MSCI Real Estate, formerly IPD, has been through a tumultuous time of late. In July it put 15 staff, including its executive director Phil Tily, on consultation in an attempt to cut costs, while managing director Laurent Ternisien agreed a departure from the business.

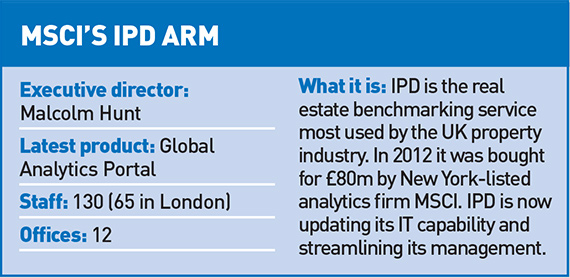

The changes follow MSCI’s £80m purchase of the benchmarking service in 2012. At that time it made an annual profit of £4m but since then its financial performance has dwindled.

The new man at the helm of MSCI Real Estate’s real estate offering, following Tily’s departure is executive director Malcolm Hunt. He has the responsibility of developing its offer and making sure it is meeting the demands of its ever more global customer base.

The new man at the helm of MSCI Real Estate’s real estate offering, following Tily’s departure is executive director Malcolm Hunt. He has the responsibility of developing its offer and making sure it is meeting the demands of its ever more global customer base.

“After two-and-a-half years MSCI has got comfortable and confident that the integration is going to plan and it has pivoted the old IPD reporting line that previously went through Laurent Ternisien into MSCI’s more standard, regional reporting communication line,” says Hunt, who now reports to Laurent Seyer, global head of client coverage at MSCI.

There is a clear drive by MSCI to make the real estate team function in the same way to its other benchmarking services in other sectors. As part of this, since the takeover MSCI has moved much of its back office, number-crunching processes to Mumbai, where MSCI has close to 1,000 staff.

“A big part of that is actually in keeping with everything else we are trying to do – standardising this collection of data, making sure that the indexes, the analytics, are all comparable. And to do that in a way that means you can easily compare London offices with New York, with Barcelona or wherever,” Hunt says.

The MSCI vision for real estate is encapsulated in its new “all you can eat” data product called the Global Analytics Portal. It allows clients to customise precisely the data they need with less need for direct assistance with MSCI staff at a more basic level.

This also involves a more standardised data inputting system that allows it to be integrated with the data collected by MSCI within other sectors.

It allows multi-sector investors to integrate the data in decisions they are making when comparing different areas rather than having to look at real estate in isolation.

In order to facilitate this, MSCI has had to make major IT improvements, which have brought about large one-off costs that have in turn hit profits.

“One of the reasons MSCI bought IPD was to meet the real estate requirements of their existing clients. There are all these multi-asset class investors and owners and it’s a huge investment to meet their requirements. That level of investment won’t be necessary permanently,” Hunt says.

He adds: “We’ve had this history of producing pre-canned data – we collect data from clients, we clean it, we scrub it, we make sure it meets governance requirements, and then in a very standardised way we make it available back to the market. This investment in technology opens it up for any users to do all of that themselves and customise it as they wish in a user-friendly way.”

With the new system customers are now being driven towards buying larger, more costly data sets – but this is largely in line with their requirements, Hunt argues.

“Some might argue that they only want to know about say, retail in Manchester. But you soon find that they are interested in retail in Birmingham, the big shopping centre market and then they want to compare it to another market. This is a user-friendly way of providing them with that.”

MSCI Real Estate is a business that has undergone much change since becoming part of the giant that is MSCI but in doing so it is aiming to become a more modern and useable service to its clients, even if there have been a few bumps in the road along the way.