Colin Stanbridge, chief executive of the London Chamber of Commerce and Industry, cracks a wry smile as he says: “I can exclusively reveal to Estates Gazette that we are definitely not moving to Luxembourg.”

Colin Stanbridge, chief executive of the London Chamber of Commerce and Industry, cracks a wry smile as he says: “I can exclusively reveal to Estates Gazette that we are definitely not moving to Luxembourg.”

The sardonic humour is perhaps an outward manifestation of the pain felt by the many LCCI members who voted to remain in the EU in June’s referendum. Yet beyond the wisecracks, Stanbridge says there is a serious intent by many London businesses to “get on with making the best of what we see as a very bad job”.

He dismisses the pre-referendum rhetoric from the Remain camp of companies immediately upping sticks from the capital to head off elsewhere. “That was never going to happen, but an awful lot of decisions have been paused. There will be no big bang, no sudden crisis, rather losses could happen gradually over time,” he says.

Stanbridge does not see this insidious erosion of the capital’s economic base as inevitable and he is leading the charge, via his organisation, to rally the thousands of London’s businesses which, by his own admission, remain shell-shocked by the referendum result. LCCI’s initial survey results, based on polling and round tables, suggest the largest issue to be addressed in forthcoming exit negotiations is talent.

“London knows that migrant workers are not just important, but indispensable to its economy,” says Stanbridge. One solution, proposed by LCCI before the referendum, is the establishment of a London visa, a concept Stanbridge claims already has widespread support, from the mayor’s office to the London Evening Standard.

By the start of the Conservative Party conference early next month, LCCI expects to have compiled a manifesto of exit terms which are representative of the views of London businesses. Stanbridge says a real challenge facing companies based in the capital, many of them SMEs, is the need to alter their corporate mindsets: “We will need to put time and effort into exporting in a way we have never done before.”

What do other members of the London forum think?

Kay Neufeld, economist, CEBR

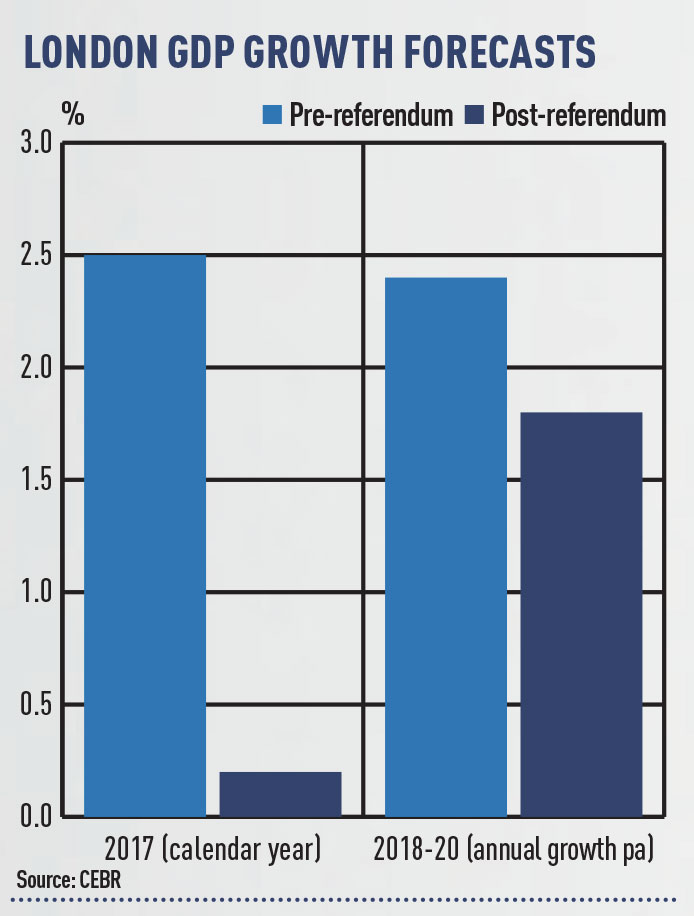

“Financial and business services are London’s specialty, but the ability to easily sell these services to our European neighbours is closely linked to access to the single market. The prospect of potentially losing this access has created enough uncertainty to stifle hiring and investment over the coming months. Consequently we have downgraded our London growth forecast for 2017 (see graph). Whether this is a temporary setback or just the beginning of a longer downward trend will depend on the negotiations between the UK and the EU and on the ability of London companies to branch out into other markets.”

Simon Neate, chairman, Indigo Planning

“The closer we move towards Brexit-lite, the more secure London’s position will be; the more radical the final outcome, the more London’s economy will be in for a shock. And the property market will be able to do very little but respond. While there may be smaller tweaks we can influence or areas where the mayor of London will have some control, it is principally national-level decision making that will determine how the capital’s economy is affected by the referendum result.”

Angus Dodd, chief executive, Quintain

“We have to work to ensure London retains its status as a global city with enduring appeal based on access to a large and diverse talent pool, rich cultural life, green spaces and a strong legal framework. These strengths should mean that companies will want to retain a substantial presence here regardless of how Brexit plays out – but it will not happen automatically.”

Bill Page, business space research manager, LGIM Real Assets

“London’s position as a leading global financial centre is earned from attributes including transparency, clustering, education and culture, most of which are apolitical. It would require a serious reversal in fortunes for London to drop behind global gateway cities. However, Brexit has the potential to provide structural impediment. The key unknowns concern immigration controls, passporting and professional service equivalence. To expect a calamity assumes that neither the politicians nor the many thousands of talented people working in London can fashion a competitive long-term outcome. Some occupiers may reconsider their location in light of these risks, but most will accept that the embedded strengths of London mean staying put is the best option.”

Jo Valentine, chief executive, London First

“While Brexit has undoubtedly come as a shock for business, our city is nothing if not resilient. The fundamentals that make London an attractive hub for financial services – timezone, language and rule of law – are unaffected by Brexit.”

John Slade, chief executive, BNP Paribas Real Estate

“London is not going to change its location, its transparency or its fundamentals. We are hearing that although the referendum result

was undoubtedly a shock, global occupiers are not making quick decisions to the detriment of London. Moreover, many corporates we have spoken to say that in their opinion London is still the financial centre of and gateway to Europe.”