A record amount of capital invested into real estate funds caused a dramatic cut in fund raising in 2015, according to Cushman & Wakefield.

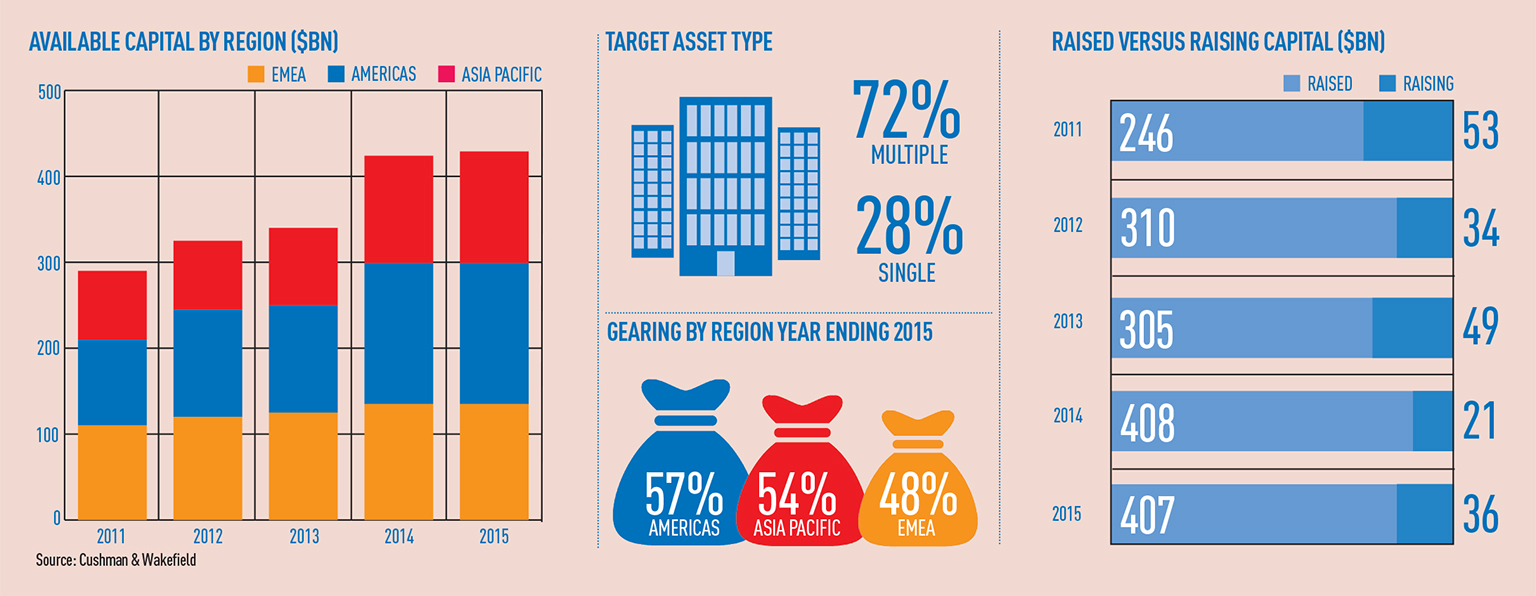

The real estate investment market had $443bn (£310bn) of capital to invest in 2015, the highest amount since 2009, according to the company’s 12th Great Wall of Money Report.

However, the need to deploy already available capital prompted a slowdown in capital raising.

New capital raised in 2015 was just 3% higher than 2014, a year in which funds of all types raised 21% more equity than in 2013.

The slowdown was most marked in the Americas and Europe, the Middle East and Africa with just a 2% increase year-on-year on the overall capital raised.

On a global basis funds drew down 1% less of the committed capital throughout the year despite more of it being raised. Some $407bn was made ready for deployment, leaving $36bn committed but undrawn by the end of 2015.

This was most notable in the Europe, the Middle East and Africa region, where deployable capital was down by 4% year-on-year to $131bn, while favourable currency and interest rates in the US boosted the amount of ready capital by 1%.

Funds investing across asset classes were the most popular destination for capital, attracting 70% of all equity funding. Single-country funds attracted 58% of available capital.

• To send feedback, e-mail mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette