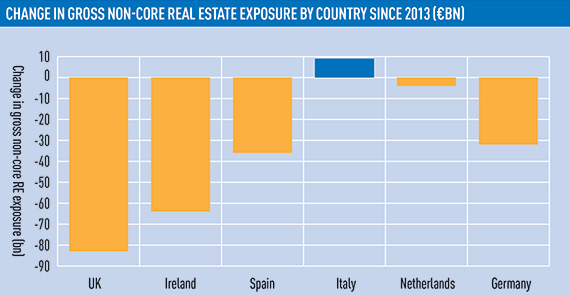

European banks have cut their distressed loan portfolios by nearly a third since 2013, according to Evercore’s first European distressed real estate market report.

European banks have cut their distressed loan portfolios by nearly a third since 2013, according to Evercore’s first European distressed real estate market report.

The report, which analyses non-core real estate distressed loan exposure in 59 banks, shows that Europe still has €462bn (£395bn) of loans and assets to deleverage.

The Netherlands led the continent in disposals this year with a massive €5.2bn sale of Propertize’s Project Swan portfolio, while the UK has slowed down its activity after cutting its NPL exposure by more than 80% since 2013.

Meanwhile, Italy has seen its exposure grow in the same period and now accounts for 20% of the region’s total.

Federico Montero, managing director of Evercore, said: “There’s now a concentration in the south, in Italy and Spain. The UK and Ireland were the two main markets that were doing their homework.

“RBS and Lloyds started four years ago. What’s remaining in the UK and Ireland is little pieces here and there.”

This was the first report NPL specialist Montero has led since leaving Cushman & Wakefield in June.

While at the firm, he was an adviser on deals including Nama’s sale of its €3.9bn Emerald and Ruby portfolios to Oaktree Capital.

- Since 2013, UK and Irish banks have led the way in disposing of their NPLs. The focus has shifted to Spain and Italy, which account for 61% of the total non-core real estate exposure in Europe. Evercore’s report notes that activity has been low in both countries but is expected to pick up, especially with growing regulatory pressure in Italy.

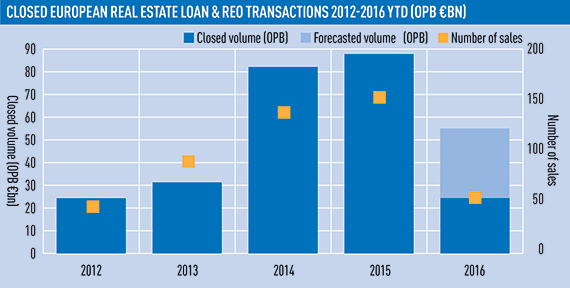

- There was €24.4bn of closed sales to the end of August this year, down by 39% in the same period in 2015. A lull fell over the market this year with deals put on hold in the run up to the UK referendum. Only three deals with a face value greater than €1bn have completed to date, down from eight in the same period last year.

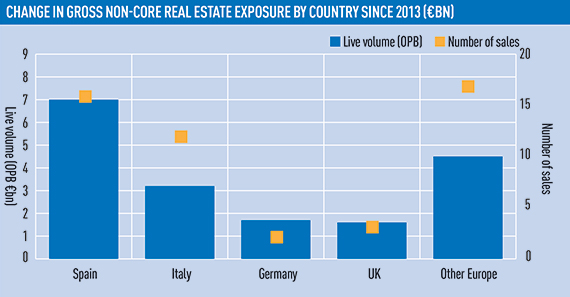

- With the biggest NPL portfolio in Europe, Spain is leading the way in disposals with €7bn of live transactions. But this is just a fraction of the country’s €189bn portfolio of NPLs still to deleverage. A total of €18.7bn in live transactions are in progress across Europe – which is 4% of its total exposure.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette