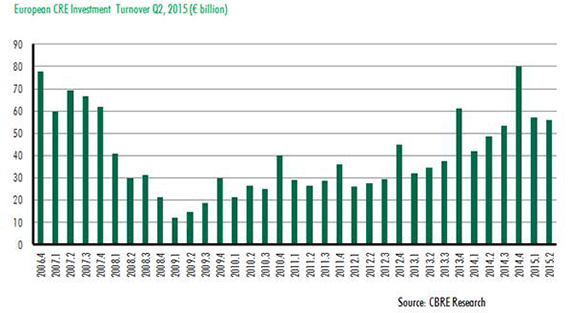

European commercial real estate investment totalled nearly €58bn (£41bn) in the second quarter of 2015 – a rise of 15% on the equivalent quarter last year, the highest level of second-quarter growth since 2007, according to research from CBRE.

European commercial real estate investment totalled nearly €58bn (£41bn) in the second quarter of 2015 – a rise of 15% on the equivalent quarter last year, the highest level of second-quarter growth since 2007, according to research from CBRE.

Germany led the way in investment growth, with €12bn coming into the market in the second quarter – a rise of 62% year-on-year.

However, overall European growth slowed marginally year-on-year despite strong increases in several markets. Spain, Portugal, Finland and Norway each doubled investment over the quarter compared with the same quarter in 2014.

Lack of supply held investment back in Central and Eastern Europe, particularly in the industrials and retail sectors. Extra office space was being developed in the region, which contributed to holding back investment in this segment, according to CBRE.

In euro terms, investment turnover was up 10% year-on-year in the UK, possibly because of currency fluctuations, but flat in sterling terms.

Jonathan Hull, managing director, EMEA capital markets at CBRE, said: “In recent months, we have seen the market trying to balance a lack of stock with the large amount of capital available for investment. This has generated a significant amount of activity in the portfolio sector, and in Q2 we again saw an increase in corporate deals, such as Merlin Properties’ recent acquisition of Spanish property company Testa for around €1.8bn.”