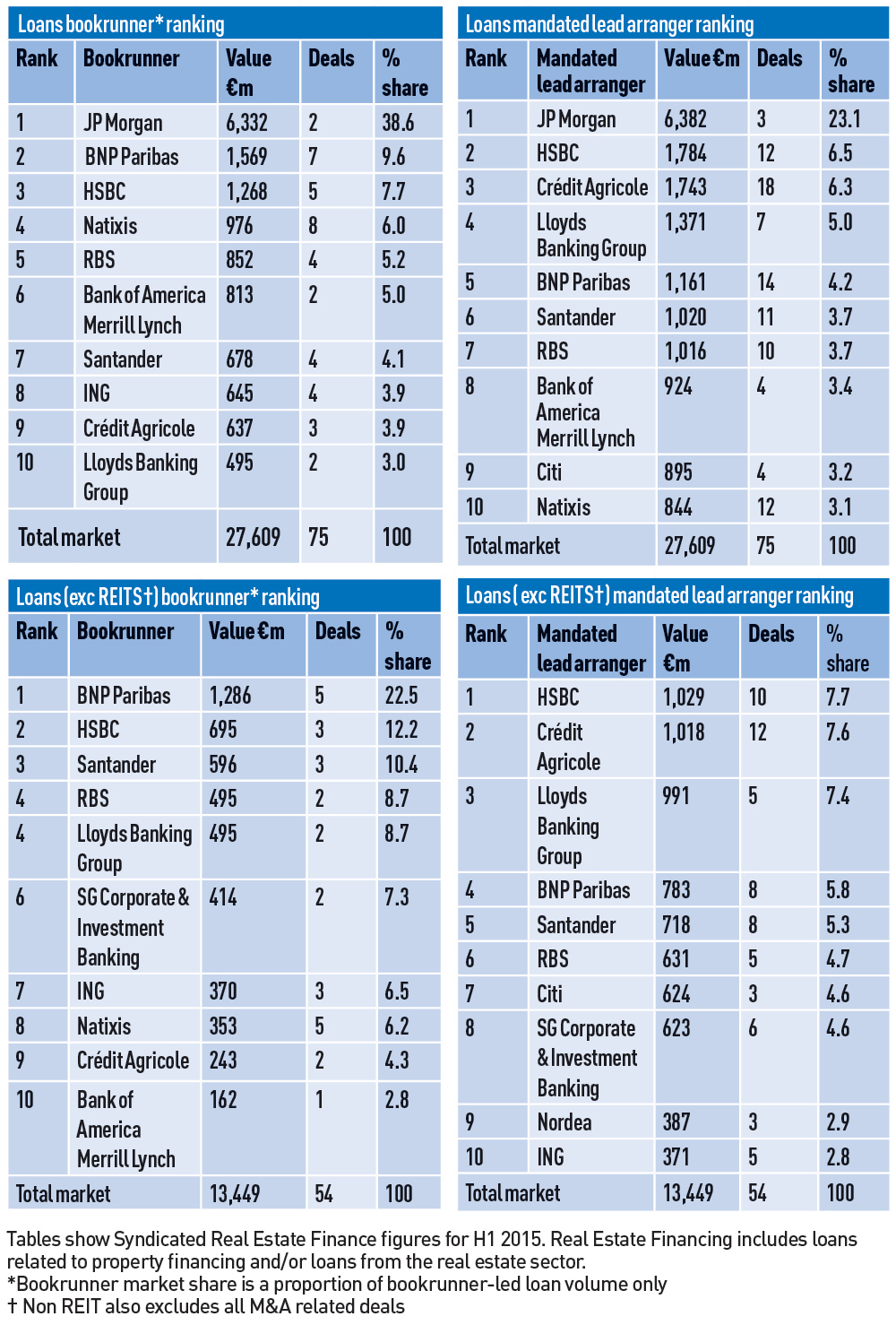

In this survey the US bank led a table of lenders which together completed a record €27.6bn (£19.3bn) of deals in Europe in the first half of the year. The total was lent across 75 transactions.

It was all change at the top of the league, with new positions for all the top five lenders. Previous lead bookrunner ING dropped to eighth place, with only Natixis remaining in the top five in the category. HSBC, Royal Bank of Scotland and BNP Paribas, which were all absent from the top five in the previous survey, filled the remaining spots.

Among mandated lead arrangers, Crédit Agricole slipped to third place from first, despite arranging 18 loans, more than any other bank over the period.

JP Morgan led this ranking too, with a 23.1% market share.

US banks were most active in the market in 2015, with three – JP Morgan, Citi and Bank of America Merrill Lynch – in the top 10, with deals totalling more than €8.2bn.

REITs made up the lion’s share of business for lenders during the period under review. But there was growth in the number of deals outside this client group, up by 35% to 54. This was despite the volume of loans to non-REIT clients falling by 3% on H1 2014.

Overall, syndicated lending was at a record level not seen since the first half of 2008. Almost a third of all £27.6bn syndicated loans were originated in the UK market.

German banks remained largely absent from the list as they tend to issue smaller loans and retain them on their balance sheets, meaning they have less chance of appearing in the top 10 listings. This is something they feel may affect their business, according to Dealogic.