The government should provide a “conciliation service” between landlords and retailers to help declining high streets and town centres in the UK, among a slew of suggested measures devised by the Housing, Communities and Local Government select committee.

The much anticipated report, High Streets and Town Centres in 2030, is the outcome of an extensive enquiry launched by the select committee in May.

It found landlords needed to “recognise the retail property market has changed and be more receptive to negotiating lease terms with retailers in financial difficulty”.

Property-related recommendations also included assessing whether existing laws such as the Landlord and Tenant Act impede the landlord-tenant relationship; removing upwards-only rent reviews; and reviving legislation on creating business improvement districts.

Clive Betts, chair of the Housing, Communities and Local Government committee, said: “It is likely that the heyday of the high street primarily as a retail hub is at an end. However, this need not be its death knell.

“We must begin a period of renewal and regeneration, establishing high streets as focal points of our communities comprising green space and health, education and leisure services, as well as a core of retail.

“At a local and national level, government must create a framework that allows high streets and town centres to thrive.”

Among several proposed actions, HCLG has also called for more intervention from local authorities.

“Local intervention, while essential, needs to be accompanied by further action by central government and at local level, as well as by retailers and landlords, to create the conditions for high streets and town centres to flourish in the future,” the report said.

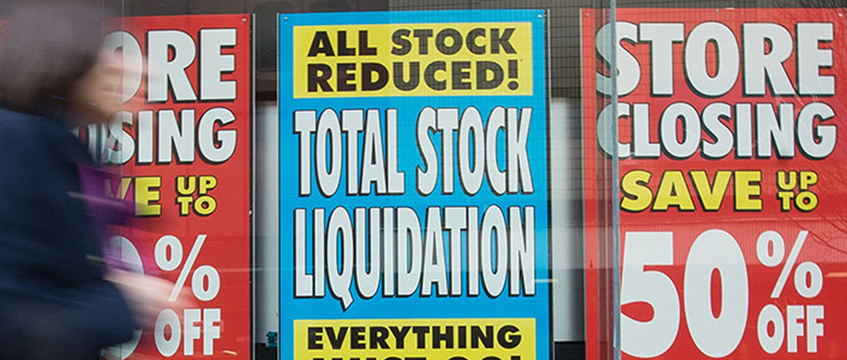

“Unless this urgent action is taken, we fear that further deterioration, loss of visitors and dereliction may lead to some high streets and town centres disappearing altogether.”

Key findings from the committee

Reconciling landlord-tenant relationships

The committee recommended that the Law Commission should review the Landlord and Tenant Act 1954 Part II in the next 12 months, assessing in particular whether the law impedes the emergence of a landlord-tenant relationship that would be “more appropriate for the current retail environment”.

“Landlords are often the least visible stakeholders in high streets and town centres but are among the most important,” said the report.

“We heard that disparate property ownership and lack of landlord engagement are key barriers to high street and town centre transformation and that high rents are affecting retailers’ profitability.

“We encourage all landlords to recognise that the retail property market has changed and to take an active approach, providing their tenants with good quality properties on a flexible basis and investing in and reconfiguring properties for new uses.

“Further, we encourage them to fully engage in local partnerships working on high street and town centre transformation and to consider the potential for further investment to help bring plans to fruition.”

Creating BIDs

Property-owner business improvement districts could also play an important role in bringing landlords into local discussions about high street and town centre transformation.

The government’s announcement that these would be legislated for in the Local Government Finance Bill, which fell as a result of the 2017 General Election, was “met with enthusiasm”.

With that in mind, the select committee proposed that the government revives the legislation needed to create such a body “at the earliest opportunity”.

Scrapping upwards-only rent reviews

The report recommended that the government should outlaw upwards-only rent reviews, given the burden on retailers caused by high rents.

“While new leases are likely to reflect the current market better, it is important that consideration is given to whether the practice should be curtailed,” it said.

Making business rates fair

Measures such as rate discounts and the move from RPI to CPI were broadly welcomed. However, more meaningful reforms to the tax system were identified as a means of reducing the burden created by business rates.

The government was therefore called upon to “urgently” assess the main proposals it received in evidence, including: a sales tax, an increase in VAT, an online sales tax and “green taxes” on deliveries and packaging.

The revenue raised from this would then be used to support the high street in the following ways:

- a reduction in business rates for retailers in high streets and town centres;

- a 12-month holiday for high street retailers from rates increases, resulting from investments to improvements in property; and

- an increase in the funding available to local areas through the £675m Future High Streets Fund.

“Each of these proposals, if implemented at speed, has the potential for real change without requiring a complete overhaul of business taxation,” the report said.

Planning reform

The government was urged to undertake a “comprehensive review of planning” where it concerns the high street.

This would include reviewing compulsory purchase orders where local authorities are concerned. The committee deemed it an “essential” tool for councils, but that the process was “too cumbersome, expensive and time-consuming”.

The report additionally criticised permitted development rights, stating that they risk undermining the vision a community has for its retail centres.

As such, it has suggested the suspension of any further extension of PDRs, pending an evaluation of their impact on the high street; and that councils should be given greater powers to do this where PDRs conflict with the local plan or established planning documents.

The reaction so far

Mark Robinson, president at Revo and co-founder of Ellandi

“What is clear – an indeed encouraging – is that there is a broad consensus across property owners and retailers on the action required.

“After such a comprehensive analysis, the onus is on government to listen, finally take meaningful action to address the unfairness in the tax system, modern leasing and inflexibility of the planning system, to empower local stakeholders to start making positive change today.”

Ed Cooke, chief executive, Revo

“We are encouraged that the select committee agrees that reform of the Landlord & Tenant Act is long overdue. There is agreement across our membership that the adaptation of town centres could be accelerated by reforming this legislation.

“The proposed streamlining of compulsory purchase orders would help fast-track town centre regeneration that has been frustrated by property owners, and we agree with the review of permitted development rights, which are not the panacea for housing delivery they were predicted to be and has led to incoherent town centre development which does not support these places in the long term.”

Helen Dickinson, chief executive, British Retail Consortium

“The damaging and outdated business rates system, which drives up the cost of doing business, is a major factor in store closures as well as hindering the successful transformation of our high streets.

“While we agree that government should examine alternatives to this broken system, we do not agree that online taxes or taxes on deliveries and packaging on those goods is the right way to go.

“Retailers are blurring the lines between the digital and physical experience. With eight of the top 10 internet retailers also having physical shops, it is clear that an online tax would further damage the high street.

“Councils must be given the resources and powers to remake high streets in light of changing consumer preferences. The BRC fully supports the committee’s recommendation that new permitted development rights should be suspended and evaluated, and that councils should be able to suspend them where they conflict with local plans for an area. ”

To send feedback, e-mail pui-guan.man@egi.co.uk or tweet @PuiGuanM or @estatesgazette