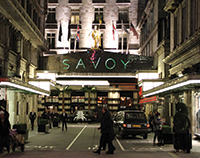

Deutsche Bank is set to provide £300m of fresh debt to refinance London’s Savoy Hotel.

The German lender is understood to be in final negotiations over the structure of the facility.

The search for fresh finance comes just one year after the partner’s vehicle, Breezeroad, completed an extensive debt-and-equity restructure with the aim of streamlining the hotel’s £458m multi-tranched capital stack.

The debt will refinance a five-year, £200m senior facility provided equally by Credit Agricole and DekaBank. It has a margin of between 380 and 400 basis points over three-month Libor.

The remaining debt comprises seven junior debt-and-equity positions. This is split between £143m provided by Lloyds and £115m by the Saudi billionaire’s Kingdom Holdings Investments. All eight facilities mature in March 2018.

The mandate is understood to have attracted term sheets from a number of investment banks including Citi, Goldman Sachs and Bank of America Merrill Lynch, with debt funds and mezzanine providers also considering the deal.

Eastdil Secured was mandated to find new finance in July.

All parties declined to comment.

bridget.oconnell@estatesgazette.com