International businesses are taking their front-office operations further afield than London, and it is not just cost savings that are luring them away. David Thame reports

First there was offshoring, then there was northshoring, and now there is leapshoring. Yes, a new word to describe a new reality as the UK office relocation market goes back to front.

Distrelec, a Swiss-based multinational selling everything from semiconductors to security equipment, has just signed up for 17,000 sq ft in central Manchester. The office at Mosley Street Ventures/Deutsche Asset Management’s 160,000 sq ft 2 St Peter’s Square will serve as an expansion of their Zurich innovation hub. It is their first toe-hold in the UK market and as everyone involved is keen to point out, this isn’t a back office relocation. It’s real, serious, top level stuff.

And so what? Not a massive deal, say the city’s inward investment cheerleaders, but a very significant one. And that’s because although this is Distrelec’s first move into the UK, and London didn’t make the final cut when it came to choosing a location. The choice was between Manchester and Berlin, and Manchester won.

This is news, because until now the appeal of the regional cities has been assumed to be mostly about cost. Big businesses and professional firms were supposed to ask themselves: why keep non-essential services in London when you could do it for half the price in Leeds, Birmingham or Manchester? Northshoring has seen HSBC take 210,000 at Miller-ACDL’s Arena Central in Birmingham and magic circle law firm Freshfields take 80,000 sq ft at English Cities Fund’s One New Bailey in Manchester.

Distrelec and a slew of other leapfrogging relocations seem to suggest that cost-driven northshoring is no longer the thing to watch for. A quite different trend – and one potentially very significant for the UK economy – is beginning to take shape. And that’s leapshoring.

The shift to the regions

Swiss-based Distrelec is, like most Swiss businesses, fabulously discrete. So for an explanation of their decision, EG turned to Nick Nelson, director at Manchester’s Sixteen Real Estate and the man who piloted the Distrelec relocation from Zurich.

“The search began in summer 2016 and the aim was to find a location for an expansion of their Zurich enterprise hub,” says Nelson. “At this stage, the choice was anywhere in Europe.”

Above all, this is no longer about cost-saving northshoring. This is about the quality and quantity of talent in our labour market, about tech skills, language skills, about the airport

Tim Newns, chief executive at MIDAS

A careful study of the demographics reduced the list of target cities to eight with both London and Manchester on the list.

“The scoring system looked at the cost of living, wages, education, city centre transport, quality of life. In the end, the choice boiled down to Berlin and Manchester,” Nelson says. “Distrelec did tours of both cities, spoke to the inward investment agencies in both, and settled on Manchester.”

Once the city was chosen, the building followed rapidly. A shortlist of three city centre options, including Spinningfields, was soon narrowed to Mosley Street Ventures and funded by Deutsche Asset Management’s 2 St Peter’s Square. Not the cheapest option at £34 per sq ft, but the clear favourite for efficiency and front-of-house image.

Today the recruitment of 110 local staff is proceeding. Just eight to 15 will relocate from Zurich. This is not back office – this is front office.

Nelson, who also advised leapshoring Swiss firm Syngenta on their 32,000 sq ft relocation to Lone Star’s Towers business park, Didsbury, says there are more leapshoring deals in the pipeline – a fact confirmed by Tim Newns, chief executive of Manchester inward investment agency MIDAS.

Today MIDAS has about 400 live enquiries – leapshoring, northshoring, and more mundane but important moves – of which about 100 will land in the city in the next 12 months. Of them, about a dozen will be relatively large, involving workforces measured in triple figures. Then look at the foreign direct investment figures – rising steadily, up from 57 in 2015, to 70 in 2016, and likely to be higher still in 2017.

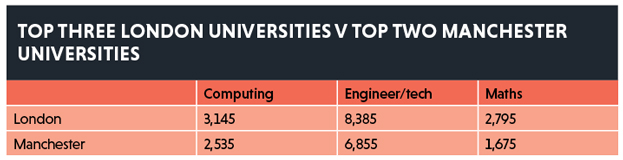

Leapfrogging: tech students

London figures based on University College London, Imperial and Kings; Manchester based on Manchester University and the Metropolitan University

Source: Marketing Manchester

Talent over cost

At the current rate of progress, back-of-envelope calculations suggest leapshoring has already accounted for about 100,000 sq ft in the first half of 2016. It could grow substantially in the coming year – and Newns hopes it will.

Brexit could help drive the process. He says: “Brexit talks will have real opportunities for this kind of leapfrogging of London, because European businesses will now need a standalone UK operation, and we see Manchester as the prime candidate. We already have the UK HQs of a long list of international operations from Kelloggs to Brother, so incomers know it can work. It’s very much an opportunity for the city.

“Above all, this is no longer about cost-saving northshoring. This is about the quality and quantity of talent in our labour market, about tech skills, language skills, about the airport. That’s the trend we’ve seen in the last two or three years and I think these are considerations that even outweigh cost for some occupiers.”

Looking at the Distrelec deal – certainly not cheap by Manchester standards, even if it looks a bargain compared to the West End in London – Newns clearly has a point.

“Yes, it is still cheaper to run an office from Manchester than London, but the story is talent, not cost. And yes, some enquiries start with cost issues but then relocators eyes get opened to very different possibilities.

“For instance, we’ve a catchment of 7m people within an hour – very similar to London and far greater than you can find from any of the German cities. So we’re seeing a lot of front offices, not back offices, and front-office expansion from those who first arrived with back offices.”

Northshoring is not dead – Newns says several law firms are “on the journey” that will see them follow Freshfield to Manchester – but leapshoring is coming up fast. The volume of tech graduates is said to be at the front of many leapshorer’s minds (see table). Others will be watching HSBC’s recruitment process in Birmingham to see how it fares.

This market is still new. Brexit promises both to give it a boost – and to unsettle it. But the trend line is now becoming clear: leapshoring is worth watching in Britain’s bigger regional cities.

The leapshorers

The list of leapshorers is long and growing longer. Fibonatix, an Israeli fintech company, leapfrogged London to look at Cambridge and Manchester, before opting for Manchester. It is expected to move into around 2,000 sq ft at Allied London’s XYZ building.

Norwegian insurance company Protector Forsikring is also settling in with plans for 100 new jobs at City Tower.

Although leapshorers tend to prefer city centre locations, out of town is also benefiting. CAF Rail UK, the UK subsidiary of Construcciones y Auxiliar de Ferrocarriles, a Spain-based rolling stock manufacturer, signed up for 1,500 sq ft at MAG’s Voyager building, next to the airport. They leapfrogged London after 20 years working on projects such as the Heathrow Express.

Smaller relocators include Indian events company Go Live, Finnish tech firm Keto Software, Israeli advertising agent Sanibel and Belgian translation service Jonckers, all of which gave London a miss and opened their UK operations from Manchester.

The trend lines

Leapshoring depends on foreign direct investment into the UK – and the picture there is good, but not amazing, according to data from accountants EY.

The UK turned in a solid performance in 2016 with growth of 7% in the number of foreign direct investment projects achieved and 2% more jobs attracted, retaining its position as the leading FDI country in Europe in 2016. Around 39% of all UK FDI went to London.

However, the Northern regions are now scoring around 200 FDIs a year – and the Midlands comfortably over 100. EY concludes that the Northern Powerhouse and Midlands Engine are now attracting roughly double the number of projects they secured at the beginning of the last decade, whereas the rest of England is attracting roughly the same number as it did then.

According to EY’s UK Attractiveness Survey, the North West attracted 90 foreign direct FDI projects in 2016 – 60% of which were first timers, and thus leapshorers.

Manchester was the strongest FDI location outside London claiming 47 projects, compared with 20 in Birmingham and 12 in Leeds.