The prevalence of the bank of mum and dad, fewer rungs on the housing ladder, the need for equity over debt and a curtailed buy-to-let market are four ways the global financial crisis continues to affect the UK housing market.

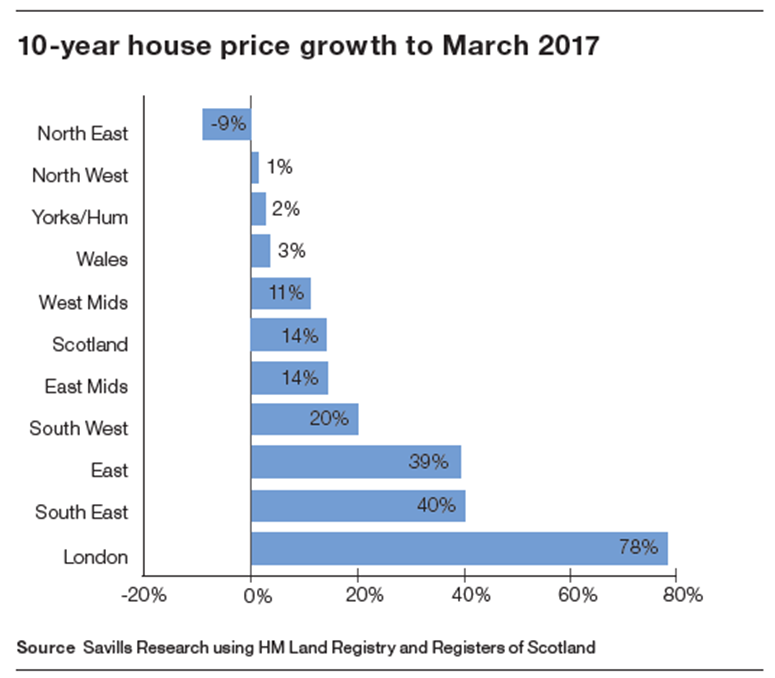

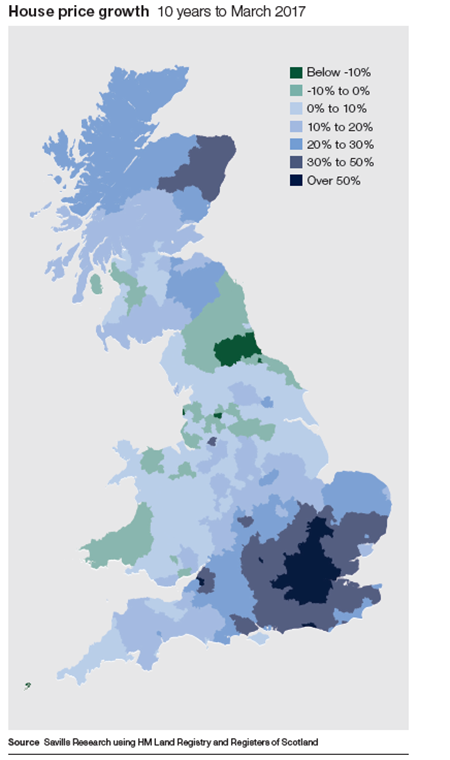

Ten years after the onset of the crash, a report from Savills says the crisis’s reverberations continue to be felt by existing and aspiring home owners across the UK – with many areas of the country still seeing house prices lower than they were in 2007.

Savills says two of the key milestones for the onset of the crash were 9 August 2007, when BNP Paribas froze two funds, and a month later when £1bn was withdrawn from Northern Rock in a day.

The average UK house price dropped by 20% in the space of 16 months and transactions, which had averaged 1.65m a year over the previous 10 years, crashed to 730,000 in the 12 months to the end of June 2009.

The market is also more divided regionally than ever before, with London seeing double the growth of the South East and East, and at least four times that seen in all other regions. The average house price now stands at £478,142 in London, more than double the £209,971 UK average.

According to Savills, the four key ways the global financial crisis continues to influence the market are:

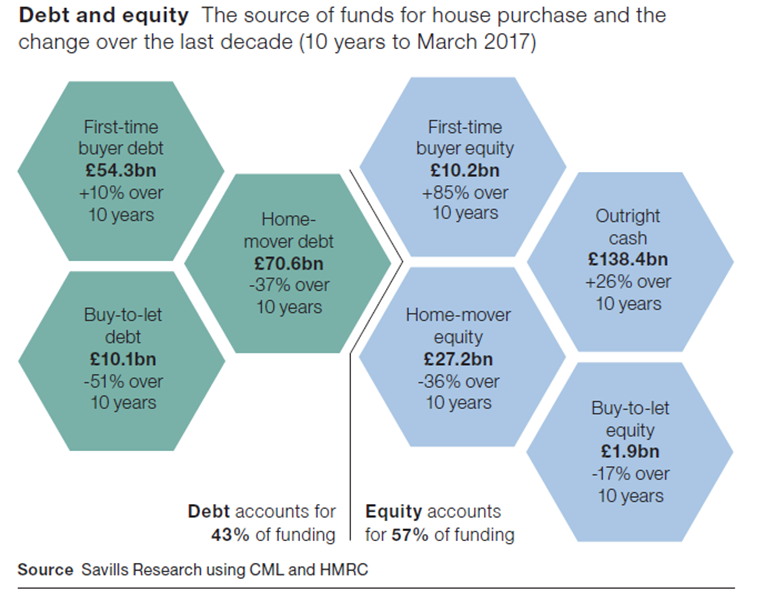

■ equity trumps debt: £312bn was spent on houses in the year to March 2017, £30bn less than in 2007, but 57% of this was cash, and lending at 90% LTV accounts for just 3.9%, down from 14.1% in 2007;

■ bank of mum & dad a major lender: the average deposit for a first-time buyer has more than doubled across the UK; Savills estimates that £4.2bn of the £10.2bn in mortgage deposits comes from the bank of mum & dad and Help to Buy;

■ fewer rungs on the ladder: a more constrained mortgage lending environment means that fewer home owners are able to trade up the ladder. In 2007, 1 in 15 existing home owners moved home, a figure that has now fallen to 1 in 27;

■ squeeze on buy to let: since March 2016 increases in stamp duty and restriction on tax relief on interest payments have curtailed investor appetite and borrowing has halved;

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette