A decade in the making, a near-miss with a Crossrail eviction notice and a search for a 300,000 sq ft-plus building that reportedly needed several entrances to spare the blushes of competing clients crossing in reception.

A decade in the making, a near-miss with a Crossrail eviction notice and a search for a 300,000 sq ft-plus building that reportedly needed several entrances to spare the blushes of competing clients crossing in reception.

Advertising giant Omnicom’s mammoth search for a new London home finally ended in quarter four, landing the southern fringe one of the juiciest office lettings in 2014 and helping to hand London its best year’s take-up for a decade.

Getting the deal completed must have required a bucketful of patience, but if Omnicom’s agents are feeling the strain they are showing no trace of it.

“It feels like passing an exam, if you know what I mean,” says Andrew Parker, head of City leasing at Cushman & Wakefield. “All those deals are pretty intense for short periods of time, but that’s not to belittle the pleasure of the deal going over the line,” he adds.

Parker is clearly uncomfortable attaching too much hubris to his comments, but the agency has been landing some big mandates of late. In the third quarter, its work for Amazon at Principal Place, along with Allsop, bagged it the top deal of the year and a top place in EG’s Q3 rankings.

Last quarter, big trophy deals made up two-thirds of all C&W’s disposals, and acting on Omnicom’s deal with DTZ and Dong Energy’s new West End base jointly with CBRE earned them a top-four position in EG’s Q4 rankings.

It echoes a London-wide trend, with trophy deals to trophy clients driving the market in 2014, pushing take-up through the 14m sq ft mark and above 2006’s peak.

Space signed for took a leap in the second half of the year, with the Docklands and southern fringe markets basking in triple-digit increases in take-up.

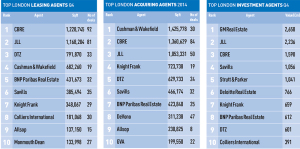

The top five deals (see page 84) made up a quarter of the last three months’ lettings by sq ft, leaving a deep impression on market figures and our league tables. Churn might have helped some boost their position, but there was not a single top-five agent that had not acted on one, if not more, of the top five deals of the quarter.

But while the markets hurtled towards historic highs, on the ground it felt a bit more subdued. “It certainly didn’t feel like the peak. It felt like 2005 or 2006, maybe, a precursor to the boom,” says Chris Vydra, head of City office leasing at CBRE, echoing a general disbelief among the agents at just how good the year-end figures are.

CBRE topped the Q4 league table, only just beating JLL. But on a market-by-market basis, London delivered a very mixed performance for all the agents. The West End rose by almost 17% quarter on quarter, despite landing just one of those top-five deals. Meanwhile, in the City core and fringe, although offices delivered a solid performance for the year as a whole, both markets fell in the last three months.

CBRE topped the Q4 league table, only just beating JLL. But on a market-by-market basis, London delivered a very mixed performance for all the agents. The West End rose by almost 17% quarter on quarter, despite landing just one of those top-five deals. Meanwhile, in the City core and fringe, although offices delivered a solid performance for the year as a whole, both markets fell in the last three months.

Midtown was the only market to see a serious slip into the red, both annually and quarterly. Annual take-up dipped by 10% and fourth-quarter lettings slipped by 16% compared with the same period last year, hampered by a sub-5% availability rate – the lowest since the middle of 2007.

What confidence agents lacked, occupiers more than made up for. Vydra says last year saw 60% more prelets “off plan” by total size compared with the previous year and expects more prelets in 2015. He says: “SocGen had the choice to relocate anytime in the last 10 years because it owned its key occupied building, so had greater flexibility on exit.”

Instead, says Vydra, it chose now. Equally, he adds: “M&G could have held over and delayed its decision to a later date, but it saw that the realistic City core relocation options were running out fast.”

With that comes the hope of rising rents. Now the City feels cheap, although most property professionals prefer to say “exceptional value”. The hope is that this will drive up rents in the core. “We are already seeing that in quoting rents,” says C&W’s Parker. “We’ve got a small building on Cannon Street that’s quoting £62.50 per sq ft, which felt a year ago more like a £52.50 per sq ft building.”

In the secondary market some say there are signs things are shifting. Chris Sutcliffe, partner at Newton Perkins, says secondary stock is moving quickly, a fact that might have helped the City specialist make a surprise entry in our table at number 11. Pointing to a building it is acting on where rents have moved from £35 per sq ft to £42.50 per sq ft in the past year, Sutcliffe adds: “That’s 22% without any particular improvement in terms of landlord capex. Prime must go up now.”

Investment

More than four times as much money was spent on London property in the last quarter of 2014, compared with the first.

Q4 saw investors part with £6.6bn, against Q1’s paltry £1.5bn.

“Very little fell through from Q4 2013 into the new year and we all started to look around and think, uh, are we in for a quiet year?” says Damian Corbett, head of central London capital markets at JLL.

Despite hurtling headlong at break-neck speed towards the end of the year, not even the sale of the Gherkin was enough to take 2014’s levels over the previous year. Overall, £17.2bn was transacted, with the City core inching ahead of the West End.

A change in sentiment after the first quarter helped and Corbett says investors started to fall into two groups: those that felt the top of the market was in sight and needed to lock-in returns and take money off the table, or those nervous about the massive pools of money they had to still invest.

Sellers that had looked outside London started to flow back in as they found the grass was not necessarily greener in Germany and the US. Overall, JLL’s sales stats showed final prices were, on average, 21.6% over the quoting price.

Despite what Corbett calls a benign interest rate environment and a “huge dollop of quantitative easing in Europe”, 2015 is unlikely to top 2014. “There is likely to be a pause in the market around election time, then foot to the floor again for the remainder of the year,” he says.

Q4: top deals of the quarter

1 Omnicom 2&3 Bankside. Southern fringe. 368,123 sq ft.

2 Société Générale Prelet at Heron Quays West 2. Docklands. 280,000 sq ft.

3 Google 6 Pancras Square (King’s Cross). Midtown. 201,617 sq ft.

4 Dong Energy 5 Howick Place (Lower ground, ground, 3rd 4th and 5th floors). West End. 81,071 sq ft.

5 Zurich Insurance Company Prelet at 64-66 Mark Lane. 7th-12th floors inclusive. City core. 68,255 sq ft.