In an office in Liverpool, a man is doing some adding up. The number he comes to is very large – many millions of pounds. “It’s an awful lot of money,” he says. “It is a ridiculous amount of money to spend on a pipedream – if a pipedream is what it is.”

In an office in Liverpool, a man is doing some adding up. The number he comes to is very large – many millions of pounds. “It’s an awful lot of money,” he says. “It is a ridiculous amount of money to spend on a pipedream – if a pipedream is what it is.”

This analysis – of the money spent so far on preparing and promoting Liverpool Waters as an office development site – is the latest to attempt to understand Peel Land & Property’s plans for the Liverpool waterfront, and now Trafford Waters. Around the North West, other people are making the same calculations.

That is because the much-trumpeted plans for the big Waters office schemes leave some property observers puzzled – the projections seem vastly out of scale with their local markets.

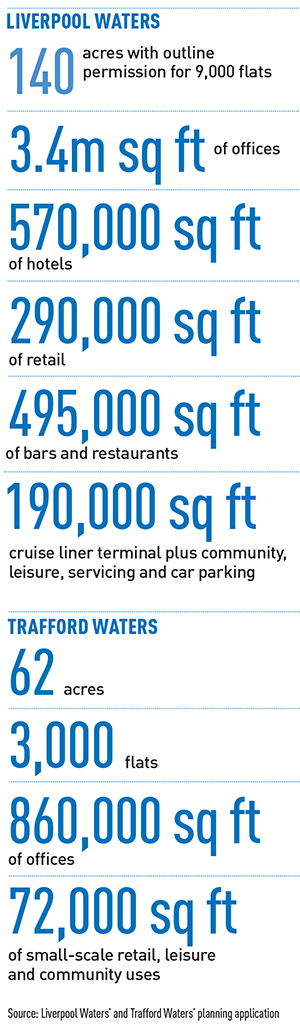

At Liverpool Waters, for instance, up to 3.4m sq ft of new B1 office space is permitted under the 2012 planning application. In 2014 – admittedly a thinnish year (see p92) – Professional Liverpool’s property group calculates that the central business district’s entire grade-A take-up was 54,615 sq ft. If grade-B floorspace is included, the total rises to 153,000 sq ft. So, at current rates of take-up, Liverpool Waters offers enough new office floorspace for 62 years.

Of course, it would take much longer if other developers secure lettings elsewhere in the city, or if anything is built by anyone other than Peel. Alternatively, assume Liverpool’s office market doubles or triples in size and sustains that scale, without blips, for a decade or so. Both sets of assumptions make agents’ eyes pop out on stalks.

Similar, if lesser, incomprehension surrounds the newly-announced Trafford Waters scheme, where 750,000 sq ft of office space is proposed. Today, the local office market is pretty much contained within the walls of Peel’s 100,000 sq ft Venus building, which dates from 2008.

It is no surprise that agents are wondering what exactly Peel will build over the 20- or 30-year lives of these projects. And where are the potential occupiers?

Uncertainty is fuelled by Peel’s pronouncements. Announcing an application for a 95,500 sq ft toe-in-the-water at William Jessop House, Princes Dock, next to Liverpool Waters, Peel director Lindsey Ashworth said: “We may develop it ourselves, sell the land on to others to develop, or form a joint venture partnership. At this stage, we rule nothing in and nothing out regarding the future development of this site.”

One of those people doing his sums is Stuart Keppie, partner at Keppie Massey. He is one of those who look at upcoming requirements from the city’s accountants and lawyers and believe that new office development in Liverpool will be needed in the next 18-24 months. And as agent on Peel’s Princes Dock, he has every reason to believe there is a genuine market for waterfront offices.

“Liverpool Waters is to be developed over a long timescale, and development is a movable feast,” he says. “It is hard to pin down. On the demand side, we have little demand for suites over 30,000 sq ft, and 100,000 sq ft would take some time to fill. On the supply side, it is difficult to see how it would work without some public money. Rents would need to be over £20 per sq ft to square the deal off.”

Some say Peel is on to a winner if it can attract the right tenants. Nick Rice of Rice Consulting says: “Of course some occupiers want to be on the waterfront while others are reluctant to cross the dual-carriageway Strand to get there. My guess, with a scheme of Liverpool Waters’ magnitude, is that it will need to attract a business cluster and to become a hub and a destination in its own right.”

Some observers suggest that Liverpool Waters’ masterplans will evolve and office blocks may well become residential towers – especially if demand in the private rented sector takes off. Keppie is not persuaded, but in Manchester, agents look at Trafford Waters and come to a similar conclusion.

John Ogden, managing partner at CBRE, says there is a real – if modest – market for office space in roughly the location where Peel plans 860,000 sq ft of offices at Trafford Waters. “This area has a micro-market of its own,” he says. “Peel’s Venus building has attracted the big engineering companies and service providers that have lots of car-using staff who work off site – but it could never pull occupiers from the city centre. It is more about going after the kind of occupiers that go to Birchwood, Warrington.”

Office use will provide a gateway for the 3,000 flats planned at the site, and the mixed-use feel that council planners like to see, says Ogden. With crowded motorway junctions and, as yet, no tram link, he doubts the appeal to occupiers beyond the current core catchment.

Mark Canning, director at Canning O’Neill, says that if the developer presses ahead with a 100,000 sq ft scheme opposite the existing Venus building, it will find occupiers, perhaps overspill or relocations from north Manchester or Birchwood.

“It wouldn’t be a bad call,” says Canning. “We are running out of new floorspace at Salford Quays, there is just 89,000 sq ft to let at Media City, and they will soon be struggling for space at Birchwood. Peel has an opportunity.”

With residential already a big part of both schemes – 3,000 flats at Trafford Waters and 9,000 at Liverpool Waters – if appraisals suggest PRS development will work, Peel could be sitting on some fine prospects. In those circumstances, envisaged B1 floorspace could be sacrificed for residential use.

Peel remains tight-lipped, but in the next 12 to 18 months, its plans for new office developments at Liverpool Waters and Trafford Waters will face the market. Will they sink or swim? History suggests that whatever calculations agents and rivals have made, Peel’s research will be more accurate and thorough. Whatever its long-term plan, it is likely to work.

On the waterfront

The Port of Liverpool’s £300m investment programme is already having a spin-off for property.

The new deep-water post-Panamax container terminal will mean larger cargoes on bigger vessels. Meanwhile, the improvement to a 5km stretch of road linking the M57/8 to the port will complete links to the motorway network. The project is costed at £250-£500m in the government’s road building programme.

Peel Ports is preparing for a series of lettings and built-to-suit developments on the back of both investments. About 400,000 sq ft of new floorspace is envisaged in the port estate this year.

Last month, Peel Logistics submitted plans for a 175,000 sq ft warehouse at its 157-acre Liverpool International Business Park. The plot – called Cell 11 – could take up to 400,000 sq ft.

Letting agents are JLL and Cushman Wakefield.