EGi’s industrial research reveals a broad spread of regional variations. Mark Simmons talks to local experts about the latest developments

EGi’s industrial research reveals a broad spread of regional variations. Mark Simmons talks to local experts about the latest developments

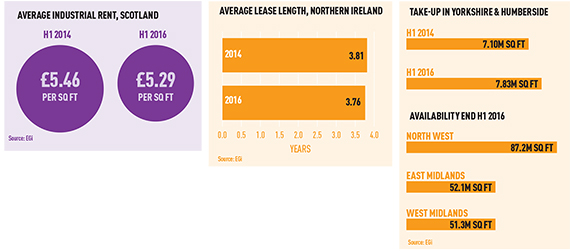

What makes Yorkshire & Humberside so special? According to EGi’s latest figures, industrial take-up there in the first half of this year actually surpassed, by 10%, the total taken in the same period two years before.

Yet in every other UK region, take-up plummeted by as much as 44%.

Iain McPhail, industrial partner at Knight Frank in Leeds, is expecting 2017 to be just as lively. “There is still a lack of existing stock in the 30,000-80,000 sq ft size range and, as a consequence, more speculative development is coming out of the ground,” he says. “Due to continued occupier demand, and coupled with a lack of readily available space, it is conceivable that prime rents for mid-sized buildings could break the £6 per sq ft barrier in 2017.”

More new space is also on the cards in the North West, even though at the end of H1 2016, the region had the highest level of supply of any of the UK regions, including those in the Golden Triangle.

“Fourteen buildings have gone up speculatively in the past 18 months, so we expect to see developers and funds gearing up to do more,” says Jon Thorne, partner at Warrington-based B8 Real Estate. “Prime areas are where the focus is but with not much land left, we’ll also get new smaller units (100,000-200,000 sq ft) in places like Knowsley.”

Looking Ahead

How do industry experts think the industrial and logistics sector will shape up in 2017?

DEVELOPER: Tim Johnson, development director, Chancerygate

DEVELOPER: Tim Johnson, development director, Chancerygate

“Big shed take-up may drop as some speculative schemes are put on hold and supply is restricted. That said, demand will remain strong, being

driven from within the UK where retailers lead the way.

“Despite the likely volatility in the markets, the lack of supply and increased occupier confidence will continue to push rents and prices on freehold property as bank lending and pension rules remain favourable for buyers.”

AGENT: Richard Evans, director, UK industrial and logistics, JLL

AGENT: Richard Evans, director, UK industrial and logistics, JLL

“We’ll continue to see speculative development in the big-box market of buildings up to around 360,000 sq ft, albeit at a lower rate than we’ve seen over the past two years. That speculative development helps to increase take-up figures, as design-and-build deals tend to take longer to agree, but overall levels of take-up might dip next year.

“Supply is likely to be significantly lower than it has been in the past, particularly around London and parts of the West Midlands, but it is still relative – we’re not talking about the market being barren. There has been strong rental growth in the past two years and there is no reason for that to diminish.”

INVESTOR: Bill Page, business space research manager, LGIM Real Assets

INVESTOR: Bill Page, business space research manager, LGIM Real Assets

“Warehousing is less exposed to economic turbulence than other property sectors, so despite the uncertainty, over the next two years we see the logistics market as being relatively OK.

“We’re not seeing uncontrolled speculative development and that, together with supply facing competition from residential uses, keeps a lid on occupational market risks.

“Although our forecasts show a slowing economy, we expect the most growth in e-commerce, so there are reasons to be relatively upbeat in a sector surrounded by uncertainties.”

PLANNER: Nick Fillingham, associate director, Indigo Planning

PLANNER: Nick Fillingham, associate director, Indigo Planning

“Although the industrial and logistics sector is a massive employment generator, local authority planners will come under increasing pressure to re-allocate land use, particularly where little residential space is available.

“So it is encouraging to see documents like the Greater Manchester Spatial Framework, which went out to consultation last month

and is obviously pro-development, looking to release land for employment on main transport corridors.”

LOCAL AUTHORITY: Waheed Nazir, director of planning and regeneration, Birmingham City Council

LOCAL AUTHORITY: Waheed Nazir, director of planning and regeneration, Birmingham City Council

“At present, there are very limited opportunities either within or around Birmingham to accommodate major development [in the heart of the Golden Triangle]. Tough decisions on the green belt along with effective strategic planning are needed, which will allow the release of new large-scale employment opportunities.”

Northern Ireland Lease lengths

While EGi research shows that average lease lengths have increased in most UK regions over the past two years, Northern Ireland is the conspicuous exception.

Although the drop in lease lengths in the province is small, Stuart Draffin, director and head of agency at Lambert Smith Hampton’s Belfast office, isn’t surprised. “Other areas of the UK are seeing purpose-built logistic development, but we’ve had nothing built speculatively for years, so the space we do have is becoming increasingly economically disadvantageous,” he says.

Draffin adds that a developer may now be willing to take the plunge, but as no scheme currently has planning consent, a speculative start may not happen until mid-2018.

Rents

Since 2014, average industrial rents have risen across the UK. However, EGi data shows that in Scotland, where absolute rental levels are relatively healthy, average rents have fallen.

Alan Gilkison, agency and development partner at Ryden in Glasgow, thinks he knows why. “Prime areas in Scotland are becoming more prime, and tertiary ones are becoming more tertiary, which is probably dragging the average down. For example, rents in the remoter parts of Ayrshire have really dropped,” he says.

Gilkison expects to see more development coming through in the second half 2017, albeit in units of less than 50,000 sq ft.

• See also Briefing: Shed slide steepens