Grainger has set out a future that sees it focus on developing and buying £850m of PRS assets in the next four years.

New chief executive Helen Gordon set out a revised strategy on Thursday that will see the 104-year-old company balance its historical commitment to regulated tenancies with that of the emergent PRS market.

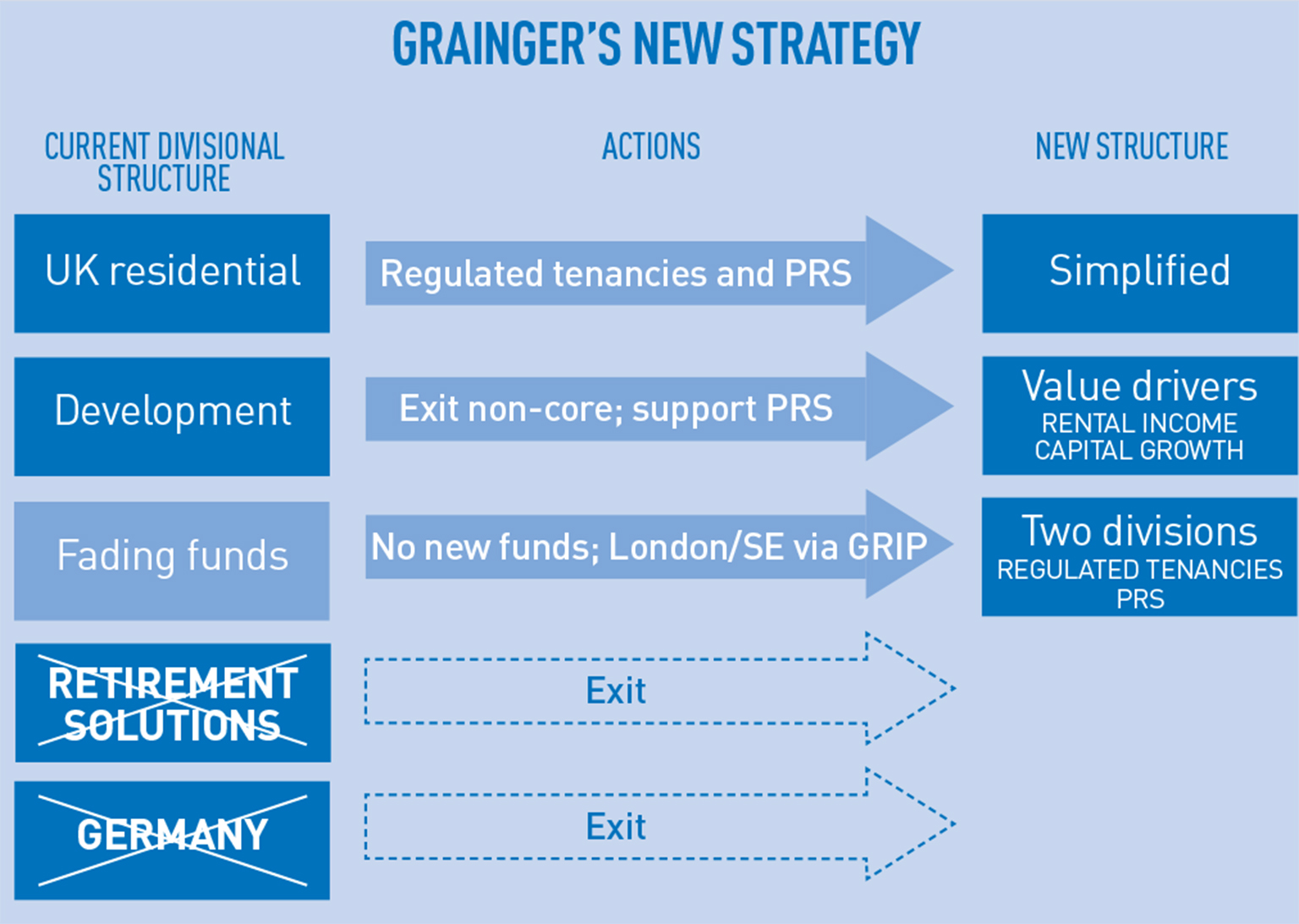

The drive towards PRS means Grainger will divest its retirement solutions business along with its German residential business, netting it £450m.

The PRS strategy will be headed by Nick Joplin, who will redirect the development teams away from build-to-sell into purely build-to-rent, all of which will be retained by the company. The purchase of standing assets will also be ramped up over the next four years.

Regulated tenancies will not be sold wholesale but will become a smaller part of the business. Although Gordon described it as a “fantastic asset class”, it will become only about 50% of Grainger’s business rather than the main focus, as it is now. At present, the regulated tenancy arm generates £100m and can deliver 4% returns for Grainger, which will now be ploughed back into the PRS project.

The changes leave Grainger with a simplified structure of just two divisions focused on the UK and income growth. Its fund management business arm will not be expanded any further. Its GRIP joint venture with APG is the last of the division’s initiatives generating fees.

With debt and associated costs reduced by the sale of the German and retirement businesses, Grainger will aim to keep debt to 40-45% over the next four years with costs at about 4% in interest.

A review of other costs is ongoing and will be delivered in Grainger’s results on 19 May.

The chief speaks

Is it too late to get into PRS?

If you believe the trajectory for this sector is taking it from 4m up to 7.2m households [PwC estimates] then there is an awful lot to do. I wanted to do the review quickly because I felt it was important to get out there and start doing more of it.

What size will each PRS scheme be?

There is a point that relates to operational efficiency. Optimum for us would be to have at least 600 units in an area. You can put all the services in at 100 but you can run them really efficiently if it’s 300 and 600 is a really good number for us. Lot sizes will be 150, 200 units as a minimum threshold.

What life is left in the regulated tenancies business?

The cashflow shows that it’s really quite stable out to 2025. In certain regions the portfolio might start depleting separately, but the core portfolio has another nine or 10 years.

Will you continue to manage the Ministry of Defence’s 630 acres in Aldershot?

We are doing the land maturing [working up planning] there. I hope that we will do PRS there because it has fantastic fundamentals. Are we going to manage other MoD land for them? I don’t think we should be doing that anymore.

Listen to an interview with Gordon at www.estatesgazette.libsyn.com

• To send feedback, e-mail mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette