BHS administrator Duff & Phelps has recovered £22.5m from landlords by surrendering the leases of three of its most desirable stores.

BHS administrator Duff & Phelps has recovered £22.5m from landlords by surrendering the leases of three of its most desirable stores.

Some BHS leases set at historical, below-market rents are being bought back by landlords, which can then relet the shops at higher current rents. This also gives landlords greater control over which retailers come into stores and the option to split or reconfigure units to be more appealing to tenants.

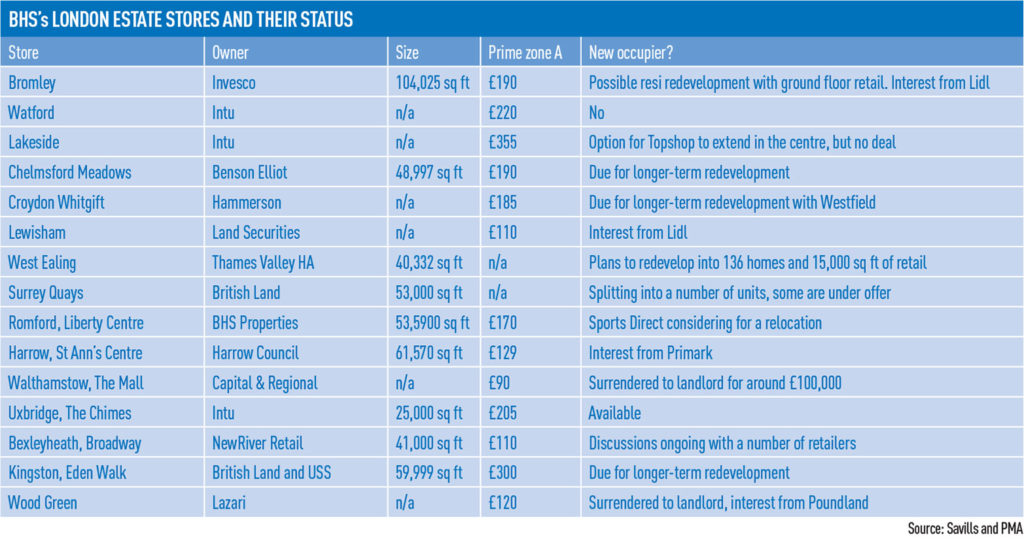

Savills and CBRE, which are advising on the disposals, have concluded deals on around a quarter of the 160-store estate since it collapsed into administration in May, and other retailers are picking over the bones to strike deals at the best locations. Although its 15 London stores are attracting interest, formal decisions are yet to be made (see table below).

M&G has paid the biggest premium to take back a BHS lease, stumping up £12m to get back its 50,000 sq ft Manchester store at 57 Market Street, part of the Arndale Centre. BHS was paying around £1.4m pa, or £28 per sq ft. Average retail rents on the street are now around £39 per sq ft, according to EGi data, meaning the store was under-rented by around £500,000 pa.

No new deal has been agreed, but it is likely that M&G will look to relet it as one unit.

In Milton Keynes, Hermes has paid £10m for the lease on a 70,000 sq ft store in centre:mk. Average shopping centre rents in Milton Keynes are £43 per sq ft, and reletting the shop as a whole is the most likely option. Primark is considering the store as well as up to nine others in the BHS portfolio.

In Brighton, Standard Life has paid a £500,000 premium for a 67,000 sq ft former BHS store in its Churchill Square mall, where average rents are £43 per sq ft. Zara is among a handful of brands looking at the space and a deal with the retailer would make it its largest store in the UK, almost twice the size of its Oxford Street flagship.

Most deals secured so far, including those in Manchester, Milton Keynes and Brighton, have been on sites which KPMG identified as the most valuable and included in its schedule of category 1 leases in preparation for BHS’s CVA in March.

The majority of BHS sites are outdated on struggling high streets and will be harder to fill.

Most of these will either be split up and let to multiple tenants or redeveloped, with some already earmarked as residential sites.

• To send feedback, e-mail amber.rolt@estatesgazette.com or tweet @AmberRoltEG or @estatesgazette