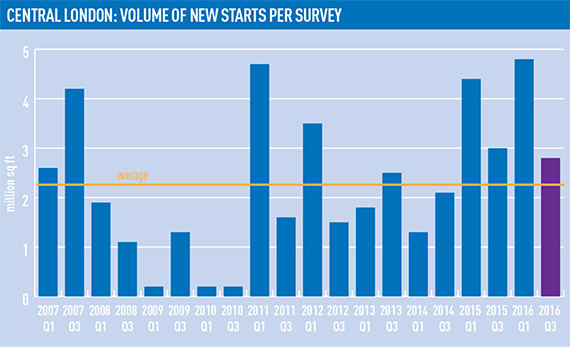

Developer confidence in London has slumped in the past six months with the amount of office space commencing construction falling by 42% compared with the six months prior, according to Deloitte’s Central London Crane Survey.

Chris Lewis, head of occupier advisory at Deloitte, said: “There is a reaction to political and economic instability, but businesses are also thinking about their future needs. We are likely to see more incentives and lower rents.”

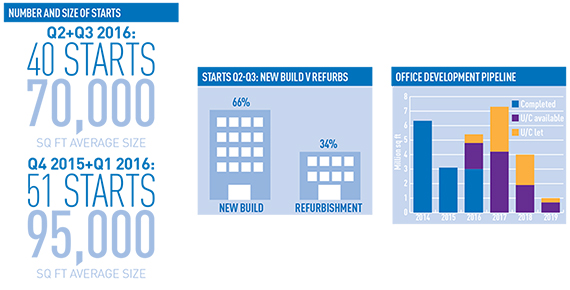

During the six months to the end of September, 2.8m sq ft of schemes began construction compared with 4.8m sq ft during the previous six months. Around 70% of the space was accounted for by refurbishments. The City of London saw 14 starts, the most number of starts of any area.

During the six months to the end of September, 2.8m sq ft of schemes began construction compared with 4.8m sq ft during the previous six months. Around 70% of the space was accounted for by refurbishments. The City of London saw 14 starts, the most number of starts of any area.

“We can trace this rise in refurbs back to the conditions six to 12 months ago when developers were looking ahead and not seeing much space available amid rising rents. Refurbishments were a way of injecting more space into the market and capitalising on rental growth. Buildings are more modern now than when we started the survey and lend themselves better to office space.”

Will Matthews, head of insight, Deloitte

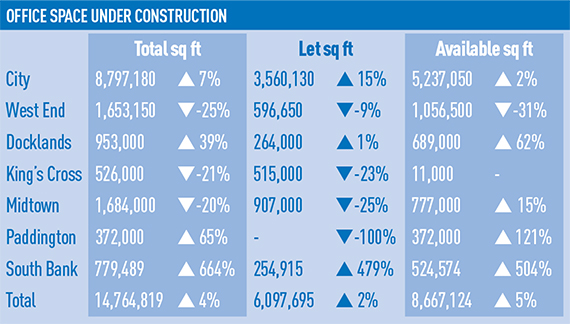

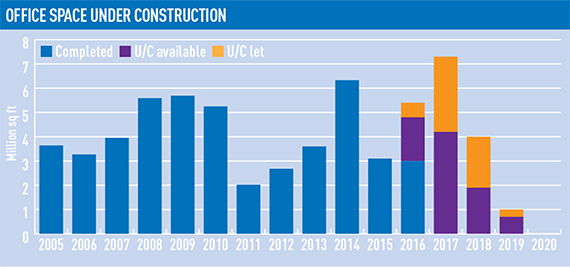

The total amount of space under construction rose marginally, with 14.8m sq ft in the pipeline. Uncertainty caused by the EU referendum on 23 June has affected the market, with developers seeing reduced demand.

The total amount of space under construction rose marginally, with 14.8m sq ft in the pipeline. Uncertainty caused by the EU referendum on 23 June has affected the market, with developers seeing reduced demand.

Caution has also prompted developers to push back the delivery of schemes. Some 3m sq ft of space expected to be delivered in 2018 will now be delivered in 2019 and 2020. The report predicts that a fall in demand could lead to increased vacancy rates, a reduction in headline rents and increased incentives such as rent-free periods.

Caution has also prompted developers to push back the delivery of schemes. Some 3m sq ft of space expected to be delivered in 2018 will now be delivered in 2019 and 2020. The report predicts that a fall in demand could lead to increased vacancy rates, a reduction in headline rents and increased incentives such as rent-free periods.

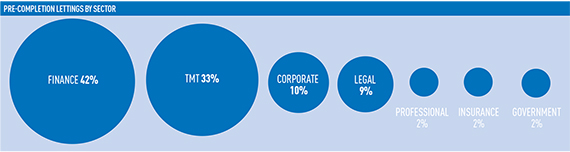

Take-up for the year to the end of Q3 stood at 6.2m sq ft, down by 37% from 9.8m sq ft last year. Of the 14.8m sq ft under construction, 6m sq ft, or 41%, has been let. Financial tenants accounted for 2.5m sq ft, or 42%, of space leased. Deloitte has predicted that the business rates revaluation in 2017 could further affect company expansion plans, with London rates rising by an average of 11%.

Take-up for the year to the end of Q3 stood at 6.2m sq ft, down by 37% from 9.8m sq ft last year. Of the 14.8m sq ft under construction, 6m sq ft, or 41%, has been let. Financial tenants accounted for 2.5m sq ft, or 42%, of space leased. Deloitte has predicted that the business rates revaluation in 2017 could further affect company expansion plans, with London rates rising by an average of 11%.