Companies pursuing an IPO will have to think carefully as they enter a year of political volatility, according to an expert panel at the Estates Gazette Finance & Investment Summit last week.

Getting an IPO off the ground could prove difficult as the windows where market activity would normally be in full swing coincide with events that could cause instability.

With the US elections coming up on 8 November, followed by French and German polls in the spring and autumn of 2017, James Riddell, managing director of Lone Star Europe, said: “You’ve got to think quite carefully over the next 12 months of the chances of getting your IPO away at an acceptable level.”

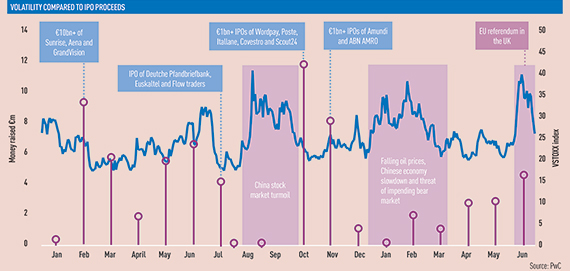

Data from PwC’s second quarter IPO Watch showed that in times when the VSTOXX volatility index peaked, money raised for IPOs plummeted. Turmoil on the Chinese stock market last August and September coincided with periods where almost no capital was raised for flotations. In October, as the index stabilised, numbers shot to over £12bn worldwide.

Forthcoming volatility could jeopardise already limited windows of market activity, windows that disappear over Christmas and the summer months.

But going public could be worth the time, effort and risk considering how the listed sector has reacted to Brexit and rewarded certain property sectors, in contrast to the open-ended funds that are still looking for liquidity to satisfy redemption requests.

While the shares of companies most exposed to London’s office market, such as Derwent London and Workspace, are down more than 20% from their pre-referendum value, logistics and industrial REITs like Hansteen and Tritax have seen share prices grow by nearly 10% in the same period.

Industrial REIT SEGRO raised £325m by issuing shares at the beginning of September.

Mark James, managing director at Jefferies Equity Syndicate, said: “If you can offer something that’s interesting, backed by attractive and sustainable yield, then you’ve got the potential to do a successful IPO.

“There’s generally an institutional demand for high-quality yield, so if you can tick that box in the context of an IPO, of course the market is open.”

The perils of dual-tracking

When a company is sold, it can run an IPO and a private sale in parallel, leaving a final decision on which to choose until late in the process. Countryside entered the London stock exchange in February with a £1bn market capitalisation after doing just that. Rebecca Worthington (pictured), chief investment officer at Countryside, explains the decision to run a dual-track exit: “Dual track is very difficult. The reason we ended up doing it was because the sponsors’ governance requirements are: Have you properly explored the market? Have you ticked that box?

“From the point of view of a private sale, if potential buyers think you’re going to end up going down the IPO route, why do they really want to put the time and effort into the huge amount of work attached to properly valuing the business? At the same time, when you’re going to talk to investors on the road about an IPO, if they think there’s a dual track going on, then they’re thinking, ‘Why am I putting all this work into understanding your business just for it to end up going private?’

“We got indicative bids first, decided that an IPO was a better outcome and immediately closed it down so that we didn’t have too much of a conflict. Even then, you’ve appointed a banker, you’ve written an information memorandum. You’re a couple of million pounds short of where you would have otherwise been, and you’re sitting, thinking: ‘This is a horrific amount of money to spend on something that you’re never going to need’. But then you have to put yourself into the shoes of the sponsor. If they’re sitting on hundreds of millions of pounds of profit from a deal, a couple of million is neither here nor there.”

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette