Statistics might not lie but they can be misleading. At first glance, it looks like Leeds city centre take-up is underperforming in 2014.

Statistics might not lie but they can be misleading. At first glance, it looks like Leeds city centre take-up is underperforming in 2014.

Yes, take-up in the third quarter fell by 45% year-on-year to 132,766 sq ft, according to EGi data, but 2013 was an unusually stellar year for the Yorkshire city, and a very hard act to follow.

While 2014 will fail to hit the heights of the record take-up of 794,000 sq ft in 2013, a number of late deals could push the annual total towards an extremely healthy 600,000-700,000 sq ft and well above the 10-year average of 517,000 sq ft.

It is all the encouragement developers with sites in the city centre need, and that rare beast, speculative development, is making a post-recession return. According to CBRE, the 274,000 sq ft of available grade-A space is dwarfed by the 850,000

sq ft of named requirements.

Aside from the usual suspects among Leeds’ legal firms, there are reports that energy firm npower and the NHS are both seeking around 150,000 sq ft. Furthermore, around 1m sq ft of lease events are due between now and 2018.

Most developers are exerting a little caution by seeking to prelet 40-50% of space before starting to build out larger schemes – but not all. Roydhouse Properties is on site with its whopping 220,000 sq ft Central Square office scheme, although accountancy firm PwC is thought to be close to signing for 50,000 sq ft. Marshall CDP’s 69,000 sq ft 6 Queen Street, acquired by Rockwood in October for £30m, is also on site and due for completion in spring 2016.

The first new building to complete will be MEPC’s next phase of Wellington Place (pictured) – the 104,000 sq ft 6 Wellington Place – at the end of next year. In October, US lawyer Squire Patton Boggs signed for 32,000 sq ft in the building.

McAleer & Rushe has its finger hovering over the button for its 173,000 sq ft City Square House, having whittled down its shortlist of development partners. Bruntwood is likely to fully commit to the 93,000 sq ft 3 Sovereign Square, which it is developing with Kier Property, in December.

Bruntwood has been strongly linked to law firm Addleshaw Goddard, which has had a 50,000 sq ft requirement for several months. So, why is it yet to sign up?

Bruntwood’s Craig Burrow says: “Their lease event isn’t until 2017, so they have some time. They’ve been considering requirements in Leeds and Manchester and we’re one of a number of interested parties talking to them, but they are currently located opposite the site.”

When asked how much of a blow it would be if Addleshaw failed to come on board, Burrow says: “There are five to 10 big occupiers in Leeds who have a lease event in the next two to three years, and this fact is helping developments to get off the ground.”

Headline rents have been stuck at £25 per sq ft for some time – a significant discount to Manchester and Birmingham for prime rental – but, says Burrow, Bruntwood is “looking at pushing rents to £27-£28 per sq ft at 3 Sovereign Street”.

Some observers wonder if there will be enough demand for all the planned development. Patrick Carter, at Savills, says: “If you’re looking for 20,000-30,000 sq ft within a building there are only a few options, and some of them aren’t really up to the required standard.”

With only 6 Wellington House completing in 2015, stock levels will still be fairly low, says Jeff Pearey, head of JLL’s Leeds office. “The supply is coming quickly but much of it has a strong whiff of prelet commitments, and we will see many more commitments come to the fore for the buildings that are being built in 2015.

“So the sweeties are being snaffled off the shelves fast. Many [firms with] lease expiries may have to hold over or hold their breath until early 2016 if they want more choice, and Leeds could lose out in the short term on footloose requirements due to the scant choice of space.”

In the meantime, expect a series of high-quality refurbishments to take up the slack, such as Formal Investments’ 21 Queen Street. Meanwhile, Evans Property Group has refurbished Minerva House and Capitol House, two buildings slap bang in the centre. Law firm DAC Beachcroft has pre-committed to 35,000 sq ft at St Paul’s House on Park Square, which is being refurbished ready for Q1 2015.

Bruntwood is trying to get on site by January to do a speculative refurbishment at 120,000 sq ft City House, but a lengthy approval process with owner Network Rail may delay it until March. In the south of the city centre, Victoria Place and 1 City Walk have been refurbished and are back on the market.

Meanwhile, London-based FORE Partnership bought Yorkshire House for £17m in October from the Apia Regional Office Fund.

The 83,000 sq ft building on Greek Street is set to undergo a substantial refurbishment, with TMT occupiers in mind when it is marketed in the new year.

Bradford bullish about development opportunity

In early 2015, the City of Bradford metropolitan district council is hoping

to market a 75,000 sq ft development, One City Park, which could be the first grade-A speculative office development in the city for many years.

The Tyrls site is part of Bradford’s former central police station. Half the building was demolished to build City Park, but the other half could not be demolished because it held the Bradford and Keighley Magistrates’ Court cells.

As part of a Regional Growth Fund bid, Bradford council was able to gain funding to move the cells and prepare the development platform, thereby de-risking the site for investors.

With construction beginning in August on a new custody suite for the Bradford and Keighley Magistrates’ Court, the Tyrls can now be demolished. This is expected to be completed by the end of March 2015, subject to planning permission.

“We will be marketing it early-ish in the new year as a shovel-ready development site,” says council leader David Green. “It’s going to have one of the best addresses and best locations in the region. It will have a front door onto the award-winning City Park, with the Alhambra Theatre and City Hall as its neighbours.”

Green says the council is acutely aware of the need for more grade-A space in and around the city centre. He adds: “We’ve got some offices not up to modern standards, but One City Park would be prime space. We would hope there would be no need for financial assistance and it is built on purely commercial terms.”

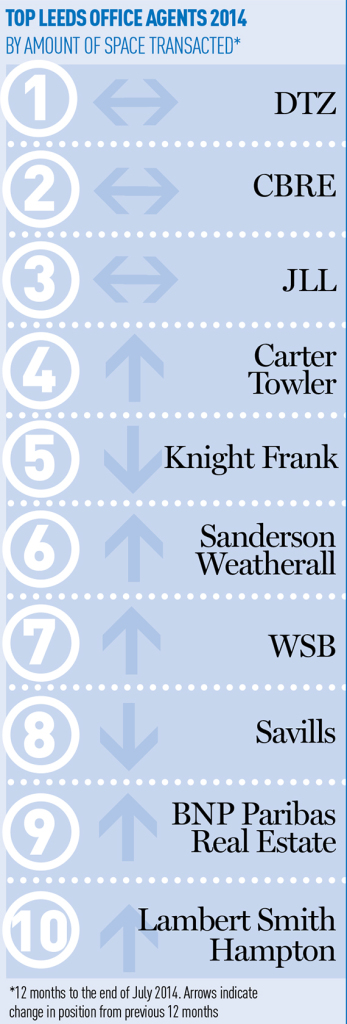

Leeds Agents Table

There’s no change in the top three Leeds office agents, with DTZ, CBRE and JLL ruling the roost. But compared with last year, there are four newcomers to the table that have squeezed out a few well-known names. It is against a drooping market, which saw the total amount of space drop by 14%, although there are now signs that activity has since started to recover following improvements in the third quarter of this year.

Going up: DTZ

National agent DTZ has pulled off a trick that no other office agent in our top five has managed – increasing the amount of space transacted this year.

In the year to the end of July, DTZ disposed of more than 200,000 sq ft, maintaining its number one position and up 7% on the same period last year. DTZ signed the third-largest deal of the year, a 29,000 sq ft letting to KPMG at Broadgate, but it was the sheer number of large deals that gave it a boost.

With an average deal size nearly double the Leeds average, it notched up five deals above the 20,000 sq ft threshold. Knight Frank was the only agent to come close to this, with two deals over the threshold.

Going down: Savills

Despite slipping just one space in the top-10 leaderboard, Savills registered the biggest drop in space transacted in the year to the end of July.

It found tenants for 37,000 sq ft of space, down 64% on the same period last year, despite inking 14 deals, more than 2013. It was size of transaction that eluded the national giant, with its largest deal being the 8,700 sq ft letting at Brewery Wharf to Buro Hapold.