The six-month suspension of Aviva Investors Property Trust was a last-resort response to an “extraordinary event”, the fund’s new sole manager has said a month after re-opening.

Andrew Hook, who has taken over management of the trust after nearly two years of co-managing the fund with Mike Luscombe, says the fund is now upping its cash levels ahead of a year of potential political turmoil.

The fund closed to redemptions on 5 July last year, becoming one of seven open-ended retail funds to do so after investors scrambled for redemptions in the wake of the Brexit vote. It re-opened on 15 December.

Hook said the fund built up liquidity in preparation for the referendum, and after selling Academy House, 161-167 Oxford Street, W1, last April for £108m to occupier Sports Direct, it bolstered its cash holdings to 16%. But the panic that followed slashed that liquidity “close to zero” in the weeks before and after the vote.

It was the first time in the fund’s 26 years it had suspended redemptions.

Hook said: “It has to be seen as an extraordinary event. Herd mentality describes what happened in the aftermath of the EU referendum vote.”

The goal for Aviva was to re-open as quickly as possible while maintaining a “business as usual” style of management. Hook said the intention was to rebuild the fund’s liquidity by selling only non-core assets.

He said: “Suspension is a last resort. Nobody wants to suspend. But it is there for the protection of investors and to make sure that all investors are treated fairly and equally. We took our time, but only to make sure we were selling the right properties and getting market value for them.”

In August, the fund said it would likely stay closed between six to eight months from 5 July before it could re-open with sustainable cash levels.

At the time, the announcement fuelled speculation about weaknesses in the fund, with some rivals questioning whether Aviva would be forced to make major structural changes.

For Hook, however, the announcement was an effort to be open with its investors.

He said: “The speculation was probably a little unfair. We had a sales programme in place and we thought it was going to take six to eight months. We thought that was the fairest way to set an expectation, and we took the right amount of time to sell the properties.”

“The suspension could have been over sooner had we picked three large, shiny assets and decided to have a quiet conversation or market them to a limited number of people. But that was not the way we wanted to sell.”

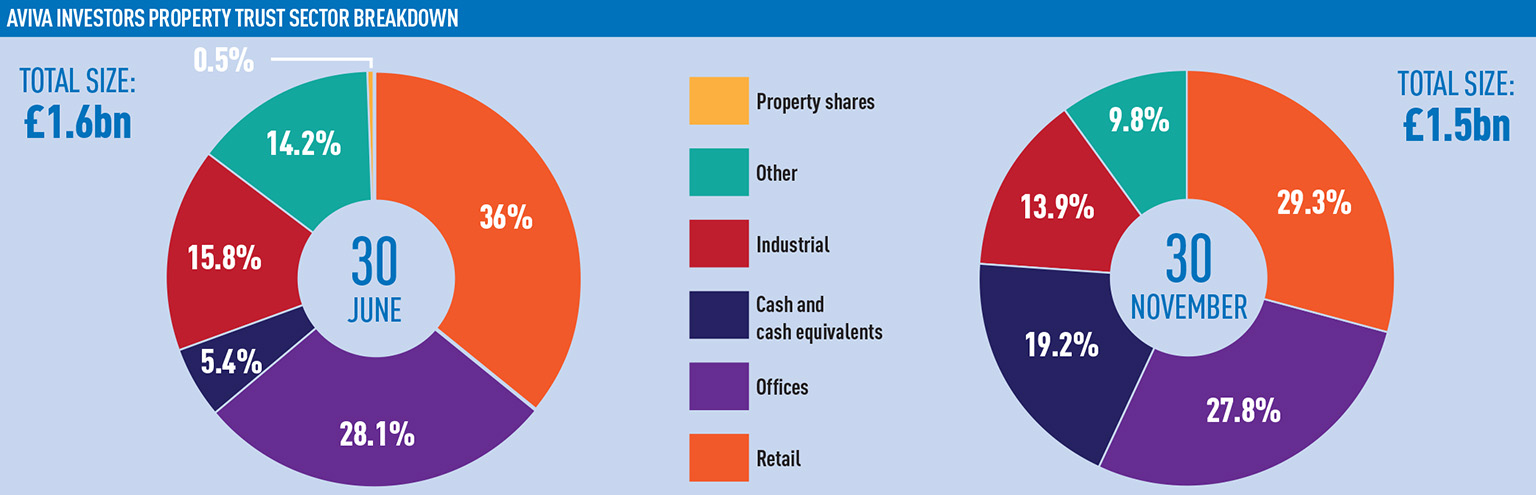

The fund made 15 sales during and just after the suspension for a total value of £300m, bringing liquidity up to 17.5% at the end of the year.

Hook said the level would drift higher in the short term in order to counter potential market volatility in the lead up to the triggering of Article 50 in March. However, in the long-term, liquidity should come down to between 10-15%.

He said: “Liquidity is great when there’s a call for cash, but equally it’s a cash drag in terms of performance. Investors don’t want to see 20%-plus on a sustained basis within these funds.”

The fund will continue selling non-core assets but retain assets in London, Manchester, Birmingham and Cambridge.

The goal, Hook said, was to become a visible long-term investor in select areas with economic growth potential. “By clustering ownership in those areas, we will be able to be seen to have a decent place at the table to influence and provide solutions for local authorities in terms of their planning,” he said.

Hook said he hoped the fund would become a buyer again in line with that strategy later this year when it no longer needed elevated cash levels.

With John Forbes’ independent review of open-ended funds expected by Easter, Hook said he was open to discussions about structural change “as long as it makes sense for the client”.

Meanwhile, the trust’s plan to convert to a PAIF, which was supposed to be finalised in mid-July before the suspension derailed the plan, will likely be re-announced later this year.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette