Nick Leslau and Mike Brown’s Secure Income REIT has sold £282.4m of shares through a placing, a move that has resulted in long-term shareholder Lloyds exiting the company.

Nick Leslau and Mike Brown’s Secure Income REIT has sold £282.4m of shares through a placing, a move that has resulted in long-term shareholder Lloyds exiting the company.

Lloyds has sold its 25% stake and Sir Tom Hunter, another long-term shareholder, has decreased his stake from 25% to 7%, which he is keeping for the long term. Directors at Prestbury, SIR’s management company, reduced their 25% share to 18%. This has allowed management to realise around £50m, but their stake still has a net asset value of around £90m.

As a result of the placing, 61.4% of the company’s issued share capital has changed hands. The new shareholders are made up of “predominantly blue-chip, long-income UK institutions” which took up 70% of the placed shares, said Leslau.

He added: “The balance is mainly large wealth managers.”

The increased diversification of the share base is expected to allow the firm to add to its portfolio, which includes Thorpe Park, Warwick Castle and Alton Towers.

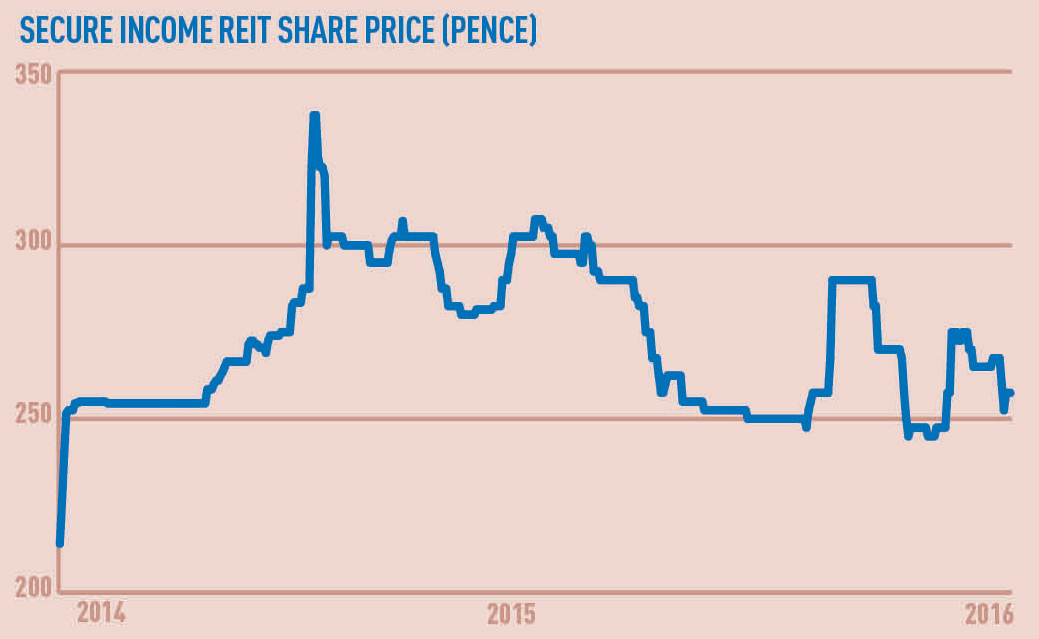

The company floated on AIM in 2014 with a £1.5bn portfolio but raised only £15m in the first instance. It has since completed a £903m refinancing and sold Madame Tussauds, NW1, for £332.5m. This has given the company increased liquidity and spending power and the ability to pay quarterly dividends, initially reflecting a yield of 4.2%.

Martin Moore, chairman of SIR, said: “Following the successful placing, we expect our broader base of institutional shareholders to provide improved flexibility as we begin to put into action the board’s ambitious plans for growth by targeting significant value-accretive acquisition opportunities.”

Goldman Sachs and Stifel Nicolaus Europe advised Secure Income REIT on the placing.

.

Nick Leslau Q+A: How the placing has changed Secure Income REIT

How difficult was raising capital in the current market?

We were comfortably oversubscribed despite market challenges. This is a testament to the investment proposition, which offered investors a 4.6% dividend yield, growing at 7% per annum for the foreseeable future. Based on a six-year profile and capitalising the predictable rent increases through mainly fixed uplifts and some RPI upward-only reviews in all the leases, at today’s yields that will deliver a total shareholder return of nearly 13% pa.

Does this mean the company can do things differently?

Having a broad shareholder base means we can operate in space where the air is very thin in terms of competition. Our deals tend to be highly structured and large – in the hundreds of millions. And our REIT status means we do not have to discount inherent capital gains tax in corporate structures that we are acquiring. This provides a significant commercial advantage. Having a new shareholder base ready to support substantial earnings and deals that are shareholder return-accretive opens up many opportunities.

What opportunities are you likely to target?

Because our deals tend to be off-market and highly structured, we are entirely agnostic as to which sectors we operate in. We believe that turbulent markets will for some time produce interesting opportunities, with asset-rich companies looking to unlock value through real estate solutions. We are aware of a significant number of long-term income deals floating around but we tend to explore deals discreetly off-market.

• To send feedback e-mail david.hatcher@estatesgazette.com or tweet @hatcherdavid or @estatesgazette