UK investor sentiment has improved rapidly with predictions of near 14% returns across all asset types by the end of 2015, according to the latest forecast from the Investment Property Forum.

The predictions were taken at the end of August from 25 fund managers and advisers who said that City of London offices in particular could hit returns of 19.9% in 2015, up by 3.5% from predictions in May and August this year.

The City was not the only area for which powerful growth rates were forecast. West End office returns are now estimated to rise to 18.8%, helping push the consensus forecast for all UK office returns to 17.9%.

While offices were estimated to deliver the strongest growth, industrials were not far behind at 15.4% nationally.

Retail was once again expected to deliver weaker total returns than other sectors, with retail warehousing forecast to deliver only 9.7% in 2015.

Unlike other sectors, retail rental income is predicted to rise in 2016-17, however.

Shopping centre rents were expected to show 1.7% growth in 2016 and 2.2% growth in 2017. The retail warehousing sector was broadly in line with this at 1.8% and 2.2% over the same periods.

High street retail rents were expected to outstrip both however, up to 2.5% in 2016 and the same in 2017.

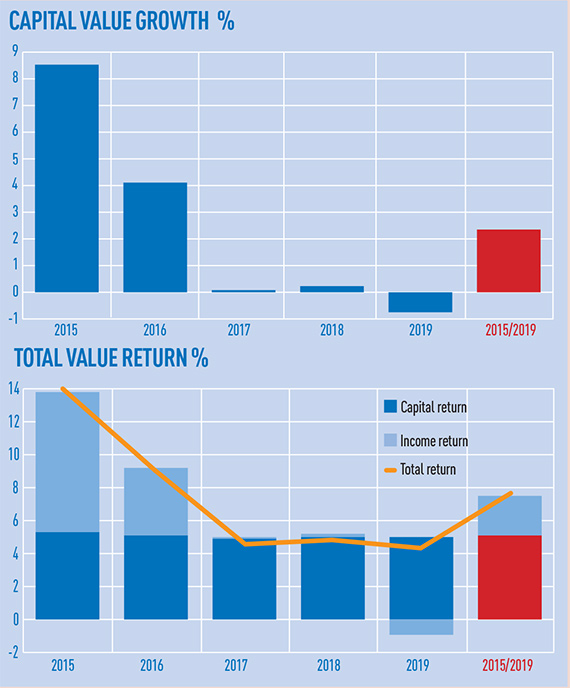

Over the following two years the consensus of those surveyed is that growth across all property will continue, but at a slower pace than in 2015.

Total returns are expected to fall to 9.2% in 2016 and then to 4.9% the following year.

This is due to a predicted sharp dip to 0.1% in capital returns for 2017, down 400bps, on the year before. Between 2015 and 2019, total returns are expected to be 7.4%.