Martin Wheeler and Kevin Cooper, co-heads of ICG-Longbow, had to build up their business at the bottom of the market following the financial crisis in 2008, having left former employer GMAC Commercial Mortgage in 2006.

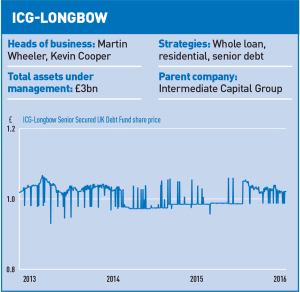

Starting in a subdued market allowed them to build up a portfolio from an initial £35m, made up of seven loans that it issued, to £3bn. The company is now working on plans to raise a further £1bn.

The idea behind that growth was always simple, says Cooper. “We knew that property needs long-term capital, but banks have short-term capital. So we thought we would raise money from pension funds on a longer-term basis to support real estate,” he says.

The idea behind that growth was always simple, says Cooper. “We knew that property needs long-term capital, but banks have short-term capital. So we thought we would raise money from pension funds on a longer-term basis to support real estate,” he says.

The idea has proved popular with both limited partners in the various funds covering three different strategies, but also with longer-term partners such as parent company ICG, the brokerage firm that first took a 51% stake in the business and bought it out completely in 2014.

Wheeler said: “To us, ICG was the ideal partner. They understood our business, they are debt fund managers but not at all involved in real estate.”

Partnership Capital, the first strategy the company adopted, used separate mandates from various partners to make whole loans based on mid-market investments. It has since grown into its largest single strategy, with £1.8bn of assets under management.

Cooper says the strategy attempts to differentiate itself from other lenders not just in the speed of delivery, but also in the way it works with sponsors to align the needs of ICG Longbow’s to theirs. “In a lot of the structures we provide money with a fixed return, but there is also a performance-type kicker.

“What it does is motivate us if there is a change of plan to support it, and if the borrower does well, we do well,” he says.

It is somewhat unusual that these loans are never syndicated, but Longbow thinks doing so makes the finance more complicated for the borrower. “We do a whole loan and it stays a whole loan,” says Wheeler.

The firm also manages a residential development fund focused on the 0-80% loan-to-value range on developments outside London. It is expanding into PRS and its residential exposure stands at around £400m of assets under management.

The final part of Longbow’s arsenal is the senior debt business. Formed in 2013 as a listed vehicle and since expanded, the early version delivered 7.5% coupons. Now, further down the line, things are a bit different. “What we provide for our clients are defensive loans that offer an alternative to investing in investment-grade corporate bonds,” says Wheeler. at around 2% pa over the average investment grade bond.

The company is thinking of doubling the size of the senior debt strategy in the coming months. This will see the senior loans business rise from £850m of assets under management to £1.7bn, aiming at a pooled investor base rather than the mandated accounts of previous vintages.

But lending is only half the story for any debt fund. Returns are the other. And for the senior strategy, returns have been 18% in gross IRR, which Cooper says “will compare well with some of the mid-performing opp funds, which are all leveraged, and we’re all pretty much unleveraged first mortgages”.

Getting it right has required teamwork from the 27 people under Cooper and Wheeler as well as an understanding of the underlying real estate.

So what next for Longbow? “We are researching potential strategies in Europe, but nothing is immediate,” says Wheeler. “And we are also investigating strategies closer to home.”

With that solid idea and the performance it has already delivered. ICG-Longbow will soon be a company with £4bn under management.