Although Leeds has enjoyed a healthy 14% surge in disposed space, that has come with a rise in deal numbers, meaning average transaction sizes have dropped against 2014 levels.

Although Leeds has enjoyed a healthy 14% surge in disposed space, that has come with a rise in deal numbers, meaning average transaction sizes have dropped against 2014 levels.

The market is still battling against a shortage of supply, with developers understandably cautious about building speculatively.

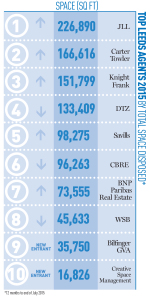

The three largest deals in the 12 months to the end of July 2015 were all prelets on new-builds at Sovereign Square, Central Square and Wellington Place, but agents are having to work extra hard to sell existing space. Carter Towler typified this, racking up a huge 71 deals to finish second in the rankings.

But the spoils were taken by JLL. With its strong Leeds focus, it was the only agent to break the 200,000 sq ft barrier.

Going up: Knight Frank

Knight Frank is clearly going after the Leeds market with renewed vigour. It has tempted Eamon Fox to the team who has in turn helped it become an agent for 1 Whitehall Riverside, where a new headline rental record was set this year. Not only this, but – along with BNP Paribas Real Estate – it acted on the largest letting in the city centre when Addleshaw Goddard took 50,000 sq ft at 3 Sovereign Square and it transacted more deals than everyone except Carter Towler.

Going down: CBRE

After two years as runner-up, CBRE falls to sixth position, with transaction volumes down by more than a third on last year. The fact that this drop-off comes as its great rival JLL strides in the other direction makes the shift look even more dramatic. However, CBRE took a similar tumble in 2012 and recovered strongly. The pressure will be on to prove this year was merely another blip.