Open-ended retail funds’ communication to investors will come under scrutiny as part of a review into this summer’s funds crisis, its author said this week.

Open-ended retail funds’ communication to investors will come under scrutiny as part of a review into this summer’s funds crisis, its author said this week.

John Forbes, an independent consultant and former PwC partner, will investigate the quality of the flow of information from the funds to the investors and between them and their proxies.

He said: “In many cases, investors have given financial advisers or wealth managers a discretionary mandate to run their money. Those managers have pooled lots and lots of Mr and Mrs Smiths together into a big pot that they then allocate.”

The Association of Real Estate Funds commissioned Forbes to produce a report on the open-ended retail property fund market after seven funds suspended redemptions following the Brexit vote. He expects to publish the report next Easter.

Forbes started interviewing members of the industry this week and said he would be “delighted to hear” views from anyone involved in the funds as managers, investors or intermediaries.

While working at PwC he produced a report in 2012 that looked at how institutional open-ended funds, rather than retail funds, suspended trading during the financial crisis.

After delivering that critical report, Forbes said he was flattered to be chosen to tackle retail funds. He said: “They clearly didn’t feel that telling some uncomfortable truths is a bad thing. When there’s an issue like that, you have to work out what the problems are and address them.

“This time around, there’s more of a sense of urgency. With what’s happening with the EU referendum, there might be further shocks to the system.”

What can we expect from the report?

Forbes says there are three broad considerations – or a combination of all three to avoid a “one size fits all” solution.

- Best practices: If nothing else changes or needs to change, Forbes says, the report will have suggestions for best practices in the event of another shock to the industry.

- Tweaking: Managers might be encouraged to operate slightly different models within the current open-ended retail fund structure in order to give investors more choice depending on their needs. The report could spell out those models.

- A new product: The most radical possibility is a requirement for a completely different product if Forbes finds that the current structure is fundamentally flawed.

What effect will the report have?

The report itself does not have any formal guidance. If AREF thinks the issues it highlights are important enough, it can add them to its code of conduct. For regulatory change to happen, AREF will have to lobby the Financial Conduct Authority.

What did the funds do when they were suspended?

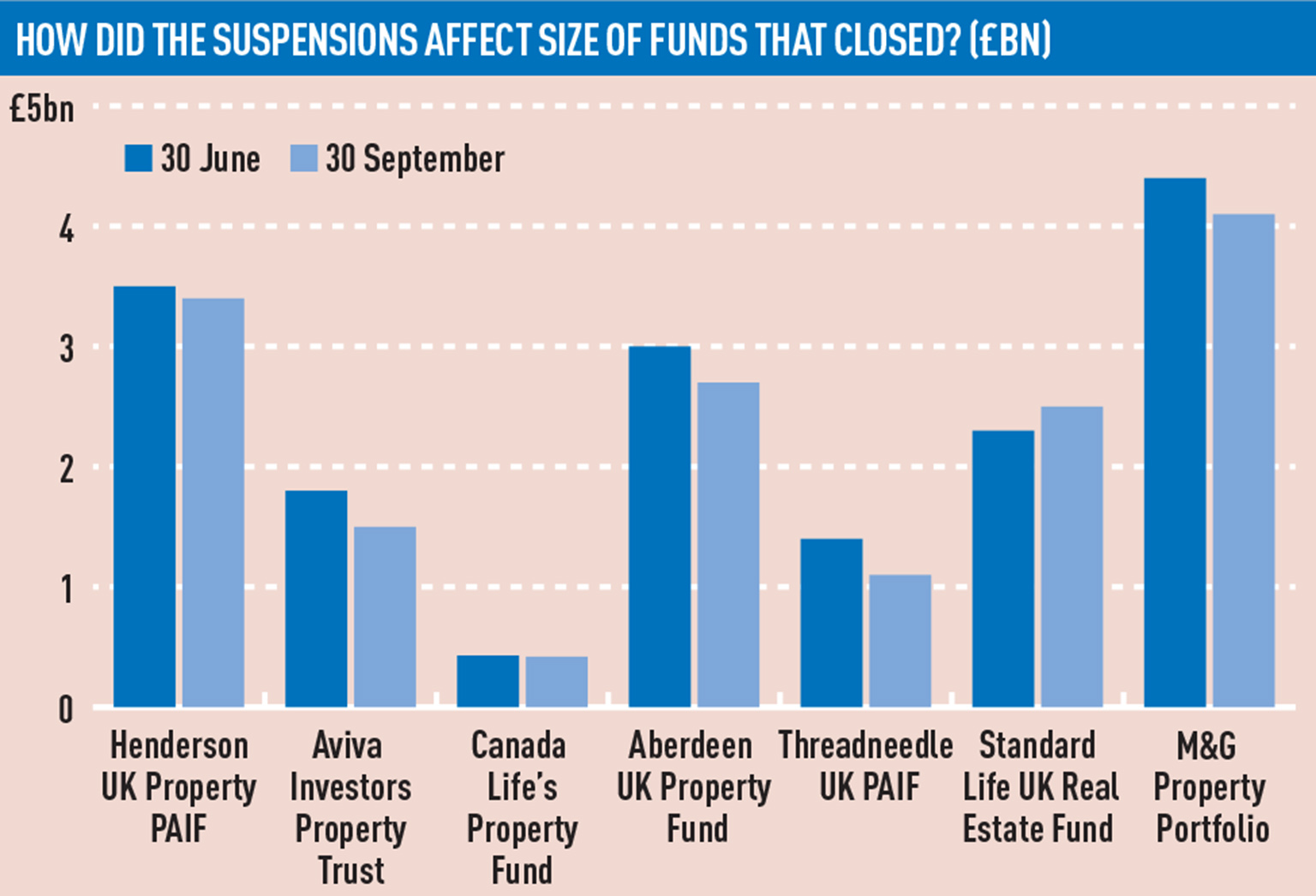

During their suspensions, funds sold assets in order to continue trading and satisfy redemption requests. Some also took the suspension as an opportunity to refocus their portfolios.

M&G, the largest of the seven that closed in July with £4.4bn of assets under management, either sold or put on offer 58 properties totalling £718m. Those assets accounted for a third of the fund’s properties, but only about 16% of its assets under management. That means it managed to offload its smaller secondary assets while retaining its higher-quality stock.

The company said the suspension allowed it to refocus its portfolio on prime assets that it expects will perform better in the medium-term.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette