Lloyds Bank lending to commercial real estate shrank by only 4% to £8.6bn in 2016 despite sharp falls in transactions in the broader market.

The bank called it a strong performance in the face of market volumes that fell by about 30% last year.

In the first half of 2016, loan origination to UK property fell by 13%, according to the De Montfort property lending report.

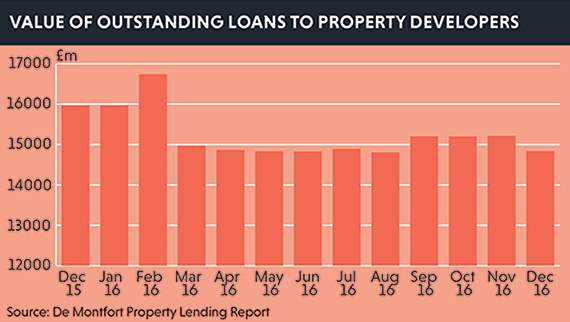

Bank of England data also showed that outstanding loans to property development made by UK banks fell by 7% in 2016 as traditional lenders regarded the industry with extra caution.

Despite this, Lloyds launched its £1bn Green Lending initiative last year. The initiative provides development loans with a discount of up to 20bps if the developer meets certain green requirements such as improved energy efficiency. It has seen £70m of loans issued so far, with the biggest, at £39.7m, provided for the University of the West of Scotland’s Hamilton International Technology Park.

At the end of the year, Lloyds led Lazari Investments’ £409m refinancing, providing a £118m, 10-year loan through its subsidiary Scottish Widows. The remaining £291m was issued in a club deal involving Lloyds, Met Life and Royal Bank of Scotland on a five-year term.

John Feeney, managing director and global head of commercial real estate at Lloyds, said: “In 2016 we distributed far more UK CRE risk than any other bank, which places us in a strong position to source sometimes volatile liquidity.

“Our prudent approach keeps us focused on quality assets and new opportunities, and on working with the industry’s most expert sponsors.”

To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette