A nine-month-long labour dispute at 29 US West Coast ports ended earlier this year. While port workers were on strike, containers from trans-maritime trade with Asia piled up on docksides and goods destined for export stacked up in logistics parks.

A nine-month-long labour dispute at 29 US West Coast ports ended earlier this year. While port workers were on strike, containers from trans-maritime trade with Asia piled up on docksides and goods destined for export stacked up in logistics parks.

Although the situation has been resolved (at least for the next five years), there may be a long-term impact on the West Coast logistics property market, which currently houses much of the US’s total stock.

“It made people think about where things come from and, as a result, the West Coast could well lose some market share to the East Coast,” says David Egan, Americas head of industrial research at CBRE.

However, a longer-term threat to the West Coast is the dispersion of manufacturing away from China, he adds. “That will have a more profound effect because it is easier to get to the East Coast,” he notes, emphasising that this kind of change is decades away.

For the moment, though, no one working in US logistics property is worried about these long-term trends, as the market is currently booming and – macro-economic catastrophes aside – is set to continue doing so for the foreseeable future.

Demand is outstripping supply by a factor of 2:1 – a situation only likely to balance out during 2016.

Yet developers appear to be resisting the temptation to go build crazy. “About 75% of our projects are still build to suit – that is much higher than we would expect at this stage in the cycle,” says Larry Harmsen, chief operating officer, the Americas at Prologis, who adds that stringent environmental regulations in states such as California are helping to constrain supply.

While demand in the UK for big boxes has dropped back, there is still plenty in the US. “There is high growth in units from 300,000-500,000 sq ft and ultra-big units are seeing continued demand from major players such as Procter & Gamble and Amazon,” says JLL industrial president for the Americas, Craig Mayer.

However, tenants are becoming increasingly demanding about the overall configuration of their properties, says Adam Petrillo, managing director at Savills Studley. “Early boxes didn’t give a ton of thought as to how occupiers actually use the space,” he points out.

Developers are also having to consider access to a consistent labour force, as well as highways. CBRE’s Egan concludes: “There is no point in having a great building if you can’t get the people to work in it.”

US logistics property for dummies

The US logistics market is very big. To put the land masses into context: the UK can fit comfortably into a single US state (Oregon) and the US is almost 40 times bigger than the UK.

So there is no equivalent of the UK’s Golden Triangle, where key population centres are reachable within a day’s HGV drive. Logistics property markets in North America have grown up around the largest population centres.

Look at a map of the US and dots representing warehouse locations cluster in a smiley face from west to east, with relatively few in the sparsely populated central and northern areas. “You go up to Montana and see how many people you can find there,” jokes Prologis Americas chief Larry Harmsen.

There are about 10 core (or tier 1) logistics property markets, most of which are coastal. You won’t find one of the largest markets on an ordinary map, though: Inland Empire, which stretches east of Los Angeles to cover 27,000 sq miles, was originally the name of a house marketing brand.

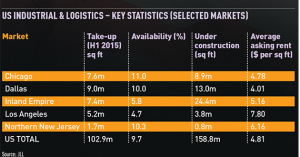

Incoming goods arriving at the coastal ports are delivered onwards to the largest inland areas of Chicago and Dallas. The split between West Coast and East Coast is about 55%/45%. Around 20 tier 2 cities are dotted along the southern US. CBRE Americas head of industrial research David Egan says: “A lot of these places, like Kansas City, Indianapolis or Cincinnati, would be major cities in other countries.”

The huge distances between centres in the US mean rail freight accounts for a much higher share of goods transit than in the UK – about 40% of freight by distance in the US is moved by train, compared with less than 10% in the UK.

What the US can teach the UK (and vice versa)

Although we share a common language and ancestry, there are significant differences between the UK and US logistics property markets. Here we consider themes that are likely to have an impact on either side of the Pond…

Although we share a common language and ancestry, there are significant differences between the UK and US logistics property markets. Here we consider themes that are likely to have an impact on either side of the Pond…

Re-shoring Manufacturers moving closer to the markets they serve, reducing transport and warehousing facilities and costs. “This is more significant in the US than the UK, as shale gas has dramatically reduced energy costs for US manufacturers,” says JLL director of UK logistics and industrial research, Jon Sleeman.

Sub-divisible warehouses Quite popular in the US, single warehouses are designed to be split into two or three sections, each a secure area. “This represents good long-term flexibility for owners and allows occupiers to grow,” says Prologis’s chief operating officer, the Americas, Larry Harmsen. UK industrial agents doubt whether this will catch on here.

E-commerce Opinion is divided about which country leads the field in bringing smaller, local warehouses and so-called dark warehouses closer to population centres, but there is consensus that developments in e-tailing will have a profound impact on logistics property in the next few years. “Online grocery retailing is more advanced in the UK than the US,” says JLL’s Sleeman, so there could be potential for operations like Ocado to appear in the US.

Solar energy generation The roofs of American sheds are increasingly likely to be covered in solar panels. “Local utility companies are often subsidised and have mandates to generate a certain percentage of electricity through renewables,” says Prologis’s Harmsen. This is easier for developers and owners in the US because they retain roof rights, whereas in the UK, buildings let on standard FRI leases give the occupier responsibility for the roof.

Truck parking In both countries there is, and will continue to be, greater demand for space for HGV trailers, which are increasing in size, within the envelope of logistics properties.

Drone delivery Despite excitement about automated delivery from the skies, JLL’s Sleeman does not expect a wide roll-out. “I can’t see it working on a large scale because it will involve delivery to dense urban areas,” he says.

Investment

A year ago, few in the US had heard of Singaporean investor GLP. But its purchase this summer of a 58m sq ft logistics portfolio from Industrial Income Trust for £2.9bn ($4.5bn) propelled it into the spotlight. With more than 173m sq ft, it is now the second-largest owner and operator of US sheds.

“Product is being acquired wholesale,” says Craig Meyer, industrial president for the Americas at JLL. “We are likely to see similar large-scale moves in Europe in next two years.”

US industrial and logistics property is so appealing to investors because the barriers to entry are relatively low. Coupled with a limited supply pipeline and the lowest vacancy rate in 15 years, the potential returns from logistics investment remain attractive.

Keith DeCoster, director of US real estate analytics at Savills Studley, says: “Many analysts say pricing and cap rate compression in the office and multi-family sector, and select high-street retail, is getting ahead of property performance. In contrast, considering the strength in the industrial sector, pricing and cap rates in this asset class [averaging under 7% nationally] appear to lag the steady demand from retailers, wholesalers, distributors and e-tailers.”