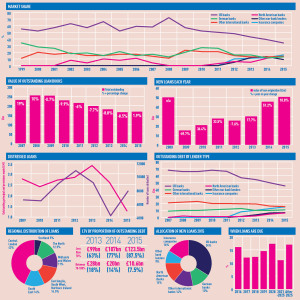

Commercial property lending is shifting towards insurance companies at the expense of UK banks, according to the latest report from De Montfort University.

UK banks remain the biggest lender, with a 45.4% share of the £183.3bn total outstanding debt compared with 15% for insurers.

Over the year, however, the UK banks lost four percentage points of market share while insurers gained 2.4 percentage points, particularly at the higher-value end.

New lending for the year totalled £53.7bn, up by 18.8% on 2014, with the majority, £29bn, weighted towards the latter half of the year.

This total followed the trend of ever-increasing lending levels since 2012, and represented the highest level since the £49.8bn recorded in 2008.

Other lenders included US banks, which increased their market share to 6.3% from 4.8%, and German banks, which increased their share to 10.8%.

There were signs of increasing caution, with more than 87% of banks extending loans at less than 70% loan-to-value. This compares with 77% in 2014 and 63% in 2013.

At the riskier end of the market, just 7.5% of loans, valued at £10.6bn, were made at 75% to 100% LTV, down from 14% in 2014.

Development finance saw a boost through 2015, with lenders extending £6.5bn on commercial projects. For only the second time since 2007 there was an increase in the amount of speculative development loans, which totalled 2.7% of all lending.

To send feedback, email mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette