From 1920s cinema to bustling ballroom, bingo hall to nightclub, Leeds’ Majestic building has had many incarnations. After spending the past 11 years declining into a derelict eyesore, its glory days seemed over. Yet local developer Rushbond is transforming the space into a six-floor office scheme, guaranteeing its future as a city centre hotspot, writes Claire Robson.

For decades crowds flocked to The Majestic on Leeds’s City Square. From cinema goers settling down to watch its first film, Way Down East, in 1922, to tango dancers and finally ’90s clubbers, the Grade II-listed domed building never struggled to pull in the punters. Now Rushbond hopes it will have the same appeal to office workers.

The developer, which acquired the building in 2010, originally planned to turn it into an entertainment complex, only for it to be ravaged by fire four years later. It now has planning permission to add three storeys topped with a new “crown” roof, and create 65,000 sq ft of contemporary workspace behind the historic façade. Work is due to start in the summer for occupation in late 2018.

Rushbond’s director of real estate, Mark Finch, says: “Given its location outside the train station, the Majestic is now right at the heart of Leeds’s commercial core. We can offer occupiers grade-A quality space within the fabric of an iconic historic building.”

News that one of the city’s best-loved buildings has been given a new lease of life has met with enthusiasm. Gerald Jennings, president of Leeds Chamber of Commerce, says: “Rushbond has a track record for transforming historic buildings and has proven it can deliver. The Majestic is in a prime position and I’m sure it will let very well.”

Certainly, the proximity to Leeds’s key transport hubs will make the statement building an attractive proposition to potential occupiers. Rushbond and letting agent JLL believe that floorplates of up to 11,000 sq ft, a three-storey atrium and ground floor amenities including collaborative zones, cycle parking and shower facilities, will woo both indigenous businesses and potential inward investors.

“Given its location and distinctive brand, the scheme is likely to appeal to a broad range of occupiers”, agrees Richard Dunn, head of office agency at Sanderson Weatherall. “I could see tech businesses, professional services firms and serviced office operators finding it equally attractive.”

He adds: “The timing should work well with a number of lease events on the horizon and by 2019 you’d think that much of the city centre’s grade-A space will have gone.”

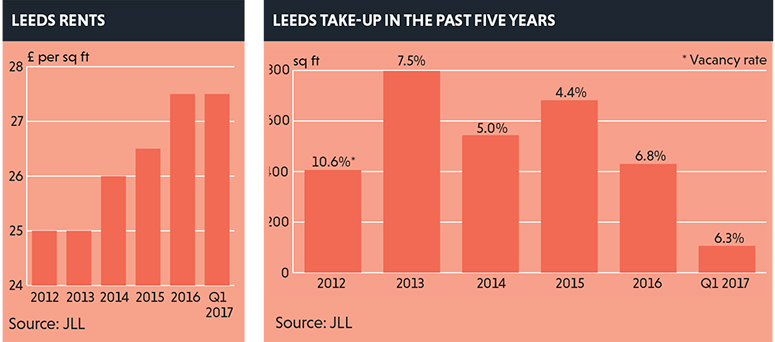

According to Savills, there are 2m sq ft of lease events in Leeds between 2018 and 2021, giving a boost to a market which experienced an unspectacular 2016. Last year’s take-up was a fairly disappointing 430,000 sq ft, compared with a 10-year average of more than 500,000 sq ft. Agents say the fallout of Brexit knocked confidence, but are encouraged by current market sentiment.

City centre requirements

There are around 1m sq ft of city centre requirements in circulation, including Walker Morris, Sky and the Government Property Unit (see panel).

Although a flurry of grade-A buildings totalling around 550,000 sq ft were completed in 2016, around half of that space is now let, with discussions under way for much of the remainder. MEPC’s 111,000 sq ft 3 Wellington Place is the only other new build set to be delivered this year and although there will be additional competition from refurbs, the Majestic should be well placed to capitalise on demand.

Knight Frank’s head of office agency in Leeds, Eamon Fox, says: “It may look like there’s a lot of stock on the market, but there are quite a few deals being done behind the scenes and come June and July we’ll be back to talking about a lack of supply.”

That all bodes well for rental growth. Rushbond is hoping to exceed £30 per sq ft and although the city centre headline currently stands at £27.50, cemented by the 12,755 sq ft letting to BDO at Central Square, agents believe that as stock is eaten up further growth is inevitable.

“You’d think that any scheme starting this year has got to have a £30 per sq ft-plus price tag”, says Paul Fairhurst, head of Savills’ Leeds. “That would certainly help development appraisals.”

Headline rent

Even if Rushbond and the wider Leeds market do break the £30 barrier, the Leeds headline rent is still at a significant discount to the likes of Manchester and Birmingham. One of the key tests for the city’s office market now is to reach out beyond its indigenous occupiers and lure footloose inward investors.

2017 may prove a bumper year for take up if GPU commits to Leeds, but the real challenge is ensuring it signals an ongoing trend rather than a welcome blip.

“We really need some new blood in the city”, says CBRE senior director Jonathan Shire. “When you take rates into account, our grade-A space is £10 per sq ft cheaper than Manchester’s. We’ve not attracted the levels of inward investment I thought we might.”

Leeds Chamber of Commerce’s Jennings says: “One reason why we haven’t attracted more inward investment is that we haven’t shouted loud enough about our successes and what we have to offer. People in Leeds tend to be modest and just get on with it, but we live in a competitive world and we’ve got to get better at selling our wares.”

GPU on the cusp of committing to Wellington Place

Leeds is hoping its appeal as a centre for relocation will be boosted by the arrival of a GPU requirement. The government’s property unit is set to sign up for 380,000 sq ft of space at 7 and 8 Wellington Place, a move which would represent a game changer for the city’ office market.

Leeds is hoping its appeal as a centre for relocation will be boosted by the arrival of a GPU requirement. The government’s property unit is set to sign up for 380,000 sq ft of space at 7 and 8 Wellington Place, a move which would represent a game changer for the city’ office market.

Neither MEPC nor GPU would confirm a deal has been struck, but market sources suggest Whitehall is negotiating a deal with MEPC, Hermes Investment Management and Canada Pension Plan Investment Board’s campus to make it the home for its new civil service hub.

The GPU targeted Leeds as the location for one of its 13 consolidated regional bases to be opened in 2019, shortlisting Wellington Place alongside BAM’s Latitude Leeds and Town Centre Securities’ Whitehall Riverside.

JLL is one of the letting agents on Wellington Place and has also been advising GPU.

Jeff Pearey, head of JLL’s Leeds office, wouldn’t comment on the deal but says: “We’re very encouraged by how Wellington Place is coming together.”

He adds: “We always had a vision that Wellington Place would become Leeds’ Brindleyplace or Spinningfields and the latest lettings and planning consent are seeing that become a reality.”

If Wellington Place does bag GPU, the other two runners will have missed out on a major coup, but agents are confident they will benefit in the long run.

“I can only see the other two prospering as demand for space improves and supply tightens”, says Colliers International’s Oliver Stainsby, “They may well find they’re the winners next time.”

Savills’ Paul Fairhurst agrees: “They will sit pretty. GPU will have taken out a lot of the grade A space in the market and when they do let up they may well find they achieve higher rents as a result.”