In the dark days of 2008, I was asked by a friend, who was a school governor, to give a speech to a business studies group about being a successful entrepreneur.

In the dark days of 2008, I was asked by a friend, who was a school governor, to give a speech to a business studies group about being a successful entrepreneur.

I expressed my reservations, because at that point I was the exact opposite. Eventually I agreed to talk about the credit crunch, which I knew a lot about.

Some days later, in front of around 25 pupils, I began. To be honest, with end-of- term parties being planned, they weren’t very interested in what I had to say, but I hope enough attended, so that when the next crash inevitably arrives, they might remember a small, dishevelled man droning on about the warning signs of impending doom and understand them.

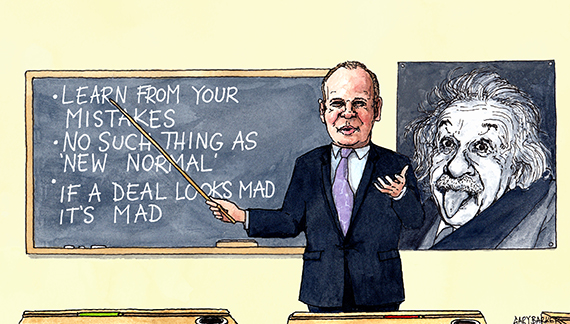

My talk centred on three signs (which I missed) that heralded the approaching Armageddon. First – the reason I am writing now – was talk of the “new normal”, or worse the “new paradigm”. I find the use of the word paradigm terrifying, but people like it and I’m now hearing it again. History should have taught us that there is no such thing – that every market is cyclical – but humans are conditioned to think that this time, “it’s different” – cue Einstein’s definition of madness.

Second sign was that banks were lending at rates they shouldn’t. Fortunately, senior debt of 65%-plus is very rare, so we’re not there yet, though some pretty punchy margins are available. The third sign, the real bell-ringer, was deals being done that leave you scratching your head about how they will make money – which they didn’t.

I’ve seen some pretty bullish deals over the past few months but we now face a quandary: a new ingredient could possibly be creating a “new normal” – 0% interest rates. This, and 0% inflation, means that real income from real assets looks attractive against a backdrop of instability in global capital markets and a commodities bloodbath.

I heard a comment recently about the risk of property values running ahead of occupier fundamentals. While difficult to disagree with per se, the opposing view is that multi-let regional property in northern Europe still trades at a gross yield gap of around 650-700bps against the cost of debt, some 400-500bps behind 2007’s gap, even in the UK. So despite secondary real estate values rebounding substantially over the past 18 months, I’d say the sector still offers value on an income basis.

And it is there that the market distortion of 0% rates (particularly when five-year eurozone swaps are negative) is most keenly demonstrated through a divergence of capital values (looking expensive) and income (offering value). With substantial yield gaps and low or negative long-term interest rates, it is difficult not to feel bullish about the return prospects for real estate in much of Europe, except cities like London where different rules apply.

I believe that, on balance, the demand for yield and demonstrable dividend will only grow, particularly as, recent equity market turmoil aside, the real economy is in good shape, with unspectacular but steady growth of around 2% pa underpinning occupiers’ ability to pay rent.

To conclude, the new ingredient of ultra-low interest rates will continue to distort our markets and, based on what we know today, it is likely that we entered a super cycle in 2009 that still has some way to run, and that medium-term investment values will be protected by the free cashflow that property generates.

Richard Croft is chief executive of M7 Real Estate