UK Commercial Property REIT has invested £29.1m in a purpose-built student accommodation asset in Edinburgh.

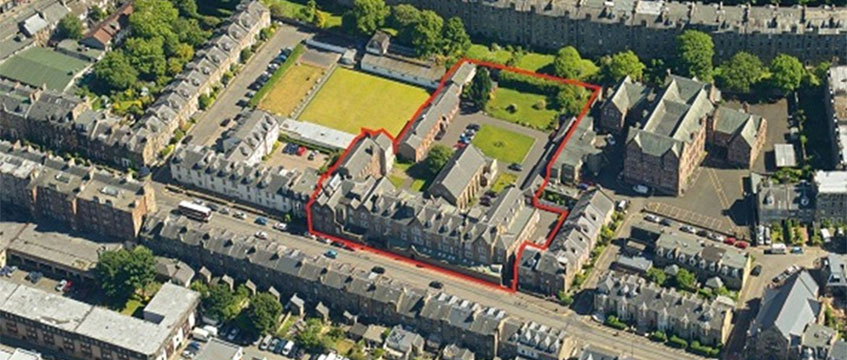

The FTSE 250 investment firm, managed and advised by Aberdeen Standard Investments, will forward fund 41-45 Gilmore Place. The land purchase from S1 Developments is expected to complete in February, with delivery of the asset due in 2022 for the 2022/23 academic year.

The building will have 230 beds, most of which will be en suite cluster rooms, with a small number of studios.

The REIT has also struck a deal to buy an Asda supermarket in Torquay, Devon, from Aviva Investors for £16.6m. The price represents a net initial yield of 4.7%, which will rise to 5.24% next July. The site is let to the supermarket group on a long lease with an unexpired term of 15.5 years.

The two deals will be funded through existing cash resources, including the proceeds of the company’s £25.4m disposal of the M8 Interlink Industrial Estate in Coatbridge.

Will Fulton, lead manager for UKCM at Aberdeen Standard Investments, said: “Through these acquisitions we are enhancing our income and increasing the portfolio’s exposure to the alternatives sector. At the same time, this disposal is in line with our ongoing strategy to refine the portfolio and recycle capital into opportunities which offer longer term income growth potential.”

To send feedback, e-mail tim.burke@egi.co.uk or tweet @_tim_burke or @estatesgazette