When a cluster of 15 tech start-ups chose to base themselves in the shabby district of Old Street more than 10 years ago, the fate of this previously ignored area on London’s City fringe changed almost overnight.

A decade on, it has evolved into one of the city’s most well-known creative hubs enticing occupiers including Adobe, Microsoft and Soho House to EC1.

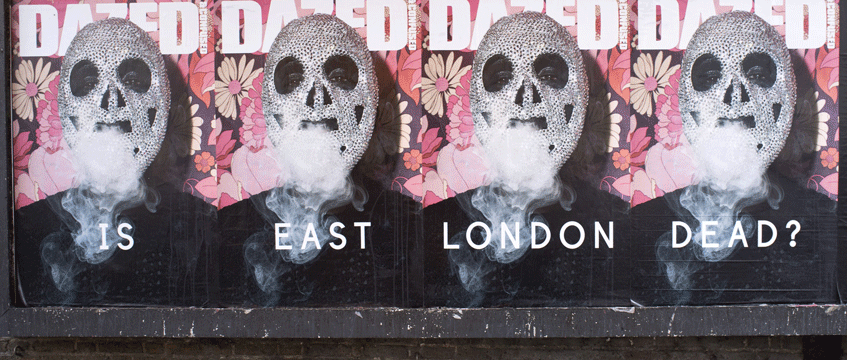

But has this evolution, originally driven by the advancement in technology, reached its peak? Will the area be able to continue to compete with other resurgent parts of the city such as King’s Cross and Battersea, which have already lured tech giants Google and Apple, as well as Canada Water and Euston, which are starting to bring forward regeneration plans?

Some of London’s best known developers entered Old Street as soon as the tech start-ups moved in, seeking to capitalise on the cheap land and the area’s potential.

Rocket Investments was one of the earliest to start building, beginning with a student accommodation block in 2006 and completing one of the first of Old Street’s raft of new office blocks in 2012.

Since then the firm has completed another 87,000 sq ft office building, Provost & East, which is fully let to WeWork. It is also building one of the largest new residential schemes in the area, The Atlas, a 40-storey building that will provide 302 homes on completion next year.

The difference between then and now is stark, says Tom Appleton, chairman and co-founder of Rocket Investments. “No-one had built in the area for a long time and you almost had the tube station to yourself. It was still relatively cost efficient and cheap, but with great transport links,” he says.

Derwent’s five principles for the office of the future

There was similar appeal to more established players too. This availability of well-located, cheap land was also behind Derwent London’s move into the area, says director David Silverman.

“What initially attracted us to the location was the real estate itself,” he says. “But also the fact that it offered low capital value per sq ft, which offered a really good value alternative to other locations. What you’ve seen over the last five to ten years is that it has become a destination in its own right.”

Other early entrants into the area included Helical and Crosstree Real Estate Partners in 2012 and Great Portland Estates in 2013.

Since those early moves into the area some 89 office developments have been completed in Old Street, according to Radius Data Exchange figures, with 11 new buildings and refurbishments completed last year. A further 36 projects have planning permission, including 15 refurbishments.

One of those schemes with planning permission is Derwent’s 125,000 sq ft redevelopment of 1960s office block Monmouth House, which sits next to its award-winning White Collar Factory. It expects to begin work on that next year, but it could be the last for the developer in the area.

“I suppose there is a limited amount of future development that can take place and I think it is important that it retains some of its original character,” says Silverman. “You don’t want to get rid of all that attracted people in the first place.”

But while the opportunities for large scale office development in Old Street may now be few and far between, Helical senior investment executive Tom Anderson does not believe the area has peaked.

Helical, with Crosstree, paid £60m to buy into the area in 2012, acquiring a three-acre site from Ireland’s National Asset Management Agency. It has since turned the derelict buildings into The Bower, a 320,000 sq ft mixed-use scheme that has attracted tenants including Gymbox, WeWork, CBS, John Brown Media and Z Hotels. Crosstree sold its stake in the project to Helical in 2015 for £76m.

And, of course, the ongoing tight supply of new space into the market is nothing but good news for landlords like Helical with new space coming online. A lack of supply plus a continued demand means sustained and possibly increasing rents.

Radius Data Exchange figures show a massive 153% increase in average office rents between 2010 and 2017, rising from £20.10 per sq ft to £50.90 per sq ft. Derwent’s White Collar Factory holds the top rent in the area, achieving £75 per sq ft with the letting of its top floor to file storage company Box.com.

Average rents for grade-A space hover at £60-£65 per sq ft with grade B space at £50 per sq ft.

While rising rents are great for landlords in the near term, the increases have been forcing some of the more traditional start-up companies away from the area. Between 2011 and 2017, the tech and media sector dominated take-up around Old Street, occupying almost 1.2m sq ft, according to Savills. In 2016, the sector represented 30% of all take up.

Shoreditch to have London’s strongest office rental growth

But by the first quarter of 2018, the activity had come to a halt with the banking sector dominating take-up, representing 41% of the market¸ followed by the serviced office sector, at 21%

The figures do not necessarily mean that the tech community is abandoning Old Street, however, but rather reflects the changing nature of office occupation, driven by the growth of the likes of WeWork and The Office Group.

Silverman says Derwent was never really targeting start-ups at the White Collar Factory, but second generation tech firms and more mature companies such as Adobe and structural engineer AKT II.

That wasn’t the case for Helical, however.

“Initially we were attracting tech and media to the buildings, but we’re now seeing some of the more professional services firms wanting to be in the area,” says Anderson. “That’s because they want to work with the tech and fast growing businesses and attract the young employees that want to be in the area. It’s being driven by the war for talent. People want to get the best and brightest and they want to be in exciting and dynamic areas surrounded by entrepreneurial, creative businesses. That is exactly what the tech industry built at Old Street.”

Gerry O’Brien, director at AKT II, agrees. He says the firm relocated to Old Street because it considers the area to be at the “epicentre of conversations and collaborations that could sculpt future trajectories and trends in design, technology and community” and the firm needed to be a “part of those conversations”.

For WeWork’s head of Europe Patrick Nelson, that’s in line with a growing trend it’s seeing with its workspaces. “Old Street historically is well known for tech and media, but we’re also seeing a large number of corporates,” he says.

Nelson believes the next step in Old Street’s evolution is the creation of “a heightened sense of community” to enable it to continue to improve.

And with Transport for London pushing forward with the redevelopment of Old Street’s concrete jungle of a roundabout, that desire for a more community feel in the area may come to fruition. Detailed plans for the revamp, which is likely to cost in the region of £25m, are expected to be submitted in September.

TfL’s Thomas Holmes says: “The main rationale for this project is to improve safety, but we have secondary opportunities to improve the city fringe. At the moment it’s noisy, congested and a dirty environment. Our project cleans that up and moves traffic away to create a much nicer environment.”

“We’ve also got opportunities to activate the space for commercial and community use,” he adds.

And it is plans such of these, including increasing the capacity of Old Street station, that mean the evolution of the area will continue, maybe not at such a pace as in previous years, but enough to ensure its survival among the competition. For now.

The developments dominating EC1

White Collar Factory

■ Landlord: Derwent London

■ Architect: AHMM

■ Status: Completed

■ Size: 237,000 sq ft

■ Tenants: Adobe, AKT II, Box.com, Capital One, Spark 44, The Office Group

The Bower

■ Landlord: Helical

■ Status: Two of three buildings complete

■ Architect: AHMM

■ Size: 320,000 sq f

■ Tenants: CBS, Farfetch, Pivotal, Allegis and Stripe, John Brown Media, WeWork.

160 Old Street

■ Landlord: Great Portland Estates

■ Status: Under construction

■ Architect: Orms

■ Size: 160,600

■ Tenants: Turner Broadcasting

The Atlas

■ Landlord: Rocket Investments

■ Status: Under construction

■ Architects: MAKE and Woods Bagot

■ Size: 302 homes

Provost & East

■ Landlord: Rocket Investments

■ Status: Complete

■ Architect: MAKE

■ Size: 82,000 sq ft

■ Tenant: WeWork

Main pic: Ray Tang/REX/Shutterstock

To send feedback, e-mail Louise.Dransfield@egi.co.uk or tweet @DransfieldL or @estatesgazette