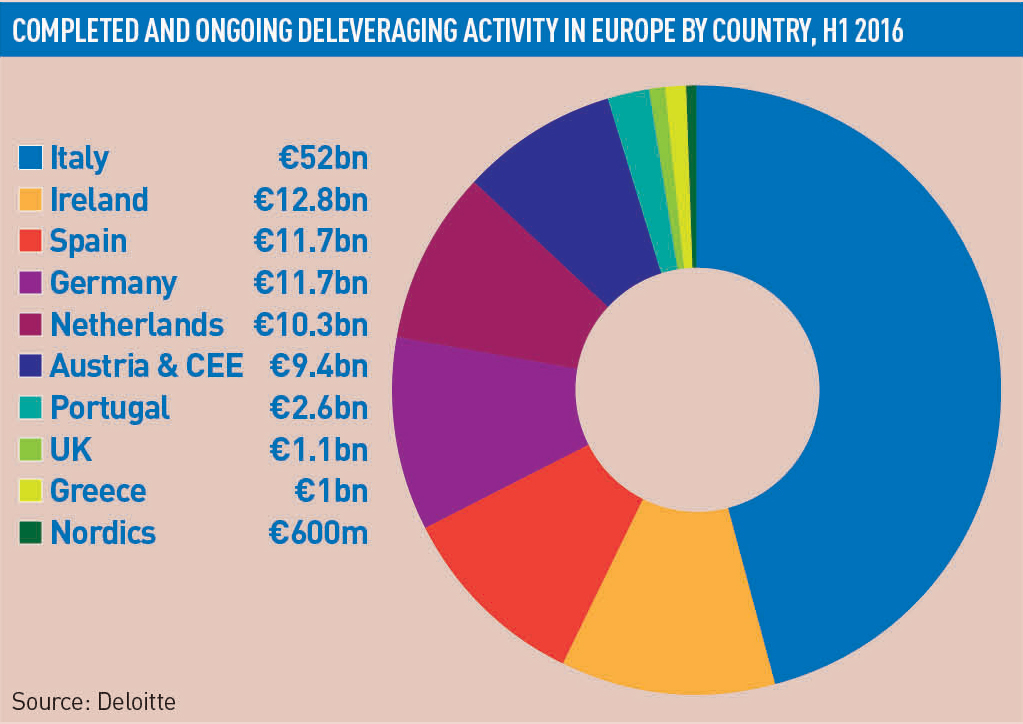

Europe is on track to see €140bn (£119bn) of loan portfolio sales completed by the end of the year as Italy and Ireland lead the way in selling their non-performing loan portfolios, according to Deloitte’s latest Deleveraging Europe report.

