Falling oil prices look set to open up new investment opportunities in Africa’s emerging markets as an unexpected list of nations make up a new swathe of the continent’s fastest growing economies

If you were asked to point out Kigali on a map of the world, how close do you think you would get? How about if it was narrowed down to a map of Africa?

Even then, you would need to know the exact position of Rwanda – and the fact that Kigali is the country’s capital – to have a decent chance of locating a city at the heart of one of Africa’s fastest growing economies.

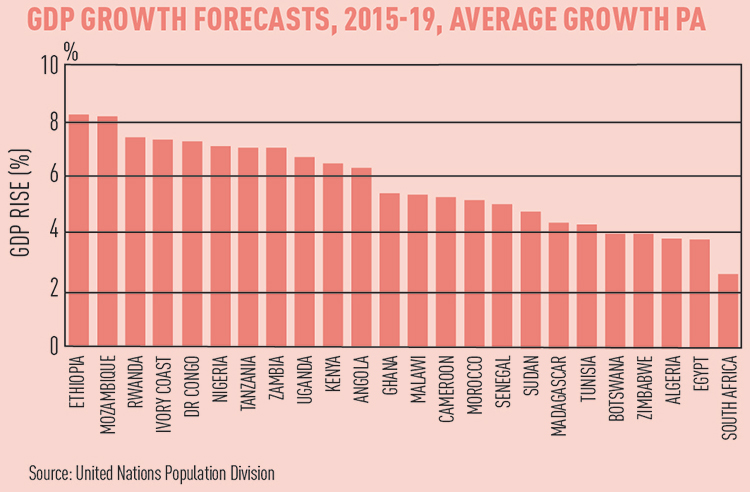

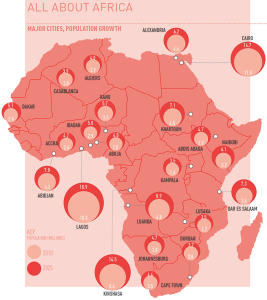

But that is how quickly development and growth locations are changing on the world’s second-largest land mass. A year ago, Kigali was on few people’s radars. In fairness, it probably still isn’t – but, arguably, should be now that Rwanda is predicted to become Africa’s third-fastest growing economy between 2015 and 2019. It follows closely behind Ethiopia and Mozambique, and these countries represent a swathe of rapidly growing African markets, according to the International Monetary Fund – and markets that do not solely rely on commodities such as oil and gas.

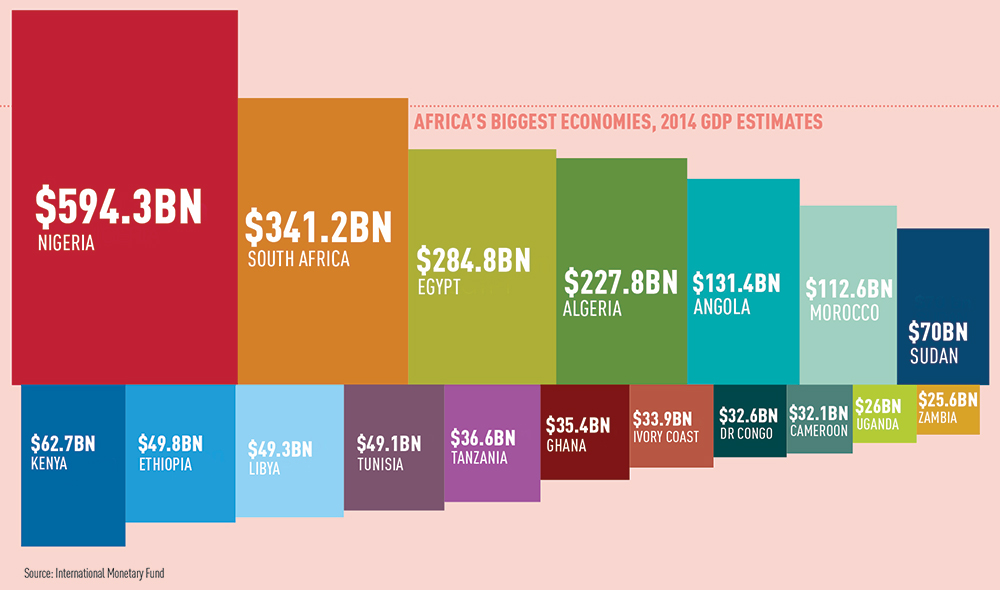

It should come as little surprise that Knight Frank’s Africa Report 2015 reveals that falling oil prices are likely to result in a slowdown in growth over the next 12 months for the continent’s major economies. Nigeria, in particular, is expected to see its growth slow from 11% in 2013 to less than 5% in 2015.

The big question is what this will mean for a continent that is still seeing a colossal increase in overseas investment. Foreign direct investment rose by 4% to $15bn (£10bn) in 12 months.

Will the growth countries, with their burgeoning agriculture and construction industries, be the next big opportunity areas? And what about the oil and commodity-reliant markets now facing a slowdown? With oil prices expected to creep back up to $100 a barrel by 2018, there is a strong case for investing now while the deals are good and there is less competition.

The good news is that, contrary to what many might expect, it looks like falling oil prices will open up fresh emerging markets, rather than limiting options for investors.

The growth continent

Despite slowdowns in some individual economies, the overarching story in sub-Saharan Africa remains one of growth. Overall GDP rose by 4.7% between 2013 and 2014 and is expected to rise again by 4.9% over the next 12 months.

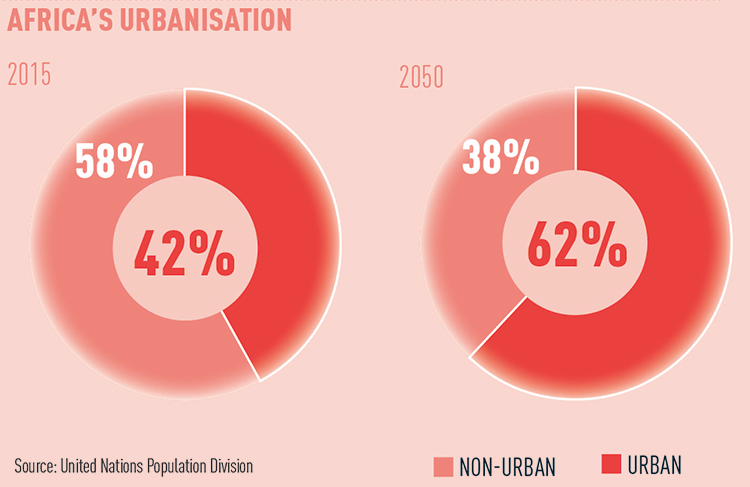

For real estate in particular, future opportunities are booming as the growth of Africa’s cities and rapid urbanisation are fuelling huge development and infrastructure schemes. And investment interest – at least outside South Africa, where growth has slowed to 1.4% – is reaching new heights.

“The interest in investment all across Africa from the Gulf, from China, from Japan is enormous,” says Peter Welborn, Knight Frank’s managing director for Africa. “We are also seeing increased interest from South African investors and developers, which have finally started to look at the rest of the continent as their economy slows.

“Global investors and developers want to know how to acquire land in Africa. They want to know about soil conditions for growing produce as the agricultural industry booms. And global corporates are desperate to enter key African countries to catch the urbanisation and the emergence of a middle class.

“Look at Procter & Gamble. It went into Lagos to set up Africa’s largest disposable nappy company. Just think about that requirement. Why didn’t anyone else think of it?

“Now others have caught on, they are looking to enter the continent with other businesses and products and all are looking for offices and HQs in the major cities.”

This is fuelling requirements for high-quality office space in major regional hubs, where increasing demand and limited supply is pushing up prime rents. The highest have now reached $15,000 per sq m a month in Luanda in Angola, followed by Lagos and Abuja in Nigeria.

Where next?

But what about future opportunities? Those that are likely to arise as economic growth rebalances, albeit in the short term, across African countries as a result of falling oil prices?

There is little doubt that now is the time to shine for Africa’s non-commodities-reliant markets. “We are starting to look more at markets like Botswana and Rwanda,” says Will Tindall, co-founder of Emerging Crowd, the UK’s first global crowdfunding and investment platform focused on emerging markets.

“Both have strong agricultural industries, where growth is looking good over the next five years.”

And Knight Frank’s Welborn adds that these lesser-known African countries are very much open for business. “Take Rwanda,” he says. “The government is encouraging the opening of offshore companies to help them stay on a growth trajectory. It is a breath of fresh air. And most people would have no idea where the capital, Kigali, is.

“That is not me being rude because, for many investors, there has not been any reason to know where Kigali is for investment purposes until very recently. This is how fast things are changing in Africa.”

Other emerging growth markets in Africa to keep an eye on are Djibouti and Ethiopia, says Welborn. The former is attracting interest from Middle Eastern investors because it is home to the largest bunkering port in the Red Sea, and the latter because of its strong manufacturing industry – which Knight Frank predicts will see Ethiopia become the fastest-growing economy in the continent over the next four years.

The country’s capital, Addis Ababa, is already attracting major corporates, including Unilever, Diageo, SAB Miller and Heineken, and saw 8.2% GDP growth in 2014.

Then there are Africa’s emerging “satellite” countries, which are starting to appear on investors’ radars following exponential growth in neighbouring markets. Uganda is now the satellite for Kenya, for example, and Ghana for Nigeria.

“Major brands and companies will traditionally start in the key multinational cities, such as Nairobi and Lagos, but soon they will start to expand and that is why we are seeing the emergence of these new cities,” says Welborn.

Wealth beyond the wells

As for Africa’s oil-rich countries, all is not lost. With barrel prices predicted to return to pre-drop levels by 2018, any slowdown is not expected to be permanent. If anything, investors should be looking to enter these markets now while it is cheaper and competition is reduced.

And Emerging Crowd’s Tindall points out that there are other markets within countries such as Nigeria that are still delivering strong returns. “Food and beverage is performing really well,” he says. “We are working with Neo, West Africa’s largest coffee chain. There are only three Neo shops in Nigeria at the moment, which is crazy considering it is now Africa’s biggest economy. Because of the country’s emerging middle class, there is more demand for high-end consumer products.”

He adds that the changing demographic has also created an opportunity to introduce a new housing model in Nigeria and so Emerging Crowd has joined forces with the largest serviced apartment provider in the country. The firm manages a portfolio of 50 flats and aims to grow aggressively in Nigeria over the next three years before expanding further in West Africa.

“There is huge appetite for development across Africa as the demographic shifts,” adds Koome Gikunda, investment principal at Actis, a British emerging markets private equity fund based in Africa. “Take the Palms in Lagos. This was the first proper shopping mall in a city with a population of 16m. It became a tourist attraction. People would come from all over just to see it.”

Weighing up the risks

Concern over risks and challenges is par for the course when looking at investment into emerging markets. Tindall’s crowdfunding platform claims to offer a much de-risked investment by doing due diligence as part of the service (see Investing in Africa). But, as Knight Frank’s Welborn says, apart from using common sense and doing the research, risk is part of investing anywhere in the world.

“The riskiest thing for any investor is political instability,” he says. “And if you look at the last 10 years in Africa compared with 1995-2005, then stability is growing in major cities. Of course there are always risks, but that is the case anywhere. Who would have thought Russia would be where it is today a few years ago? I would rather be in Africa.”

Read Knight Frank’s full Africa Report 2015 from Monday 30 March at www.knightfrank.com/africareport

Join the crowd investing in Africa

Ploughing money into emerging markets will always come with risks. Emerging Crowd’s Will Tindall says: “We are the UK’s first global crowdfunding and investment platform focused on unlisted growth-stage companies in emerging and frontier markets. It allows ordinary investors to buy shares and bonds issued by businesses in some of the world’s fastest-growing markets. It helps to de-risk investments by applying rigorous investor protection standards and all firms appearing on the platform are subject to forensic legal and commercial due diligence conducted by experienced investment analysts.”