Total returns for London commercial real estate slowed to 4.7% in 2016, down from 18.1% the year before, according to the Levy Real Estate and MSCI London Markets Analysis.

Levy said that a rental recovery is beginning to emerge in 2017 as market sentiment improves post-referendum, though there remains wariness over business rates.

Total return and rental growth, 2011-2016

Islington delivered the highest total return of the 20 measured central London submarkets for the year, reaching double digits, while Hammersmith saw the lowest. Levy said a number of Brexit-led sales affected its total return.

The report says the prime market has been underpinned by overseas buyers, who are seeing a 15% with a 15% currency advantage, and that demand for freehold investments in core markets remains strong.

Total returns market by market, 2016

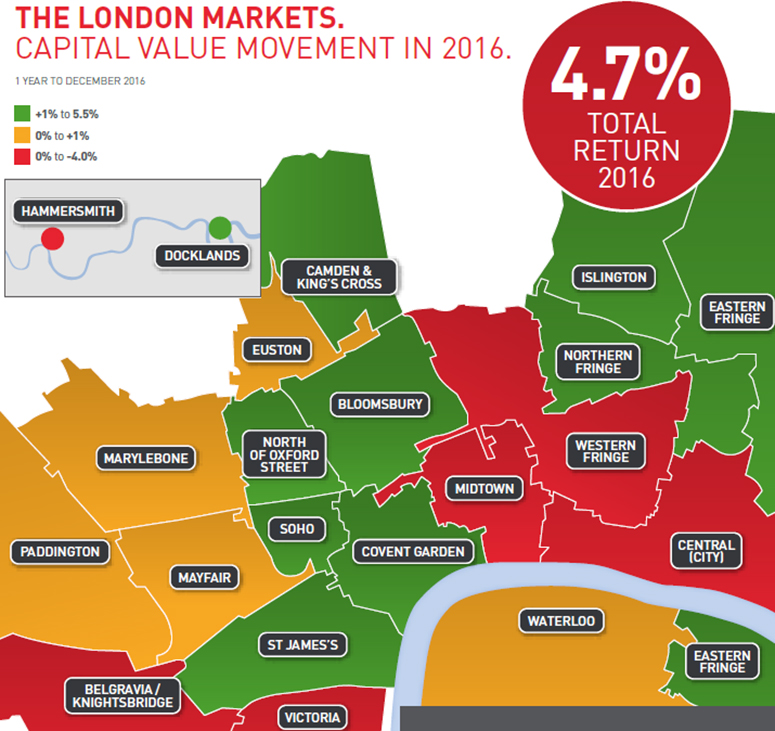

Capital growth varied by over 8% among the various markets, with the all London average just 0.9% for the year.

The strongest growth came from Camden and Islington at more than 5% and the largest fall was in Hammersmith at close to -4%.

Capital growth by markets, 2016

Levy said that despite caution regarding the market, London’s submarkets remain competitive with Europe, where similarly sharp yields exist in markets with higher vacancy rates.

Despite this, equivalent yields, yields based on estimated rental values, rather than passing rent, are still under 5% in a number of core markets.

Equivalent yields

Jonathan Martyr, head of investment at Levy Real Estate, said: “Undoubtedly the prime London market has been underpinned by overseas buyers with a 15% currency advantage making the most of the short run on the market, with some spectacular sales from the retail funds. As it turned out, this was a two-week window.

“Demand for freehold investments in core markets remains strong and on occasion record price levels were achieved in Q4 2016.”

Ranges of London submarket returns

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette