Grosvenor Fund Management is becoming Grosvenor Europe as part of a refocus away from the UK and towards the Continent.

Grosvenor Fund Management is becoming Grosvenor Europe as part of a refocus away from the UK and towards the Continent.

Grosvenor Europe will continue to work with existing investors to undertake joint ventures and run its existing funds to the ends of their lives. These include the Liverpool Fund, which owns the Liverpool ONE shopping centre (pictured). However, it will ultimately become a property company, not a traditional fund manager.

Mark Preston, chief executive of Grosvenor Group, said it was possible the company could launch a fund at some time in the future, but added that it had nothing new planned.

The change of strategy comes into effect on 1 July. Preston said it would be a gradual transformation from a fund manager to a real estate investor that works only with its own capital.

“We are talking about a period of years rather than months to realise the change,” he said.

The new direction was prompted by shifts in investor sentiment and a desire by Grosvenor to increase its exposure to Europe.

“Focusing on Europe coincides with our desire to focus a chunk of our capital on those markets and to give the business more control over its capital than it had when it was purely a fund management business. It essentially turns us into a property business,” said Preston.

He admitted that it had been a challenge to raise funds in recent years.

He admitted that it had been a challenge to raise funds in recent years.

“The industry has evolved to a place where investors are more selective and demanding about the terms of the funds that they invest in, so it has become more difficult,” he said.

Finance director Nick Scarles added that investors wanted greater control over their investments.

“The general strategy of investors investing with organisations like us is still there, but the way they want to do it is through more partnership-type structures,” said Scarles.

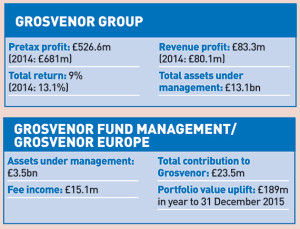

Grosvenor reported a pretax profit of £526.6m for 2015, down by 22% on 2014. The fall was the result of a slowdown in London price rises, following significant uplifts in 2014.

The company added that its profit was likely to continue to fall against the backdrop of low interest rates.

Preston said: “We expect that over the next couple of years results will be quite a bit lower, principally on the back of weaker revaluations. And it is no longer controversial to say that interest rates are likely to stay at their current level for some time. Therefore we are likely to see our returns come from the income side rather than the capital side.”

It will also focus on its development pipeline, which includes projects such as The Peninsula hotel in Hyde Park, W1, which could reduce profits further.

Scarles said: “Starting a development programme will affect overhead, so we are deliberately planning a strategy that will probably mean a fall in revenue profits. But we are looking to increase the value of the organisation over the medium term.”

The shift of focus to development is also being driven by the firm’s belief that the West End residential market has peaked.

“The top of the West End residential market reached its peak last year, and in anticipation of that we took a lot of chips off the table,” said Scarles.

“But we still have a long-term belief in London, and there are still rental growth opportunities in offices.”

• To send feedback, email amber.rolt@estatesgazette.com or tweet @amberrolt or @estatesgazette