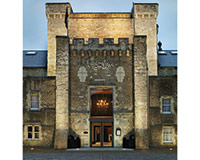

Land Securities has fought off rivals to secure a Norman-era medieval castle and prison in Oxford that has been converted into a hotel.

Land Securities has fought off rivals to secure a Norman-era medieval castle and prison in Oxford that has been converted into a hotel.

The REIT is under offer to buy the Malmaison Oxford hotel for around £50m, a 5% yield. The price reflects a new 20% premium to the £42m asking guided by JLL on behalf of vendor, Osborne Group.

LandSec already owns the adjacent Westgate shopping centre in joint venture with The Crown Estate. The centre is currently undergoing an 800,000 sq ft redevelopment that is due to complete in 2017.

The hotel is now expected to be incorporated into the Westgate scheme, which includes 100 shops and 25 restaurants.

Interest from parties including CBRE Global Investors, DTZ Investors and Frasers Hospitality – which bought the Malmaison brand earlier this year – helped to push bids well above the asking price.

A source said: “This is a logical move for Land Securities and you can see the value in doing it.

“LandSec will now have the ability to create a city centre scheme that benefits its Westgate strategy by getting more footfall between the two.”

Trevor Osborne’s Osborne Group converted the castle into a 95-bedroom hotel in 2006.

It plans to reinvest the capital from the sale into its current development pipeline.

JLL advised Osborne Group; Land Securities was unrepresented.