John Forbes’ independent report into last summer’s open-ended retail fund crisis has said the vehicles “undoubtedly [have] significant flaws” but that they should not be scrapped altogether.

The former PwC partner said in his report, commissioned by the Association of Real Estate Funds, that the crisis should be an opportunity to diversify real estate funds rather than replace current structures.

He outlined four key recommendations to diversify the market through a regulations review, a valuations review, improved communication and product development (see below).

The report found that if there was demand for the continued existence of open-ended funds that attempt to provide daily liquidity, then they should be allowed to exist, even if there are fundamental problems in delivering this practically.

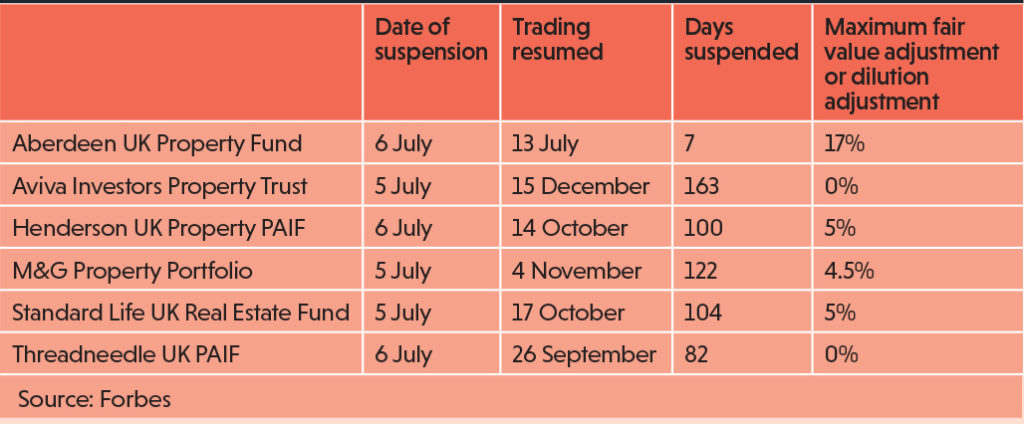

After the EU referendum in June 2016, seven open-ended retail funds closed trading when there was a surge in redemptions from investors. As a result, AREF commissioned an independent review of fund structures.

Forbes said that part of the problem leading to the crisis was a lack of choice for investors. Independent financial advisers were increasingly using broad “model portfolios” that invested in a range of asset classes, the reports said. This required a common structure, which meant investors who might not need daily liquidity were locked into it.

The report also noted that this structure, combined with technology that made trading faster, meant that advisers could quickly re-allocate investments.

For example, if an investor’s portfolio allocation to real estate goes from 10% to 8%, that reflects a 20% drop. If there are enough re-allocations in a short period of time, as there were in June and July 2016, that could deplete a fund’s liquidity.

What happens now?

AREF will keep the report open to consultation until 21 April to let members respond to Forbes’ comments and suggestions.

A final report will be published in the last week of April in time for the FCA to take it into consideration in its consultation paper discussing illiquid assets in open-ended funds, which closes on 8 May.

Forbes report’s key recommendations

Regulations review

The Forbes report encouraged a rethink of the “inconsistencies and complexities” of the regulations behind open-ended funds, which, it said, had stifled the development of diverse fund structures that could respond to a complex asset class such as real estate.

For example, the report noted that the Financial Conduct Authority allowed for fund structures that trade in intervals of up to six months, but regulations for ISAs, the most popular retail platform for investing in funds, allows trading “no less frequently than bi-monthly”.

New models could include a fund structure that might temporarily suspend or defer redemptions while staying open to new subscriptions. Others might have quarterly rather than daily trading for investors who are currently paying a price for liquidity they do not want.

The industry should work with the FCA on a “comprehensive review” of these regulations, Forbes said.

Valuations review

Open-ended funds need a review of how underlying assets are valued. In particular, the lag between valuations and sales means that in a falling market, by the time an asset is sold, the value will have fallen and exiting investors have been overpaid.

In a rising market, incoming investors have been undercharged as values grow.

With RICS’s standards update coming up this year, Forbes recommended that they review their valuation methodology, looking at how to address forward-looking valuations.

He has also encouraged the FCA to review its regulations on market value adjustments for underlying assets, which respondents said were ambiguous with regard to whose responsibility they were and in what circumstances they should be allowed.

Communication

AREF should take a more active role in explaining fund products to investors and their proxies, and ensure it does this without favouring any one model or manager. This is particularly important, Forbes said, if funds make different decisions on whether to suspend or adjust their portfolios’ market value during a period of high redemptions.

With financial advisers and managers having a better understanding of the funds, there would also be more scope to move from one type of retail fund to a range of funds with different structures and targets.

Product development

Although the report was not about the EU referendum, it said the event could be used to address a lack of diversity in retail products in the same way the global financial crisis led to new funds for institutional investors.

However, it added that bringing in sweeping regulatory changes too quickly or without input from the industry could lead to more volatility if it prompted investors to take out their holdings.

Timeline: how open-ended funds reacted to the EU vote

■ 24 June – EU referendum result; Henderson introduces 5% fair value adjustment (FVA)

■ 27 June – Standard Life Investments introduces 5% FVA

■ 28 June – Legal & General introduces 5% FVA; Kames introduces 5% FVA; Aberdeen Asset Management introduces 3.75% FVA

■ 1 July – M&G introduces FVA of 4.5%

■ 4 July – Standard Life Investments suspends UK property fund

■ 5 July – Aviva and M&G suspend UK property funds

■ 6 July – Henderson, Columbia Threadneedle, Aberdeen suspend UK property funds; Aberdeen increases FVA and dilution adjustment to 17%;

■ 7 July – Legal & General increases FVA to 15%; Kames increases FVA to 10%

To send feedback, e-mail karl.tomusk@egi.co.uk or tweet @ktomusk or @estatesgazette