Derby City Council is bringing four major sites with an estimated investment value of £210m to the UK and international markets as part of its new 15-year masterplan.

Derby City Council is bringing four major sites with an estimated investment value of £210m to the UK and international markets as part of its new 15-year masterplan.

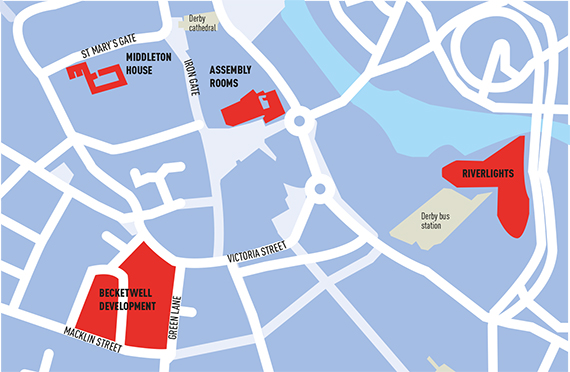

The four sites – The Assembly Rooms, Becketwell, Riverlights Two and Middleton House – are crucial to the council’s regeneration plans for the city centre. The council and its masterplan partners, including intu, want to create 1,900 homes, 4,000 jobs and attract £3.5bn in investment by 2030.

It is quite a step up from the 2005 masterplan and is the result of intervention from the council and new opportunities such as the Assembly Rooms site.

The partners are also casting their investment net wider, actively searching for overseas investors. “If you look at Birmingham and what’s promised in Sheffield, China is looking for investment opportunities in secure economic environments,” says John Forkin, managing director of Marketing Derby. “Attracting Chinese investment might accelerate our plans and significantly shorten the 15 years.” The city sent a delegation to MIPIM UK last month and has just returned from a Midlands Engine Pitchbook trade trip to China.

The council’s number-one priority is securing a partner for the three-acre Assembly Rooms site. The former concert venue was badly damaged by a fire in 2014 and after much debate the plan is to develop a new performance venue. “This will be a real game changer,” says councilor Martin Rawson, cabinet member for communities and city centre regeneration. “It will help to drive footfall and attract people into the city centre. It’s on the Market Place, which is the historic centre of the city, so it’s important that we bring it forward.”

There is much support in the city for the masterplan, but pushing the Assembly Rooms first is the only element on which there are doubts.

“I have mixed views,” says Nick Hosking, director at Innes England. “The Assembly Rooms will work but from a practical point of view we shouldn’t lose sight of the fact that we need a resolution on Duckworth Square. The city centre will continue to suffer if this happens, even if the Assembly Rooms is done.”

Becketwell, which includes Duckworth Square, is the city’s white elephant. It’s an area around St Peter’s Quarter that has been derelict for more than 10 years and featured as an opportunity in the council’s 1992 masterplan. Developers have tried to take the site forward many times but failed owing to its complex ownership.

“The city council decided it needed to step in, take the lead and make this a better opportunity,” says Rawson. The council is in the final throes of buying the former Debenhams building on the front of the site from intu Derby, using £4m of Local Growth Fund cash for the purchase and land assembly. It will then own the entirety of the site.

It is looking for mixed-use development with potential for residential, commercial, leisure and possibly a student accommodation quarter. Greg Jennings, head of regeneration projects at the council, says there have already been discussions with a number of interested parties. “We expect to go out to market with this in January. We will turn this around with the private sector and it will be transformed in five to six years,” he says.

Jennings is keen to point out that the masterplan is not just about property, although taking these sites forward will boost investment and job creation. “We have a strong belief that to be competitive and to drive the local economy, the city centre has to be the right type of place.”

The council wants to create a cultural, retail and leisure destination with a business district – the latter is something that has so far eluded Derby’s city core – and a thriving market for city centre living.

There has been some success already. Forkin says the city has realised more than £3bn of investment since 2005 with £1.75bn in the pipeline. Yet with no tradition of city centre living – unlike most other major UK cities – it’s Derby’s residential market that is currently burgeoning.

“The transformation in the resi market is something to behold,” says Russell Rigby, managing director of Rigby & Co. He points to the 400,000 sq ft of empty office space in the city that has been reduced to about 110,000 sq ft, largely because of residential conversions. Some 26 sites around Derby have either been completed in the past few months, have planning or are about to go to market.

Castleward, a 38-acre urban living village that is a joint venture between Lovell and Riverside Housing, now has its latest phase under construction. The site, which sits between intu Derby and Derby Rail station, will eventually have 800 homes, a school and retail. The city has also registered its highest monthly rent ever at £2,000.

“We have got to press the throttle hard on this and bag as much as we can,” says Rigby. “We need larger investors with experience in cities like Manchester, niche funds and PRS players. They aren’t going to be local.”

Rigby points to Cathedral Court, the 350-bed student accommodation scheme completed in September as an example of the changing scene. The project was bought forward by developer London and UK Developments, funded by Prosperity Capital and forward sold to Aviva. Another, Steam Rock Capital, which bought the Audley Shopping Centre in 2014, is to restore the building to its original height by adding residential apartments.

But while this market is hot, the office market is not. “It’s good that offices have been converted to resi but we don’t want to give up on our central business district,” says Forkin.

Jennings adds that they are aware that resi could become too successful. The council runs its Connect Office project to offer serviced offices to SMEs and has bought land on Bold Lane for an office development to provide “next-level” space for its businesses and boost the office market. “We are doing something proactively,” he says.

Derby’s investment sites

The Assembly Rooms

After the fire in 2014, many in the city were pushing for restoration, but at a cost of £10m this was ruled out. The council is currently bidding for £8m from the Local Growth Fund to finance the demolition and preparation of the site to attract a developer. The government will announce the successful bidders in the Autumn Statement. There are two options: a concert or comedy venue at a cost of around £20m or theatre and musical venue at a cost of £50m. The Midland Engine Pitchbook values the total scheme at £115m.

Becketwell

Set in three acres, Becketwell has a long history of failure and was earmarked for regeneration as far back as 1992. Westfield owned the former Debenhams building from 2007, which fronts the site, and refused to sell to any major retailer. Intu took possession in 2014 and is currently selling to the council to form an integrated package of potential retail, leisure and resi. It is valued in the Midlands Engine Pitchbook at £50m.

Middleton House

This 35,693 sq ft former council education and social services office is currently empty. “This is a fantastic location in the heart of the medieval part of the city. It has a Grade II listed front and needs a discerning investor to turn its attributes into real value,” says the Pitchbook. It is on the market and valued at £25m.

Riverlights Two

This 150,000 sq ft of land at the back of leisure development Riverlights is close to intu Derby and fronts the river. There is still discussion on whether some of the site will be used for an expansion of the bus station but it is earmarked for resi, office and leisure. The Pitchbook value is £20m.

Cushman & Wakefield is the agent on all the sites.

• To send feedback, e-mail stacey.meadwell@estatesgazette.com or tweet @EGStaceyM or @estatesgazette