A wave of loan portfolio sales are being undertaken in Ireland as lenders to the country’s property market during the boom years race towards the end of their deleveraging processes.

A wave of loan portfolio sales are being undertaken in Ireland as lenders to the country’s property market during the boom years race towards the end of their deleveraging processes.

The Irish Bank Resolution Corporation has come to the end of its disposal process while the National Asset Management Agency, Ulster Bank and Lloyds Banking Group can see light at the end of the tunnel.

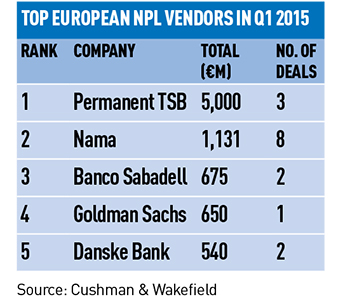

Federico Montero, head of EMEA loan sales at Cushman & Wakefield, says: “Irish and UK lenders and asset management agencies have led the way, accepting from the start that they had a mountain of troubled assets and getting on with the process.

“The success of the likes of IBRC and Nama has set an example to the other European asset management agencies, with many looking at the approach and processes of the Irish asset management agencies in forming their own deleveraging strategies.”

With so many sales opportunities in such a short space of time, investors must make shrewd decisions on whether the available portfolios are of the appropriate quality for their portfolios and what their viable exits are.

Many of the portfolios that are available are highly granular and made up of lots of small, sometimes low-quality, loans to a large number of borrowers. In general, portfolios that were secured against larger and higher-quality properties and were more straightforward were sold earlier in the cycle when the market was weaker.

“Until now it has been more distinct single-borrower connections, but now the market is moving into aggregating smaller loans and borrowers together. That is what we and others are focusing on,” says one seller.

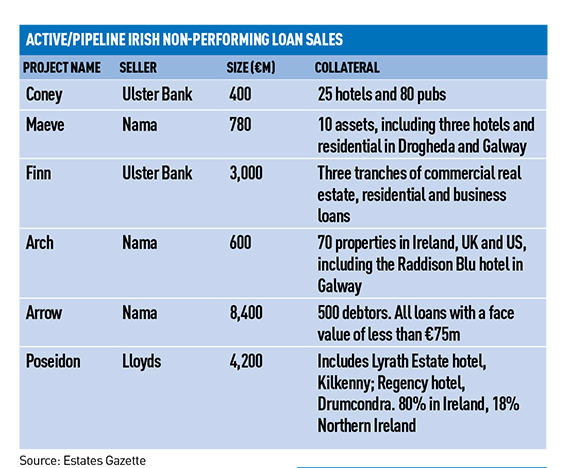

Portfolios such as Ulster Bank’s ongoing €3bn (£2.1bn) Project Finn sale (see table, below) are also now being made up in part by loans taken out by SMEs with real estate assets.

“As a larger investor we have guys who do not focus purely on real estate and they can look to see if they are viable businesses. We think that gives us an advantage,” says one private equity investor.

Players looking to enter Ireland now are at a disadvantage to those that have an established presence because they will have less information to base their valuations on and the prospect of a shorter pipeline of deals.

EY partner Mathieu Roland-Billecart says: “Some people are looking at Ireland for the first time and deciding they are too late. If you are going in now, how many deals are there going to be, how many will you win and is that enough to amortise the investment you make in your set-up?”

But there are still plenty of opportunities elsewhere.

Deloitte partner Andrew Orr says: “Buyers are geographically generally pretty agnostic. There is a huge amount of product around Europe at the moment and attentions will start to shift more to markets such as Spain and Italy.”

The investors that have landed enormous portfolios since the collapse of the Irish market must now start to consider their exits and, with such a large number of assets, that might not be straightforward.

One major buyer says: “We are not believers in price appreciation any further in Ireland. We are looking at values and assuming, and praying, they stay the same.

“What worries me is that if the firms with literally thousands of properties on their books start to sell whether there will be enough underlying demand in the market to absorb it all.”

david.hatcher@estatesgazette.com