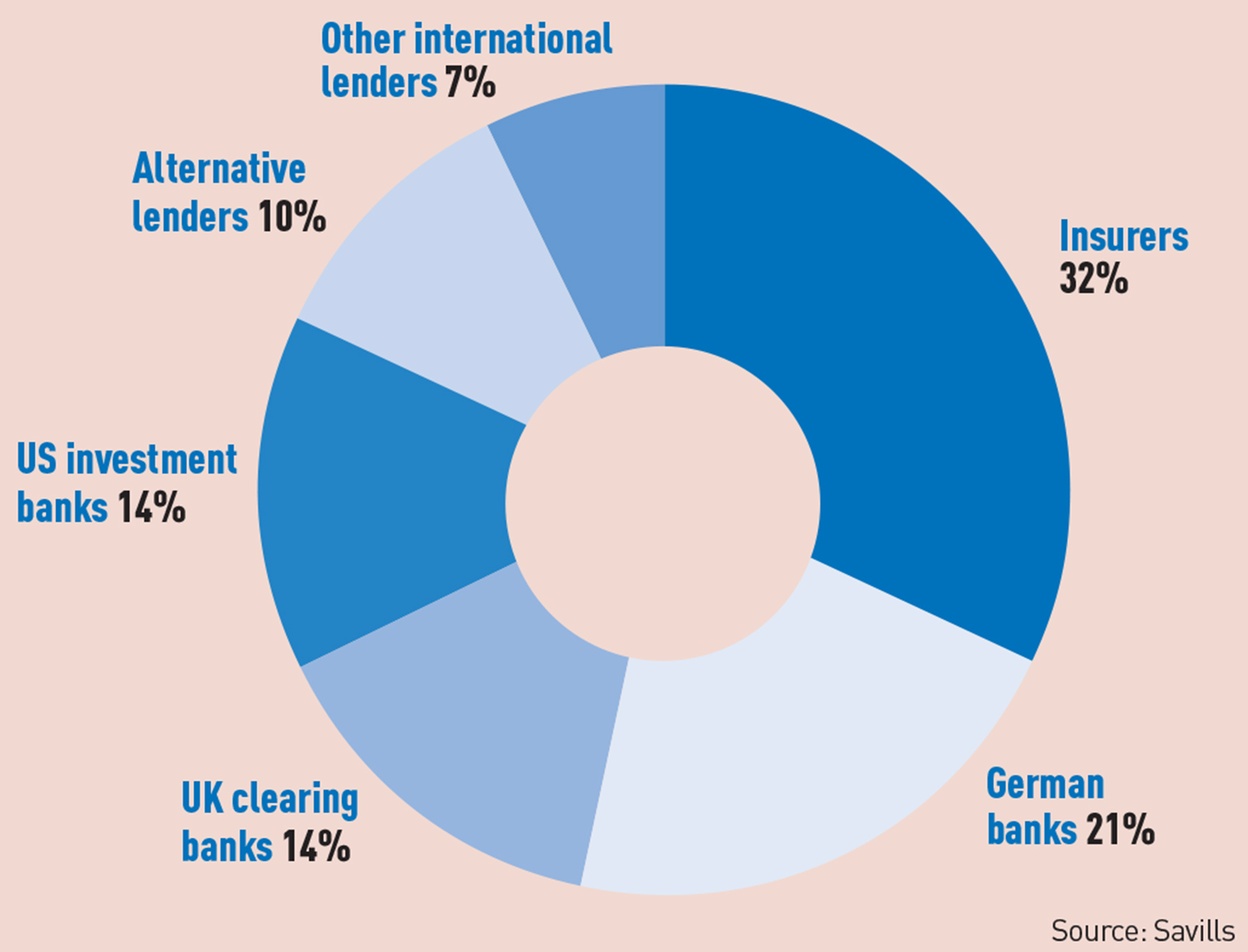

Insurance companies have further increased their presence in UK real estate lending and now account for nine of the 28 big-ticket lenders active in the market.

Insurance companies have further increased their presence in UK real estate lending and now account for nine of the 28 big-ticket lenders active in the market.

According to Savills’ 2016 Financing Property report, AIG, Aviva, ING, Legal & General, M&G Investments, MetLife, Pricoa, Rothesay Life and TIAA Henderson all originated and held two or more real estate loans of £100m or more during the year to 31 March.

By number, insurers now eclipse German banks (six), UK clearing banks (four), US investment banks (four), alternative lenders (three) and other international lenders (two) in the big-ticket lending market.

The activities of insurance companies in the UK real estate market have increased markedly during the past four years, with £8.6bn lent by them last year, a 58.5% rise on the year before and a 238.2% increase on 2012.

Insurers have become more active in the real estate market in order to match their annuity liabilities with interest paid by landlords, generally through longer-term deals, and have gained market share from traditional bank lenders, which have reined in their lending since the financial crisis.

Big-ticket lenders to commercial property

Last year William Newsom, Savills’ senior director and author of the report, said that the UK real estate lending market was in a “Goldilocks period” in which it was “not too hot and not too cold”. But he added that in the final quarter of last year margins started to increase and LTV ratios started to decrease.

These trends were down to “macroeconomics, being well advanced in the cycle, the impact of regulation, increased lenders’ costs and a reappraisal of property fundamentals”.

The report calmed fears of overheating in the market. Newsom said that the amount of development finance being issued was a barometer of the market and that last year this totalled £16.2bn, of which only £1.9bn was secured against speculative development. In 2007, lending on development exceeded £40bn.

The conservative market was being shaped by the strong hold that regulators now hold over banks through instruments such as “slotting” and by a healthy memory of past mistakes, said Newsom.

Savills’ big-ticket lenders

Must have lent £500m or more during the year to 31 March

• Aareal

• AIG

• Aviva

• Bank of America Merrill Lynch

• Bank of China

• Barclays

• Blackstone

• Cain Hoy

• Citi

• Deka

• Deutsche Bank

• Helaba

• HSBC

• ING

• JP Morgan

• LBBW

• Legal & General

• Lloyds

• M&G Investments

• MetLife

• Morgan Stanley

• Deutsche Pfandbriefbank

• Pricoa

• RBS

• Rothesay Life

• Starwood Capital

• TIAA Henderson

• Wells Fargo

Savills’ top 10 alternative lenders

• AgFe

• Blackstone

• Cain Hoy

• DRC Capital

• ICG Longbow

• LaSalle Investment Management

• Oaktree

• Fortwell

• PGIM

• Starwood Capital

Q&A: Savills’ William Newsom

Q&A: Savills’ William Newsom

This year’s Financing Property report will be the last one written by Savills senior director William Newsom, who will retire next month. The 2016 report was presented at Merchant Taylors’ Hall, EC2, and in the West End this week ahead of a UK roadshow next week.

EG spoke to him about this year’s highlights

Which of those new lenders to the market are likely to have the biggest impact next year?

I am going to highlight the Children’s Investment Fund, which has recently agreed a £350m development financing at Marble Arch Tower. That’s remarkable because it is speculative and large. So I think we can expect more action from them. I’ve highlighted the China Construction Bank, because we are assessing increasing activity by the Chinese banks. Bank of China is on my list of the top 28 most active bigger-ticket lenders as well. I would also highlight Gatehouse Bank, which has recruited a new team and is resurgent.

Why did you highlight interest rate floors as a potential problem?

Some lenders impose them, others don’t. If you borrow at 200 bps over LIBOR and it drops to negative, you would normally expect your interest rate margin to remain the same. With a floor, the bank is able to increase its margin. This is difficult territory to interpret. Is this the next bank mis-selling scandal in the making? They say they are explaining it clearly, but some borrowers may still claim a lack of knowledge none the less.

Why do you also have concerns over peer-to-peer lending?

Are the risks of P2P lending fully understood? Many of these lenders are fee driven and may be prompted to recommend deals when it would be better to say “sit on your hands”.

Listen to the interview in full below

To send feedback, email david.hatcher@estatesgazette.com or tweet @hatcherdavid or @estatesgazette