Efficiency gains in the workplace, in light of concerns about economic uncertainty are driving occupier decisions, according to CBRE.

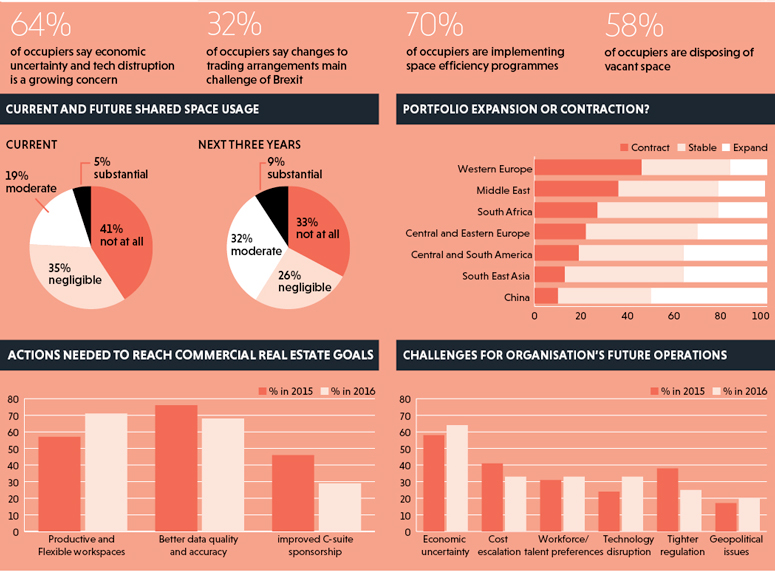

The advisory firm’s 2017 Occupier Survey shows that 64% of occupiers cited economic uncertainty as a major challenge to its future operations.

Nearly half of occupiers still saw Brexit as a material issue, with activities in the UK seen as particularly susceptible.

In banking and finance, 71% of companies see the issue as significant or very significant, compared with 61% for professional services and only 25% in technology and telecoms.

But SMEs were more concerned about possible labour shortages, as well as escalating wages and a reduction in funding. There was also a concern that the venture capital funding to companies outside the EU will be reduced, with some medium-sized American tech companies having curtailed growth plans for London in favour of other locations in Europe, particularly Dublin.

The survey showed that 90% of occupiers said cost reduction and strategic alignment between real estate and wider business aims were key focuses of their corporate real estate strategy, while drivers of on and offshore activity were based on cost (86%) and labour and skills (78%).

To save on costs, 70% of occupiers sought to make their space more efficient, 58% disposed of vacant space.

Rising rents have made lease renegotiations less attractive. Only 48% said they had successfully renegotiated leases on existing buildings over the past twelve months, compared with 67% last year.

Technology and telecoms are more focused on space efficiency and restructuring programmes (81%) and less concerned about disposals or lease renegotiation. By contrast, banking and finance companies favour disposal of surplus or vacant space (73%) including, in many cases, rationalisation of branch networks.

Smart workplaces are ever more in demand. Occupiers are focusing on disruptive technology, flexible working and shared space to in order to enhance workspace.

Technology is being more frequently used to generate large data streams, for personal environmental control systems, analytics and to support flexible working.

Richard Holberton, head of EMEA research at CBRE said: “In light of this, occupiers are no longer interested in getting the endorsement of senior management to pursue flexible working strategies, and are now more interested in what tech is around that will allow these things to be developed.”

Strategies like virtual desktop access and video conferencing are increasing in popularity, having increased by 35% and 28% respectively. Technology tools were seen as success factors by 50% of occupiers, up from 24% last year.

A growing reliance on tech also meant more technology occupiers were expected to expand their presence across Europe, growing operations across the continent in response to demand for services.

Holberton said: “We are certainly seeing tech occupiers making a big impact on markets. As a set of tools to help occupiers achieve corporate real estate strategies better, it is absolutely fundamental.”

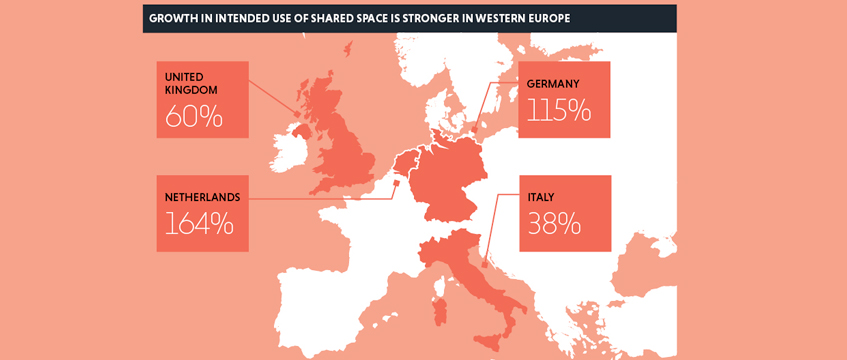

The survey also recorded a 70% growth in interest in using shared space substantially or moderately over the next three years, driven by growth in co-working spaces in particular. Almost half of European occupiers surveyed expect to have moderate or substantial use of co-working space by 2020.

Wellness was also being focused on much more, with 72% of those that have or are planning to introduce a wellness programme, having expressed some degree of preference for WELL–certified buildings.

Holberton added: “The motive of investors is changing from capital to income driven, meaning an understanding of what occupiers are thinking and doing in order to support occupancy rates and income generation. I think we are close to a turning point where the kinds of issues occupiers are concerned about will become more n more important for generating returns.”

To send feedback, e-mail Shekha.Vyas@egi.co.uk or tweet @shekhaV or @estatesgazette