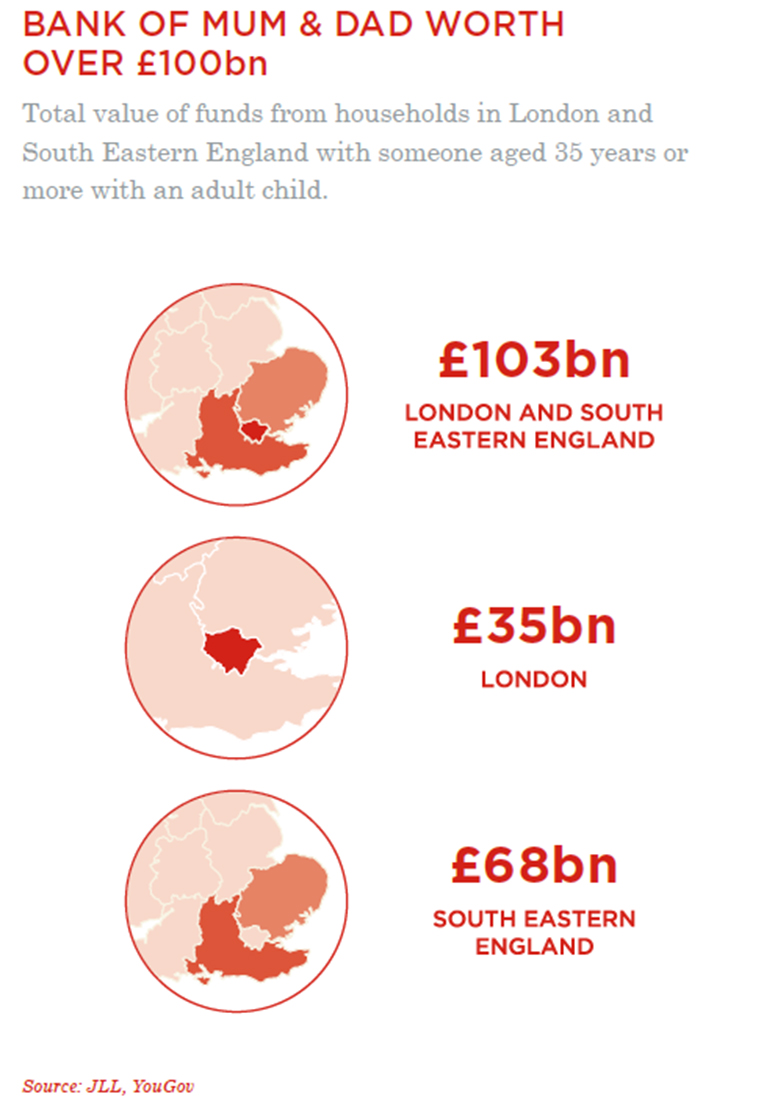

The bank of mum and dad in London and the South East is worth £103bn, according to research from JLL Residential. This, the agent estimates, could be used to buy more than £1tn of housing stock. £1.8tn meanwhile, will be passed down in inheritance.

Bank of mum and dad worth over £100bn

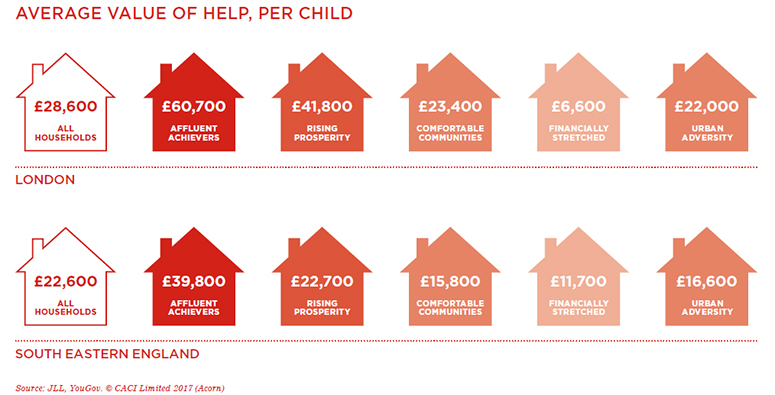

The average hand out, according to the research, is £24,800, and 70% of the 5,200 people interviewed for the research said they would hand it down as a pure gift.

Average value of help, per child

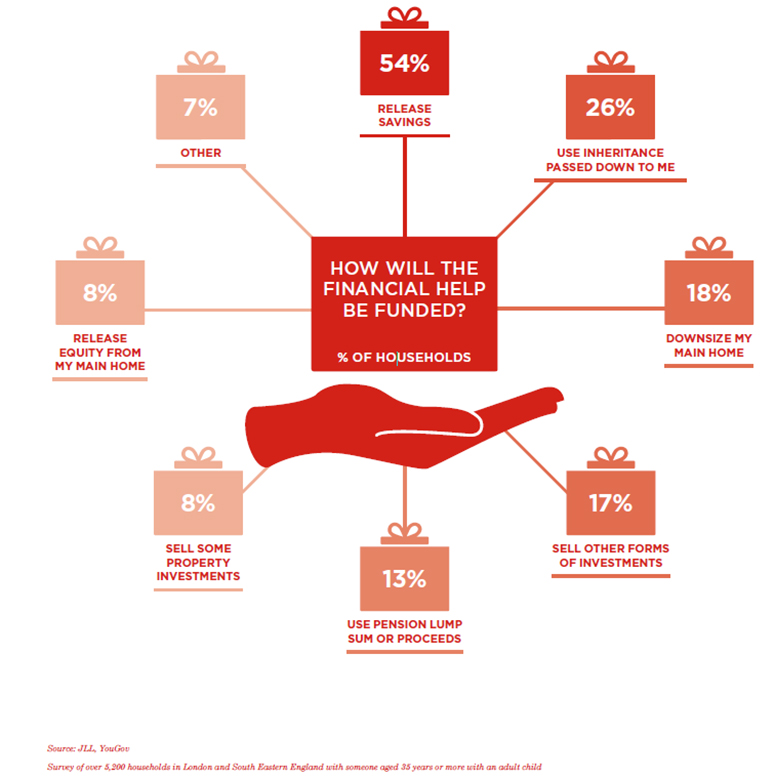

Meanwhile, 54% of respondents said they will be releasing savings to help their children, while 26% said they will use the inheritance passed down to them.

How will the financial help be funded?

Neil Chegwidden, director of residential research at JLL, said: “The worrying social element is that the Bank of Mum & Dad phenomenon is set to extend the gap between the ‘haves’ and the ‘have-nots’.

“With Bank of Mum & Dad support likely to push house prices even higher when affordability is already stretched it means that the Bank of Mum & Dad will become even more important for the privileged parts of society, but inevitably leaving other households further behind.”

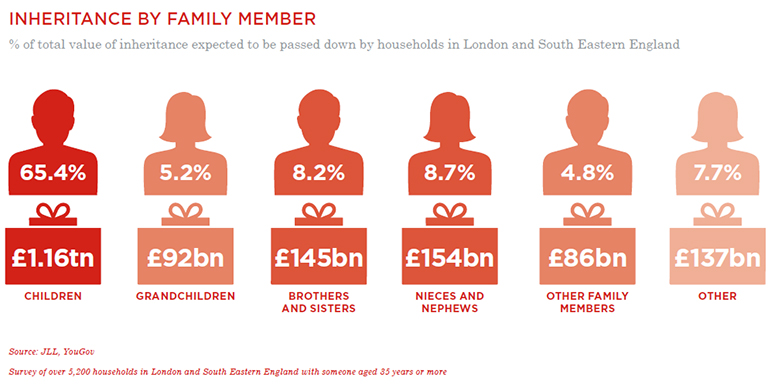

Inheritance by family member

Key stats

- £1.77tn – total value of inheritance predicted

- 318,000 – the average inheritance value

- 5.2m – the number of households passing on some inheritance

- 65% going to family’s children

- £103bn – the value of the bank of mum and dad

- £24,800 the average financial support by child

- £1.03trn, the total potential value of bank of mum and dad

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette