Depending on whether you choose to mark the start of the financial crisis in the summer of 2007 or its worst phase in the autumn of 2008 when the banks nearly collapsed, we are now six or seven years on. That, if you look at studies of previous crises – and I would recommend Reinhart and Rogoff’s This time is different – is when we should be getting over its worst effects and returning to normality.

In growth terms, that is roughly true. Britain’s economy will have grown by around 3% this year, which sounds like a normal, if belated, recovery. Uncertainty around the general election, of which more in the coming months, will slow things a little next year, although forecasters including the Bank of England and the Office for Budget Responsibility still expect an expansion in the 2.5-3% range, which is very respectable.

The return of some kind of normality, at least as far as growth is concerned, has not stopped David Cameron and George Osborne telling us about the “red warning lights” on the dashboard of the global economy and evoking the worst days of the financial crisis in 2008. I think they are greatly overstating it, but you know how these politicians are. Cameron is worried that voters will think things are stable enough to risk another Labour government.

In some respects, however, we are a long way from normal. For one thing, the budget deficit is still huge, as Osborne was forced to concede in his Autumn Statement. Another is that the financial system is still adjusting to the post-crisis world and still has some way to go.

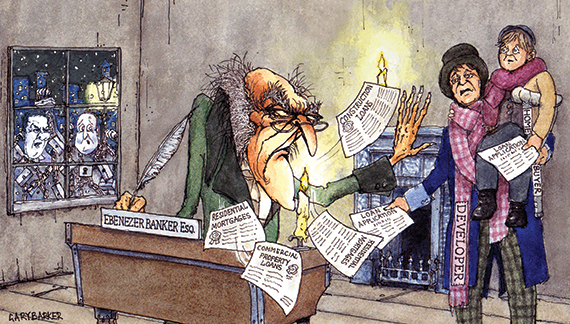

There are two aspects of this which should be of interest to readers of Estates Gazette. One is what is happening to mortgage lending. This should be the time when we are seeing a sustained recovery in mortgage approvals. It is not happening. The latest Bank of England figures show that the weakness in approvals is continuing. Mortgage approvals for house purchases dropped to 59,426 in October, compared with an average of 63,727 for the previous six months. This was the fourth successive monthly decline, and 22% lower than the recent peak of 76,574, reached in January.

We know partly why this is. The mortgage market review’s toughening of lending criteria, together with other moves by the Bank’s financial policy committee have reduced appetite on both sides. The Help to Buy scheme had a big initial impact, but that may now be fading. It is not the only area of weakness. While bank lending to some sectors of business is increasing, it remains resolutely weak as far as property and construction are concerned. Again, using the Bank’s figures, commercial real estate lending in the 12 months to October was down by 8%, while construction lending fell by 7.6%.

There are, of course, sources of finance other than the banks, and the drop in mortgage approvals may be temporary. Even so, there is something a little troubling about such weakness at this stage. This should be a time when the money is going in, not when it is being rationed.

It certainly bears watching.

David Smith is economics editor at The Sunday Times