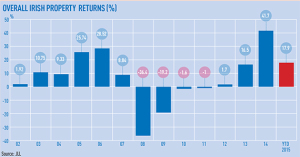

Irish total property returns have risen by 7.7% in the third quarter, helping the figure for the year to the end of September to reach 25.9%.

Irish total property returns have risen by 7.7% in the third quarter, helping the figure for the year to the end of September to reach 25.9%.

The figures from JLL confirm the continuing recovery of the Irish market as it experiences its 16th consecutive quarter of positive growth.

Capital values increased by 6.1% over the quarter or 18.1% over the 12 months, with retail values increasing the most of any sector.

Capital returns in the retail sector grew by 8.6%, according to JLL’s research, followed by industrial returns at 5.5% and offices lagging behind at 4.6%.

Despite the strength of the returning Irish market, in which values were up by 46.2% on the bottom of the market, values are still half those reached at the peak of the market in 2007.

Overall estimated rental values were up by 2.7% across Ireland during the quarter. Rental values for the industrial sector led the way at 3.8% while office rental values were up by 3.2%.

While the capital returns of retail outperformed other sectors at just 1.7%, the growth in estimated rental values was the weakest of the three main sectors, according to JLL.

Income growth lagged behind capital growth in Ireland, up by just 0.8% in the quarter and 0.4% over the half year.

Hannah Dwyer, head of research at JLL in Dublin, said: “The index continues to perform steadily with strong overall returns. This continues to be driven by increases in capital values, with growth across all sectors.

Overall capital values increased by 18.1% in Q3 2015, which compares with 31.7% in Q3 2014. Although this is still strong growth, the pace of this increase is starting to stabilise.”

JLL measured the performance of 29 properties across Ireland with a total value of £420.3m (£306.5m).