Japan’s largest online shopping mall, Rakuten Ichiba, has 75m Japanese users who can choose from more than 90m products from 38,000 merchants.

According to its mission statement, the retailer is focused on two approaches to growth: to empower people and society through continuous innovation and operation based on its five concepts of success, and to establish a “Rakuten eco system”, which enables it to maximise its customers’ lifetime value and leverage synergies.

Guided by the key phrase “more than web”, the Rakuten group is taking on the challenge of creating new value by driving convergence between the internet and traditional “bricks-and-mortar” businesses.

It is this approach that is setting the tone for the evolution of the Japanese retail sector as a whole.

In the past decade, the make-up of Japan’s bricks-and-mortar shopping experience has moved in parallel with the rise of technology and multi-channel retailing strategies.

“Ten years ago, malls made up 1% of retail space,” says Theo Knipfing, director of retail services for Cushman & Wakefield in Japan. “But that has increased to more than 20%, and they are definitely popular with younger people.”

Although the shift towards malls has been at the expense of department stores, Knipfing says the parallel growth of e-commerce has not prompted retailers to make huge changes to their store layouts. “Japan has always embraced technology and that is where shopping is changing,” he says.

Contactless payment using cards, money transfer by mobile phone, and the recently launched Octopus shopping sticker for the iPhone 4 are among the innovations transforming Japanese retailing (see below).

“Japan has been late to join the e-commerce revolution,” says Knipfing. “They were behind the rest of the world for the internet, so they skipped that and went to mobile phones. But, in terms of buying online, Japan is catching up.”

In the face of this threat, depato, or department stores – which still comprise most of the market – are starting to react. Although the sector is still very strong, no one under the age of 40 feels attracted to department stores, says Knipfing.

“I guess there has been a generational shift. These stores have aged with the children of the 1950s,” he says, “and they have seen 100 consecutive months of losses.”

Average shopper

Knipfing admits he doesn’t go to department stores. “They are not children-friendly, feelings are low – same old brands, same old layout – and the average shopper is 70 or 80 years old.”

Will Johnson, research and consultancy associate with Savills Japan, says that with sales volumes in steady decline, department stores are beginning to move away from traditional formats. “Some operators have invited international fast-fashion brands to open flagship outlets within their department stores to improve competitiveness,” he explains.

For example, Forever 21’s May 2010 opening in the Matsuzakaya department store in Tokyo’s Ginza district – known for its luxury brands – helped to heat up competition among other casual clothing retailers, including Zara and H&M, already in the district.

Forever 21’s Matsuzakaya outlet, its second in Japan, covers 3,000m2 across four floors and is twice the size of its Harajuku outlet, which opened in 2009.

In March last year, UNIQLO launched its fourth store in the heart of Umeda, one of Osaka’s major shopping hubs and the busiest commercial district in western Japan. Located on the renovated 13th floor of the Daimaru Umeda department store, a prime location linked to two railway stations, the new store has been marketed as a magnet for families.

Owner Fast Retailing says its new 1,450m2 Umeda store highlights UNIQLO’s renewed emphasis on store openings in urban areas, shopping malls and high streets.

H&M opened its first department store outlet last month. Located inside the Matsuzakaya department store in Nagoya, the 3,200m2 store is among the country’s largest and is H&M’s 19th outlet in Japan.

Although the younger market is growing in importance, Savills’ Johnson points out that some retailers are giving more consideration to Japan’s gradually ageing demographic. For example, on 26 April, Aeon, Japan’s largest shopping mall developer and operator, opened a supermarket in Funabashi, Chiba prefecture, offering a wide range of products and services aimed at seniors.

Shohei Murai, executive officer of Aeon, told reporters at the launch that the company would “continue to respond to the needs of seniors, who are becoming increasingly active and diversified”.

Aeon plans to gradually convert its existing stores into facilities that are friendly to older people. Senior-friendly features include a slower escalator speed and large signs inside stores. The centre comprises a supermarket and 160 speciality stores totalling 61,600m2.

According to C&W’s Q1 Marketbeat report, retailers are slowly starting to see some more definitive and positive signs of growth in the first quarter of 2012.

The second quarter of 2012 will be a busy time for retail in Tokyo, says C&W’s Knipfing. In the report, he forecasts that prime retail demand in the high streets “will continue to grow unabated as retailers continue to compete for coveted ‘no-brainer’ flagship locations and seek to consolidate their presence in Japan in a smaller but more nimble and focused way”.

Contactless payments

Back in the UK, sandwich shops are gradually installing contactless payment systems. For example, 50,000 retailers, including Eat, YO! Sushi, Pret a Manger, Krispy Kreme and Little Chef, have taken up Barclaycard’s system.

It was launched in seven City and Docklands postcodes by Visa Europe and MasterCard in 2007, and by September last year there were 73,000 contactless terminals and 19.6m cards had been issued across the country.

In Japan, contactless payment emerged in 2000 and, according to data from Nikkei Marketing Journal, by November 2011 the top six pre-paid e-money currencies had issued 167.2m cards, handling 200m transactions a month.

Electronic money became popular around 2007, when two major retailers, Aeon – Japan’s single largest shopping mall developer and operator – and Seven & i Holdings started their own versions of electronic money.

Today, they account for about 50% of all transactions in Japan.

Waon, owned by Aeon, has grown from 4.2m users and 24,000 stores in 2008 to 22.8m users across 130,000 locations today.

Epiport, a company that tracks digital marketing and business trends in Asia, says virtually all commuters in Japan’s major metropolitan areas use contactless cards to pay their fares.

Consumers can also make payments using phones in convenience stores, news stands, restaurants, shops and vending machines. Around 60% of all mobile phones – 70m – in Japan are equipped to handle electronic wallet functionalities.

Retailers are promoting the use of their e-money currency by giving shoppers points and discount coupons.

In March, Rakuten announced the launch of a prototype server-managed electronic money system using near-field communication protocol.

In a statement, it said: “Shifting e-money systems to a server-managed model will allow participating stores to reduce the cost of terminals and running costs. It also increases convenience to customers, for example by supplying coupons tailored to the customer’s demographic.”

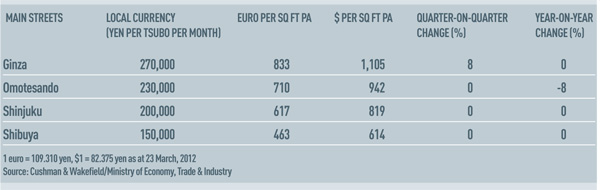

Prime retail rents – March 2012

Expanding brands

International casual fashion brands such as Gap, H&M, Forever 21, Zara and, more recently, Bershka, Old Navy and American Eagle Outfitters, as well as domestic brands such as UNIQLO and g.u., are now at the expansion stage in Japan.

Will Johnson, research and consultancy associate with Savills Japan, says: “Such brands have opened flagship stores in prime city-centre locations, but are also opening stores within suburban malls and department stores.”

American Eagle Outfitters (pictured), the third-largest US retailer of casual wear, has just opened its first two stores in Japan. According to Ryutsu News, American Eagle’s two new locations in Tokyo – Tokyu Plaza Omotesano Harajuku and DiverCity Tokyo Plaza – attracted 100,000 shoppers over five days from 18 April.

The sales figure for the first day at its Harajuku store was reported to have been a record for the brand; industry sources put it at $200,000. More than 1,000 people are said to have queued outside for the Harajuku store opening and entrance gates were closed frequently to avoid congestion.

But Knipfing says retailers need to be cautious: “If you’re a fad, you’re going to die. But if you go steady – like Zara, which has been here for 10 years, or Gap, which has been here 15 – you’ll do quite well.”

He points out that Abercrombie & Fitch, which opened in 2010, did not do so well in Japan because it was overpriced.

Recent developments in 2012

• TOKYO SOLAMACHI (TOKYO SKY TOWN)

Location: next to new Tokyo Sky Tree Tower in the Sumida ward, Tokyo

Shopping centre developer: Tobu Railways

Opening: 22 May, 2012

• SHIBUYA HIKARIE SHINQS

Location: Shibuya ward, Tokyo

Developer: Tokyu Railways

Opened: 26 April, 2012

Cost: 100bn yen (£765m)

Located next to Shibyu station – used by 3m people daily – this 34-floor glass tower with three basement floors has nearly 200 shops, 26 eateries, design and art galleries, office floors and a 2,000-seat musical theatre. It is aimed at customers in their 20s-40s, with shops selling luxury goods and healthy products. Plans to revitalise the station and its surroundings over the next decade include renewal of the 78-year-old Tokyu department store.

• TOKYU PLAZA OMOTESANDO HARAJUKU

Location: at the intersection of the Omotesando /Harajuku districts of Shibuya Ward, Tokyo

Developer: Tokyu Land

Opened: 18 April 2012

Size: total floor area 11,850m2

• DIVERCITY TOKYO PLAZA

Location: Daiba, Minato ward, Tokyo

Developer: Mitsui Fudosan

Opened: 19 April 2012

Size: total sales area 49,600m2

Tenants: include major fast-fashion brands such as H&M, UNIQLO, Forever 21, Zara, Bershka, Old Navy and American Eagle Outfitters. Luxury brands include Coach Men’s, Burberry and Marc by Marc Jacobs. Popular Hawaiian coffee chain Honolulu Coffee also launched its first Japan store at the development.