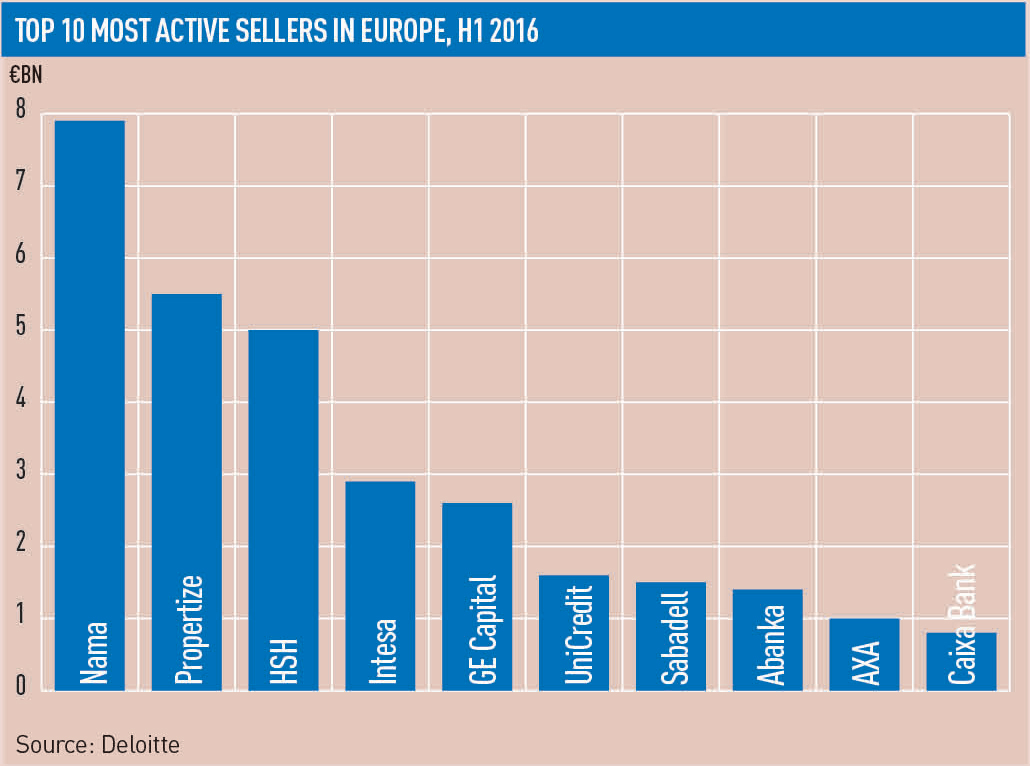

Italy has already surpassed last year’s activity, with €52bn of deals either completed or ongoing in the first half of 2016, compared with €17.3bn completed in 2015. Ireland’s National Asset Management Agency was the biggest seller in H1 2016.

A €140bn total would be 34% above last year’s €104.3bn.

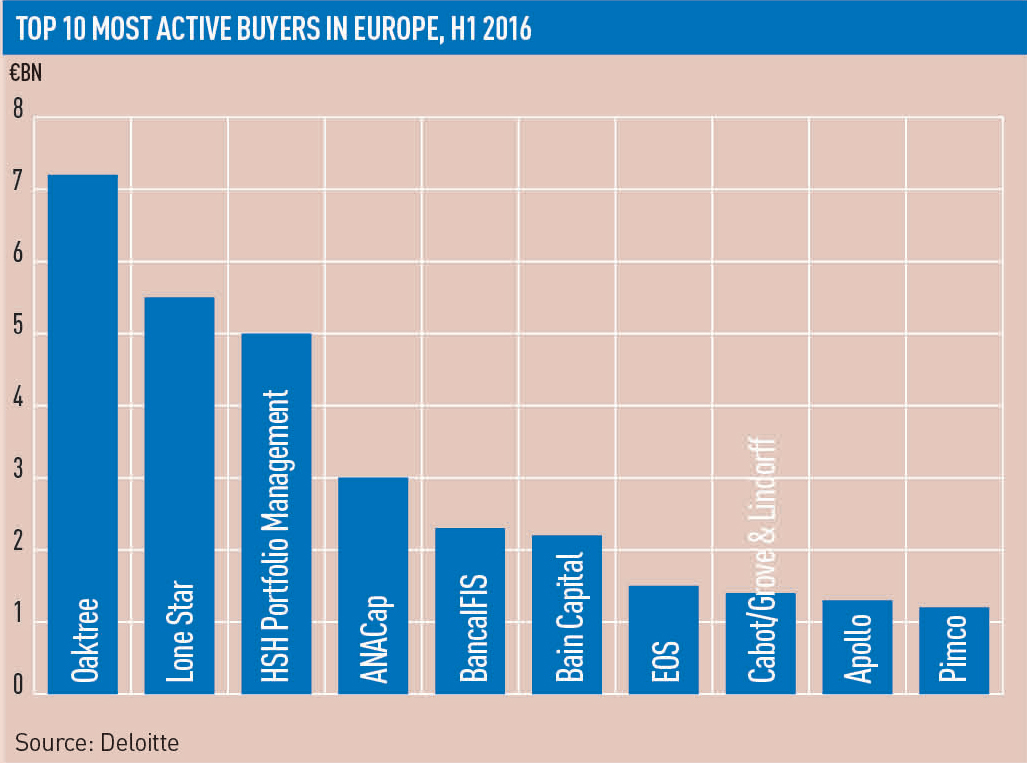

The three deals Nama completed, including the sale of its Ruby and Emerald CRE portfolios, had a combined value of €7.9bn. Nama has a further €2.1bn of ongoing deals.

The Ruby and Emerald sales also made Oaktree, which bought the portfolios in June, the biggest buyer in Europe.

By contrast, the UK only completed €1.1bn in loans in the first half of 2016.

Andrew Orr, UK head of portfolio lead advisory services at Deloitte, said that although UK activity slowed down in the months before and after the EU referendum, it was largely because the banks with the biggest NPL portfolios have been selling them since 2010.

He said: “The RBS and Lloyds of the world have mostly completed the deleveraging of assets. We are not expecting any significant commercial real estate-backed transactions to come out in the UK in the near future.

“A lot of activity has already been done, whereas Italy is just starting its journey in terms of deleveraging assets. It started its journey a bit later than the UK and Ireland.”

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette