The Grosvenor Liverpool Fund posted the highest annual return of any unlisted property fund in 2015, according to the latest AREF/IPD Property Funds Index.

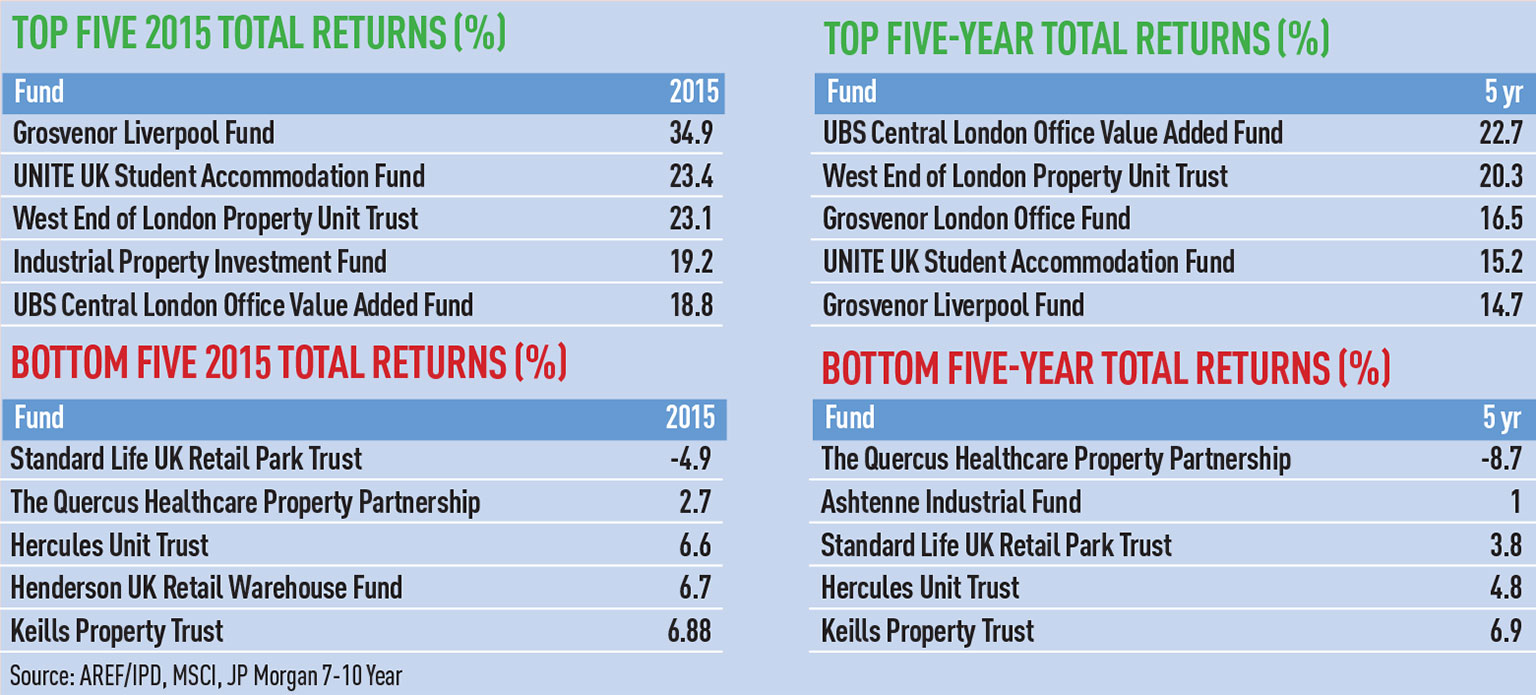

The fund, which is comprised mostly of the Liverpool ONE shopping centre, delivered an annual return of 34.9%, well ahead of the Unite UK Student Accommodation Fund in second place, which returned 23.4%.

Unlisted real estate funds returned 12% on average in 2015, compared with the 13.8% delivered by direct property.

Balanced funds – those that have a more even allocation across the different sectors – returned 12.5%, while specialist funds returned 12.9% and long-income funds returned 8.1%.

Performance was strongest for funds with a focus on either the industrial or office sectors in London and the South East, as returns mirrored those of direct property investments in the best-performing areas.

In the retail and alternative markets, performance was more mixed. The Standard Life UK Retail Park Trust delivered the lowest annual return of -4.9%.

Over a five-year period, the highest returns have generally come from London-focused funds. The UBS Central London Office Value Added Fund came top of the ranking of 46 property funds, with a return of 22.7%.

Since 2010, the index has produced an average annual return of 9%, above the 4.8% of equities and 5.4% of bonds, but below the 12.3% delivered by property equities and 10.8% returned by balanced property.

The index has a NAV of £44.2bn. Unlike the direct property index, it includes the effect of funds’ developments, transactions, cash and debt on their performance.

• Click here for a full funds performance list.

To send feedback, e-mail alex.peace@estategzette.com or tweet @egalexpeace or @estatesgazette